Mexico Cancer Immunotherapy Market Analysis

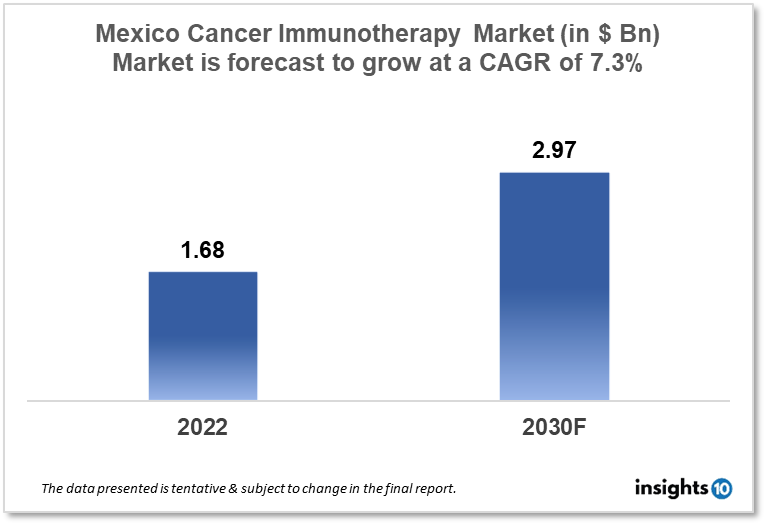

Mexico's cancer immunotherapy market is expected to witness growth from $1.68 Bn in 2022 to $2.97 Bn in 2030 with a CAGR of 7.3% for the forecasted year 2022-30. The rising prevalence of cancer in Mexico and the increased government funding to support immunotherapy in Mexico are driving the growth of the market. The Mexico cancer immunotherapy market is segmented by type, application, and end user. Monticello Drug, Zoetis, and Bristol-Myers Squibb are the major players in the Mexico cancer immunotherapy market.

Buy Now

Mexico Cancer Immunotherapy Market Executive Analysis

Mexico's cancer immunotherapy market is expected to witness growth from $1.68 Bn in 2022 to $2.97 Bn in 2030 with a CAGR of 7.3% for the forecasted year 2022-30. The overall expenditures for New Mexico in fiscal year (FY) 2022, including general funds, additional state sources, bonds, and federal funds, were $23.2 Bn, according to the National Association of State Budget Officers (NASBO). Public welfare ($3,488) and elementary and secondary education ($1,955) were New Mexico's two highest per-person spending categories. The majority of Medicaid funding is classified by the Census Bureau as part of public welfare, but some of it is also given to public hospitals. Although useful for comparing states, per capita spending is an incomplete measure because it doesn't take into account a state's demographics, political choices, administrative processes, or resident preferences.

Breast cancer, which claimed close to 8000 lives in Mexico in 2020, was the most lethal type of cancer. Prostate cancer was next, accounting for 7.46 thousand fatalities in that year. In the meantime, Mexico's top cancer hospital was Instituto Nacional de Cancerologa.

In Mexico, the area of cancer immunotherapy is still in its infancy, but both the public and private sectors are showing increasing interest and investment in it. Immunotherapy, which has shown promising results in treating some cancer types, works by using the patient's immune system to identify and target cancer cells. Immune checkpoint inhibitors, which act by inhibiting proteins on the surface of cancer cells that prevent the immune system from attacking them, are one of the most frequently utilized types of cancer immunotherapy in Mexico. CAR T-cell treatment, which modifies a patient's T cells to target cancer cells, and cancer vaccines, which compel the immune system to identify and combat cancer cells, are two more types of cancer immunotherapy. With domestic and foreign pharmaceutical companies investing in research and development, there are an increasing number of clinical studies in Mexico that are dedicated to cancer immunotherapy. The development and commercialization of cancer immunotherapy therapies have also received support from the Mexican government, with regulatory organizations expediting the approval procedure for new cancer medications.

