Mexico Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

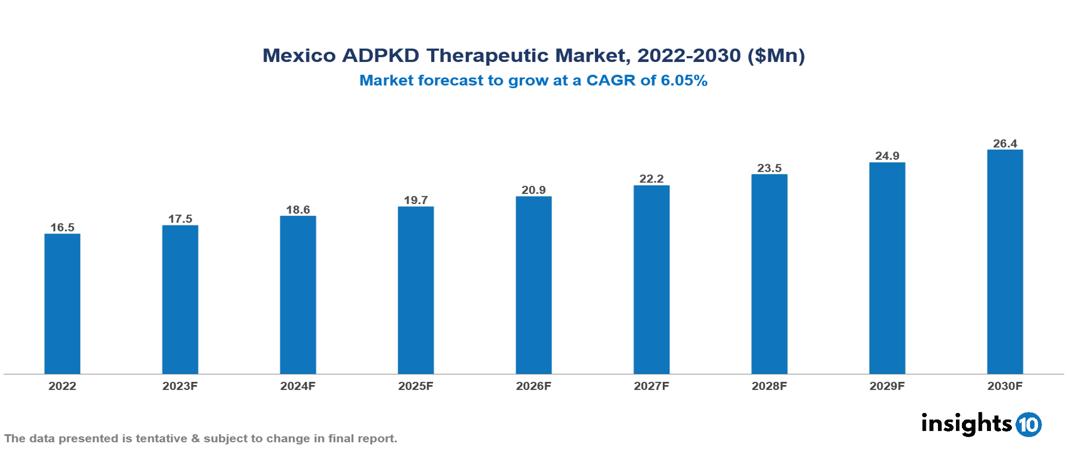

The Mexico Autosomal Dominant Polycystic Kidney Disease Therapeutics Market was valued at US $17 Mn in 2022, and is predicted to grow at a CAGR of 6.05% from 2023 to 2030, to US $26 Mn by 2030. The key drivers of this industry include the upward trend in the incidence of autosomal dominant polycystic kidney disease, government initiatives, and other factors. The industry is primarily dominated by players such as Otsuka, Sanofi, Roche, Biogen, AstraZeneca, Janssen among others

Buy Now

Mexico Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

The Mexico Autosomal Dominant Polycystic Kidney Disease Therapeutics Market is at around US $ 17 Mn in 2022 and is projected to reach US $26 Mn, exhibiting a CAGR of 6.05% during the forecast period.

Autosomal dominant polycystic kidney disease (ADPKD) is a genetic condition affecting multiple systems caused by mutations in the genes PKD1 and PKD2. It is characterized by the development of numerous cysts within the kidneys, resulting in renomegaly, often progressing to end-stage kidney disease (ESKD) in most patients. The symptoms of the condition include pain, urinary tract infections, and fatigue, among other manifestations. Currently, there is no cure available for this rare disease, and the treatment regimens rely on preventive management. Tolvaptan (Jinarc), manufactured by Otsuka Pharmaceutical, is the only approved medication available that is a vasopressin blocker and has shown a reduction in cyst formation in a subset of patients. Additional options include pain management and lifestyle changes as preventive measures.

Mexico is a country in southern North America that borders the United States. The incidence of ADPKD is around 457 per 1,00,000 individuals in Mexico. With improved healthcare infrastructure, rapid diagnosis, environmental variables, genetic predisposition, and modifiable risk factors, the prevalence of ADPKD is projected to increase. The market is therefore driven by major factors like the increased prevalence of ADPKD cases, government initiatives and public health programs, and evolving healthcare infrastructure in the industry. However, conditions such as high costs of treatment, a lack of local research activities, and others hinder the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in the incidence of ADPKD: The country of Mexico has an incidence of 457/1,00,000 individuals, which is the highest in the world. These estimates translate into a huge pool of patients requiring treatment like dialysis, resulting in the growth of the market.

Government initiatives: Government initiatives and public health programs such as Seguro Popular (Popular Insurance) are helping to bridge the gap in affordability and accessibility of essential medicines for eligible patients.

Increased awareness: Groups such as the Mexican Association of PKD and Genetic Kidney Disease and the Medical Gazette of Mexico are expanding public knowledge about ADPKD, potentially leading to earlier diagnosis and greater demand for treatment.

Evolving healthcare infrastructure Mexico's investments in modern medical facilities and nephrology departments are increasing ADPKD patients' access to specialized care and diagnostic equipment. Improvements in ADPKD research and development yield novel treatments and medications like gene therapy, bringing prospects for improved disease control and potentially attractive market investments.

Market Restraints

High costs of treatment: Treatments for ADPKD, such as Tolvaptans, can be costly, causing a considerable financial burden on both patients and the healthcare system. These out-of-pocket expenditures hinge on treatment, especially for those with inadequate insurance coverage, and can result in the non-compliance of patients, digressing the growth of the Mexican market.

Access to specialist care: Even with improvements in healthcare infrastructure, discrepancies in accessing nephrologists and specialized ADPKD care persist in certain areas of Mexico. This limitation can hinder prompt diagnosis, optimal treatment commencement, and holistic care for patients, which distorts the growth of the market.

Research gap: In contrast to certain developed nations, there's a lack of extensive local research on ADPKD in Mexico. This constraint impedes the creation of culturally suitable and economical solutions tailored to the distinct requirements of the Mexican population.

Dependence on import medicines: Mexico heavily depends on imported medications for ADPKD, leaving the market vulnerable to fluctuations in exchange rates and potential disruptions in the supply chain. Consequently, this may result in price hikes, shortages of medications, and inconsistencies in patient access.

Notable Updates

June, 2023: COFEPRIS has begun an accelerated evaluation procedure for a novel oral ADPKD medicine, potentially expediting its release in the Mexican market. This implies a greater emphasis on streamlining approvals for novel ADPKD treatments.

April, 2023, COFEPRIS, Mexico's health regulatory authority, granted approval for Jinarc (tolvaptan) registration to treat ADPKD. This notable decision substantially enhances access to the initial medication explicitly designed for ADPKD in Mexico.

Healthcare Policies and Regulatory Landscape

In Mexico, various significant authorities and agencies manage the healthcare policies and regulatory framework. The primary entity overseeing healthcare products, including pharmaceuticals, is the Federal Commission for Protection against Sanitary Risk (COFEPRIS). COFEPRIS holds responsibility for regulating, supervising, and authorizing health-related products, encompassing all therapeutics.

Besides COFEPRIS, the Mexican healthcare system involves a blend of public and private healthcare provisions. The public healthcare sector is managed by the Ministry of Health (Secretaría de Salud), entrusted with the responsibility of delivering healthcare services to the population.

Compliance with COFEPRIS requirements is a prerequisite for obtaining a license in Mexico. Before commercializing therapeutics, companies are required to get registration and marketing licenses from COFEPRIS. Technical and scientific data proving the product's efficacy, safety, and quality must be submitted as part of the registration process.

Mexico has a strong regulatory framework and a resilient healthcare system, creating an advantageous setting for businesses to function effectively. Additionally, its geographical proximity to the United States provides favourable market access, allowing companies to reach and engage with North American markets.

Competitive Landscape

Key Players

- Otsuka Pharmaceutical Co., Ltd

- Janssen Pharmaceuticals

- Reata Pharmaceuticals

- AbbVie Inc

- Sanofi

- Galapagos NV

- Biogen Inc

- Pfizer

- Roche

- AstraZeneca

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Segmentation

By Treatment

- Pain & Inflammation Treatment

- Kidney Stone Treatment

- Urinary Tract Infection Treatment

- Kidney Failure Treatment

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Surgical Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.