Mexico Anti Aging Therapeutics Market Analysis

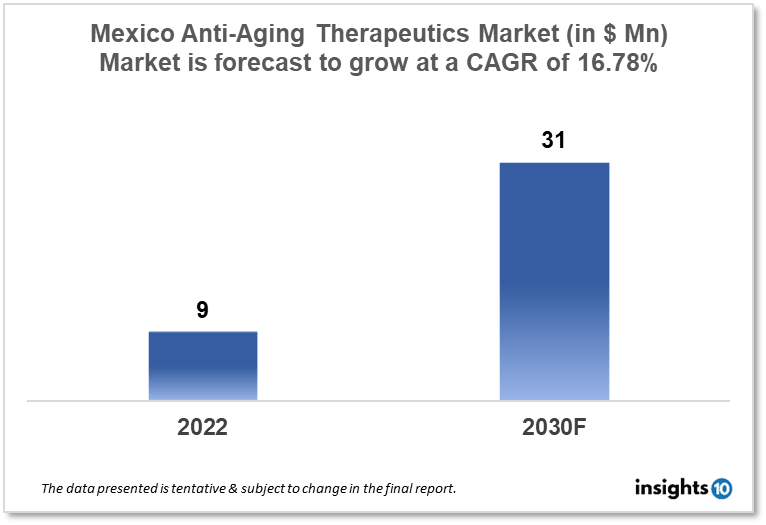

Mexico anti-aging therapeutics market is projected to grow from $9 Mn in 2022 to $31 Mn in 2030 with a CAGR of 16.78% for the year 2022-2030. The rising elderly population and increasing awareness about anti-aging treatments are the major factors responsible for the growth of the market. The Mexico anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Novastem, Liventia, and ENDYMED are some of the key competitors in the market.

Buy Now

Mexico Anti-Aging Therapeutics Market Executive Summary

The Mexico anti-aging therapeutics market size is at around $9 Mn in 2022 and is projected to reach $31 Mn in 2030, exhibiting a CAGR of 16.78% during the forecast period. According to information released by the national statistics office, INEGI, household healthcare spending in Mexico exceeded $55 Mn last year or roughly 60% of all health spending in 2022. The numbers provided by INEGI included unpaid work in the health sector, such as caring for the sick and providing preventative care, which was estimated to be equal to 1.6% of GDP. The country's total healthcare expenditure decreased from 6.5% of GDP in 2022 to 6.2% last year. The share of public healthcare spending in the GDP was only 2.5 %.

The body progressively develops aches and pains, fatigue, age spots, wrinkles, hair loss, mood swings, poor concentration, insomnia, frailty, and decreased sex drive as the body gets older. The majority of these changes occur as the cells in the bodies begin to diminish, leading to improper upkeep of organisms. One of the most effective anti-aging medications lately developed in Mexico, rapamycin also has favorable effects on health in old age. The TOR signaling system, which controls a variety of fundamental cellular functions including energy, nutrition, and stress levels, is suppressed by rapamycin. In essence, rapamycin is used to precisely control the principal driver of cellular metabolism. Currently, many antiaging compounds target the calorie-restriction mimetic, autophagy induction, and putative enhancement of cell regeneration, epigenetic modulation of gene activity such as inhibition of histone deacetylases and DNA methyltransferases, are under development in Mexico.

Market Dynamics

Market Growth Drivers Analysis

A demographic shift is taking place in Mexico, where the number of individuals over 65 is rising. The demand for anti-aging treatments is rising significantly as a result of this population shift. More individuals are making higher salaries as Mexico's economy expands. This is encouraging people to spend more money on anti-aging goods and services. Mexican consumers are becoming more and more conscious of the advantages of anti-aging treatments. The desire for goods and services that can make people look and feel younger has increased as a result of this.

Market Restraints

In Mexico, only a few anti-aging procedures are covered by insurance. This may make it challenging for some customers to pay for these therapies, which may restrict the Mexico anti-aging therapeutics market expansion. The regulatory framework for anti-aging therapeutics in Mexico can be complicated, which can pose challenges for businesses seeking to launch new goods or services.

Competitive Landscape

Key Players

- Geolife Swiss México (MEX)

- Genbio (MEX)

- Innovak Global (MEX)

- Novastem (MEX)

- Liventia (MEX)

- ENDYMED

- Fotona

- LUTRONIC

- Quanta System

- SharpLight Technologies

- Solta Medical

- SpectruMed

- Abbvie

- CAO Group

Healthcare Policies and Regulatory Landscape

The Federal Commission for the Protection against Sanitary Risk (COFEPRIS) is the regulatory authority in charge of regulating and monitoring the approval of anti-aging medications in Mexico. . COFEPRIS is in charge of ensuring the efficacy and safety of all medications sold in Mexico. It collaborates closely with the pharmaceutical sector to make sure that all medications adhere to the nation's regulatory standards. Pharmaceutical firms must provide COFEPRIS with thorough information on the safety and effectiveness of their anti-aging medications in order for COFEPRIS to approve the drug in Mexico. After reviewing the information, the agency makes a decision regarding whether to permit the drug's selling in the nation. Healthcare Policies and Regulatory Landscape. In addition to approving new medications, COFEPRIS is in charge of post-marketing monitoring to guarantee that medicines remain secure and efficient after they have been released onto the market. Companies that disregard the nation's drug laws may be subject to enforcement action by the government.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.