Market Dynamics

Market Growth Drivers

Personalized treatment, which includes cancer immunotherapy, is gaining popularity in Mexico. Cancer immunotherapy is a viable treatment option for patients who are looking for individualized care. The development and commercialization of cancer immunotherapy therapies have received backing from the Mexican government, which has aided in the Mexico cancer immunotherapy market's expansion. For instance, the COFEPRIS regulatory body in Mexico has sped up the introduction of novel cancer medicines to the market by streamlining the approval procedure for new cancer drugs. Pharmaceutical companies are making significant investments in the study and creation of novel cancer immunotherapy therapies, which are fostering innovation and fostering market expansion. Additionally, Mexico is growing in popularity as a site for clinical trials, which is hastening the creation of brand-new treatments.

Market Restraints

The high cost of cancer immunotherapy therapies may make them out of reach for many patients in Mexico. For both patients and healthcare providers, the high cost of treatment presents a significant problem and may be a growth inhibitor for the industry. For many patients, the cost of cancer immunotherapy treatments may be prohibitive in Mexico due to the country's restricted insurance possibilities. For pharmaceutical companies trying to promote their goods in Mexico, this is a significant obstacle. Established cancer therapies like chemotherapy and radiation therapy, which are still popular in Mexico, compete with cancer immunotherapy treatments. The Mexico cancer immunotherapy market potential may be constrained by the fact that these therapies are frequently less priced and may be viewed as more effective by some patients and healthcare professionals.

Competitive Landscape

Key Players

- Farmaceutica Maypo (MEX)

- Siegfried Rhein (MEX)

- Senosiain Laboratories (MEX)

- Munticello Drug (MEX)

- Zoetis (MEX)

- Bristol-Myers Squibb

- Novartis

- Celgene

- Amgen

- Merck

- Janssen

- Seattle Genetics

- Printegra

Notable Deals

November 2022- The Immunotherapy Institute introduces a CAR T-Cell protocol for the treatment of colon cancer in Mexico, enabling patients from other countries to benefit from the cutting-edge cancer immunotherapy treatment that is revolutionizing healthcare worldwide. A powerful non-toxic form of colon cancer treatment is now available to patients thanks to a successful CAR T-cell immunotherapy regimen that was implemented by a cancer facility in Mexico.

Healthcare Policies and Regulatory Landscape

The majority of cancer treatment in Mexico, including cancer medications, is provided by the public sector. The formal sector (workers and their families), comprises five distinct social health insurance (SHI) institutions, which each have its own separate facilities and managerial styles, to provide health coverage and care. The primary SHI provider is the Mexican Social Security Institute (IMSS), which covers 46% of the people who work for private firms. State employees, who make up about 10% of the population, are covered by the Institute for Social Security and Services for State Workers (ISSSTE). According to their respective rules, regulations, and drug formularies, these institutions provide coverage for cancer treatment. The Ministry of Health (MoH) institutions offer healthcare to people without SHI (approximately 42%); each facility has its own regulations and management style. Most members of this demographic are covered by the People's Health Insurance (Seguro Popular de Salud, SPS), public insurance that pays for medical facilities according to a list of interventions. SPS covers all pediatric cancer kinds as well as some of the most common adult cancer types while adhering to its own set of rules and procedures. The SPS's list of drugs that are covered is listed in its catalogue of interventions, which is likewise based on the national formulary, and is used by the MoH facilities.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Immunotherapy Segmentation

By Type (Revenue, USD Billion):

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- PD-1/PD-L1

- CTLA-4

By Application (Revenue, USD Billion):

- Lung Cancer

- Breast Cancer

- Head and Neck Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Cancer Research Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Monticello Drug, Zoetis, and Bristol-Myers Squibb are the major players in the Mexico cancer immunotherapy market.

The Mexico cancer immunotherapy market is expected to grow from $1.68 Bn in 2022 to $2.97 Bn in 2030 with a CAGR of 7.3% for the forecasted year 2022-2030.

The Mexico cancer immunotherapy market is segmented by type, application, and end user.