Mexico Dental Care Market Analysis

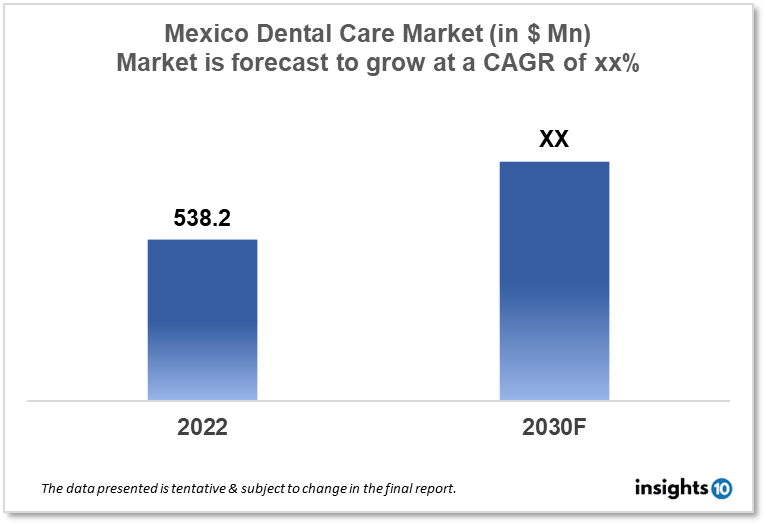

Mexico's dental care market size is at around $538.20 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. This report by Insights10 is segmented by treatment type, age group, and clinical setup, and by demography. The market is captured by giant dental chains like Dental Solutions, Dental Cosmetics, Clear Choice Dental, and OrthoDental which take the dental tourism phenomenon in their stride.

Buy Now

Mexico Dental Care Market Executive Summary

Mexico's dental care market size is at around $538.20 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. Mexico has a diversified economy that ranks 11th in the world in terms of nominal GDP and is classified as an upper-middle-income country. The economy is strongly reliant on foreign trade, especially with the United States, Mexico's primary trading partner. The country's manufacturing industry is robust, particularly in the automotive, electronics, and textile industries and its services sector is expanding. Mexico's GDP is $1.258 trillion, with health spending accounting for 5.46% of the GDP for a population of 129 million. Mexico has a substantial informal sector in which a major section of the workforce works in unregulated and unregistered firms, resulting in low productivity and earnings. Agriculture continues to employ a sizable proportion of the workforce. Agriculture still employs a major portion of the population, but it has been declining in recent years. The country also boasts a sizable oil and gas industry, which contributes significantly to the national economy.

Mexico has attempted economic changes in recent years with the goal of increasing growth and decreasing poverty. These include labor market reforms, energy sector reforms, and business climate improvements. However, the country continues to face obstacles such as high levels of inequality, a huge informal economy, and poor institutions, limiting its capacity to fully capitalize on its economic potential. The formal-sector workforce in Mexico, which accounts for little under half of the total, is protected by social insurance institutions that provide considerable benefits. A state-corporative system finances and governs social insurance organizations by demanding mandatory contributions from employers, employees, and the government, all of whom share governance. Each institution integrates financing and provision, relying primarily on salaried people. As in many other countries, there is a disparity in the quality of care provided in rural vs urban areas. Public hospitals are sometimes overcrowded, and the major language spoken, particularly in rural areas, is Spanish. Private hospital rooms, a wider variety of experts, and faster wait times are just some of the benefits of supplementing your coverage. While finding an English-speaking doctor is generally not difficult, private health insurance, as well as private rooms in more pleasant and sophisticated facilities, almost guarantees it. This disparity in coverage standards is a significant reason for people to carry supplemental health insurance.

Mexico offers both private and public dental treatment. Many Mexican dentists are privately owned and operated, and they provide a wide range of treatments. Dental tourism is a popular option for certain people because prices are often lower than in the United States, Canada, and some other countries. The Mexican Social Security Institute (IMSS) runs the country's public dental care system, which provides free or reduced-cost care to qualifying citizens and legal residents. IMSS clinics and hospitals are spread around the country and offer a variety of dental services. Overall, the quality of dental care in Mexico is regarded as high, however, it varies depending on region and practitioner. Some Mexican dentists have acquired training and schooling in the United States or other countries, and they may be more experienced and well-equipped than others. Before visiting a dental clinic, it is best to look for reviews, certifications, and accreditation.

