Mexico ENT Devices Market Analysis

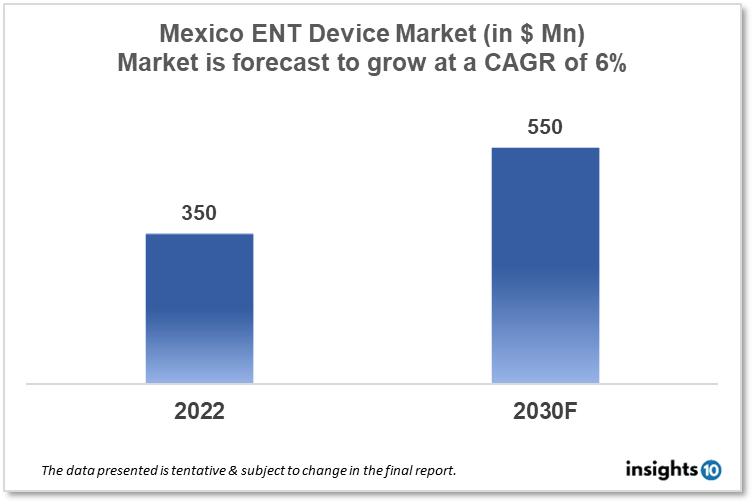

Mexico's ENT Devices Market is projected to grow from $350 Mn in 2022 to $550 Mn by 2030, registering a CAGR of 6% during the forecast period of 2022-30. The rising prevalence of ENT disorders, such as hearing loss, sinusitis, and tonsillitis, is a major driver of the ENT device market. The market is highly competitive, with a large number of players operating in the space, ranging from small, specialized companies to large multinational corporations. The domestic key players in the Mexico ENT devices market include ACI Medical, Gamma Medical Instruments, and LAB-MED.

Buy Now

Mexico ENT Devices Market Analysis Summary

Mexico's ENT Devices Market is projected to grow from $350 Mn in 2022 to $550 Mn by 2030, registering a CAGR of 6% during the forecast period of 2022-30.

Mexico is a developing country in North America having coastlines on the North Pacific Ocean, the Gulf of Mexico, and the Caribbean Sea. Mexico is Latin America's second-largest medical device market, trailing only Brazil. Mexico is Latin America's biggest medical importer, owing to rising healthcare spending and the acquisition of new technologies. Mexico's government spent 6.2% of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

Mexico's government has expanded healthcare spending in recent years, which may provide opportunities for ENT device manufacturers. In Mexico, the prevalence of ENT illnesses such as hearing loss, sinusitis, and rhinitis is increasing, driving demand for ENT equipment. The Mexican government has launched programmes to boost access to healthcare services and funding for medical research. Preventive care, diagnostic imaging, dental items, patient aids, orthopaedics, and prosthetics are the most popular medical gadgets. These aspects could boost Mexico's ENT Devices Market.

Market restrains.

Imports account for roughly 90% of medical gadgets sold in Mexico. Mexico imports medical equipment from around the world, with the majority of them originating from the United States, Asia, and Europe. Many individuals in Mexico lack access to healthcare, which can hinder the uptake of ENT devices. The cost of ENT devices might be prohibitively expensive, limiting access to them for those who cannot afford them. In Mexico, there is a lack of understanding about the need for early identification and treatment of ENT illnesses, which can lead to delayed treatment and lower health outcomes. These factors may deter new entrants into the Mexico ENT Devices Market.

Competitive Landscape

Key Players

- ACI Medical: ACI Medical is a Mexican company that specializes in the design and production of ENT medical devices. The company's product range includes nasal cannulas, oxygen masks, and oxygen tubing

- DeatschWerks: DeatschWerks is a Mexican company that produces medical devices for the ENT market, such as micro ear curettes, ear specula, and nasal specula

- Gamma Medical Instruments: Gamma Medical Instruments is a Mexican company that designs and manufactures a range of ENT medical devices, including laryngoscopes, otoscopes, and endoscopes

- LAB-MED: LAB-MED is a Mexican company that produces a range of medical devices, including ENT devices such as nasal cannulas, oxygen masks, and catheters

- Medtronic: Medtronic is a global medical device company that has a strong presence in Mexico. The company produces a wide range of ENT devices, including cochlear implants, hearing aids, and surgical instruments

Healthcare Policies and Reimbursement Scenarios

In Mexico, ENT devices are regulated by the Federal Commission for the Protection against Sanitary Risks (COFEPRIS) under the Ministry of Health. COFEPRIS is responsible for ensuring the safety, efficacy, and quality of medical devices sold and used in Mexico. Generally, medical devices used in public hospitals and clinics are covered by the Mexican Institute of Social Security (IMSS), which is a social security program for salaried workers in the formal sector. However, coverage and reimbursement policies can differ depending on the region and institution.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ENT Device Market Segmentation

The ENT Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Co2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices (Revenue, USD Billion):

- Endocsopes

- Hearing Screening Devices

By Surgical Device (Revenue, USD Billion):

- Powered Surgical Instruments

- Radiofrequency (RF) Handpieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End Users (Revenue, USD Billion):

- Hospitals and Ambulatory Settings

- Home Use

- ENT Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.