Market Dynamics

Market Growth Drivers

The growth drivers for dental care services in Mexico include:

- Mexico is a popular destination for medical tourism, and dental chains can benefit from this trend as patients from other countries come to Mexico for dental care

- Dental services in Mexico are often more affordable than in other countries, which makes them an attractive option for people seeking dental care. This can drive growth for dental chains that offer competitive prices

- Many dental chains in Mexico offer high-quality care, which can attract patients from other countries who are seeking affordable dental care that is also of high quality

- Dental chains in Mexico are investing in technology that allows them to offer a wide range of advanced procedures and treatments, which can help to attract patients and drive growth

- Government support for the dental industry in Mexico can also drive growth for dental chains by providing incentives for investment and expansion

Market Restraints

There are several limiting factors that can affect the growth of dental care corporations in Mexico are: Many people in Mexico do not have dental insurance, which can limit the growth of dental chains as it makes dental care less accessible for some individuals. Dental chains may have difficulty expanding into rural areas of Mexico due to a lack of infrastructure and limited access to resources. Some people in Mexico may not have a good understanding of the importance of regular dental care, which can limit the growth of dental chains. Some dental chains may not have the same standards of care as others, which can limit the growth of chains that do not offer high-quality care. Government regulations and oversight: Government regulations and oversight can limit the growth of dental chains, as they may be subject to strict regulations and oversight that can be difficult to navigate. Dental chains may face competition from other chains as well as independent clinics and dentists, which can limit the growth of any single chain. Economic factors such as recession, inflation, and currency fluctuations can also limit the growth of dental chains in Mexico

Competitive Landscape

Key Players

- Dental Departures

- Sani Dental Group

- Dental Solutions

- Dental Cosmetics

- Clear Choice Dental

- OrthoDental

- The Dental Wellness Center

- Dental Care Mexico

- Dental Spa Mexico

- Mexico Dental Network

Notable Recent Deals

April 2021 - National Dentex Labs (“NDX”), the largest network of fully-owned dental labs in the United States providing superior restorative dentistry solutions, announced today the acquisition of Dental Services Group (“DSG”), a growing network of dental laboratories across North America. Dental Services Group, a growing network of dental laboratories based in the US, Canada, and Mexico, provides dentists with the best of both worlds: the personal relationship and care of a local laboratory, combined with the technical expertise and full suite of offerings of a national laboratory. The combined company will operate under the National Dentex Labs brand.

Healthcare Policies and Regulatory Landscape

In Mexico, the regulatory body for dental services is the Mexican Federal Commission for the Protection Against Sanitary Risks (COFEPRIS). This organization is responsible for regulating and overseeing the practice of dentistry in Mexico, as well as enforcing standards for the quality and safety of dental services. COFEPRIS also monitors the sale and distribution of dental products, such as dental materials and instruments, and it works to prevent and control the spread of infectious diseases in the dental community. COFEPRIS also certifies dental practitioners and dental offices. The Mexican Dental Association (ADM) is also a professional organization that represents dentists in Mexico and sets ethical guidelines and standards for a dental practice. Dentists in Mexico are required to be a member of the ADM in order to practice.

Reimbursement Scenario

Health care in Mexico is delivered via a 3-tier system. The Mexican social security program, known as the IMSS, covers employees in the private and public sectors. In short, if you work for a Mexican company, you directly qualify for medical coverage under the IMSS. The employee’s portion of the costs comes directly from their paycheck. Workplace HR staff do all the paperwork, making participation in the IMSS very easy. The cost of coverage through IMSS is very affordable, costing approximately $500 per year. A second option for participating in the country’s public health insurance system is the Seguro Popular program. The Seguro Popular was set up to provide for those who don’t qualify for the IMSS tier, either due to financial reasons or because of pre-existing conditions. Those covered by Seguro Popular are primarily the unemployed, the homeless, and those with exclusionary medical conditions. Theoretically, between Seguro Popular and IMSS, everyone in Mexico should be covered through the public system at a price they can afford. The final tier in Mexico’s health care system is provided through private insurance. This is a desirable option for many people as the private healthcare system offers greater comfort and privacy. However, it is very expensive compared to the public system.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.