Mexico Alcohol Addiction Therapeutics Market Analysis

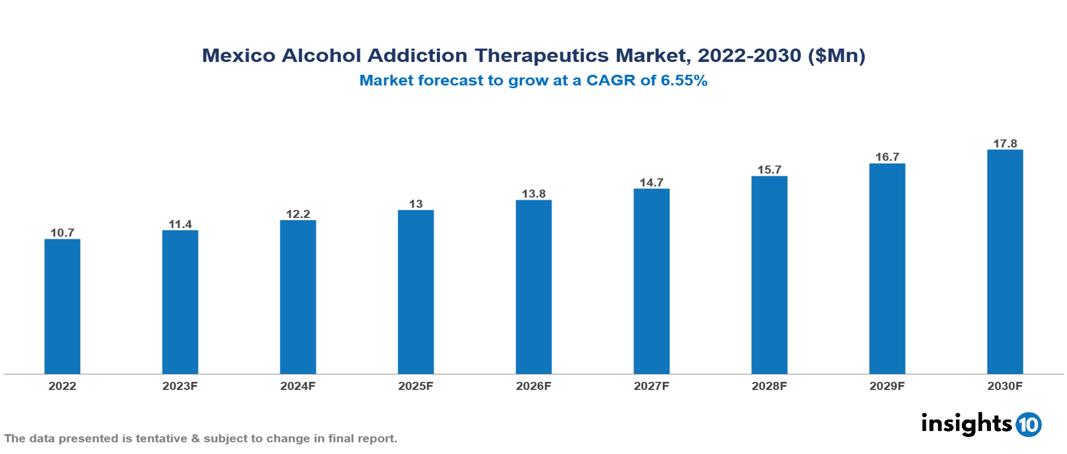

The Mexico Alcohol Addiction Therapeutics Market is valued at around $11 Mn in 2022 and is projected to reach $18 Mn by 2030, exhibiting a CAGR of 6.55% during the forecast period. The market is fueled by drivers such as increasing prevalence, an increase in the efforts taken by the government to battle addiction, and the adoption of newer advanced technologies by the general population. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in Mexico are Elli Lily, Roche, AbbVie, TEVA, Otsuka Pharmaceuticals, GlaxoSmithKline, Johnson & Jhonson, Viatris, Grupo Ferrer and Genomma, among various others

Buy Now

Mexico Alcohol Addiction Therapeutics Market Executive Summary

The Mexico Alcohol Addiction Therapeutics Market is valued at around $11 Mn in 2022 and is projected to reach $18 Mn by 2030, exhibiting a CAGR of 6.55% during the forecast period.

Alcohol addiction, sometimes referred to as alcoholism or alcohol use disorder (AUD), is a chronic illness marked by an inability to regulate or abstain from alcohol consumption despite its detrimental effects. It is seen as a progressive illness with major potential effects on one's social, mental, and physical well-being. A mix of hereditary, environmental, and psychological variables impact alcohol addiction. It may have detrimental effects on one's physical well-being. Combining counselling, support groups, and behavioural therapy is a common approach to treating alcoholism. Medication may occasionally be recommended to treat withdrawal symptoms or lessen cravings.

In Mexico, the typical age of onset for alcohol usage is between 16 and 17 years. Binge drinking (5+ drinks on each occasion) has grown dramatically in recent years. Alcohol dependency was reported by more than 2.2% of the population aged 12 to 65. Men have a larger incidence than women (3.9% vs. 0.6%). The market is fuelled by drivers such as increasing prevalence, an increase in the efforts taken by the government to battle addiction, and the adoption of newer advanced technologies by the general population.

International firms with well-known names like naltrexone and acamprosate, such as AbbVie and Otsuka, control a large portion of the market. They may have an advantage in generating income due to their extensive worldwide reach and marketing resources. While local companies may not have as large a market share as global companies, they can still gain from cost-competitive production and can concentrate on meeting particular local demands. Businesses in narrow markets like Farmacéutica Serral and Genomma generate substantial income.

Market Dynamics

Market Drivers

Increasing Prevalence: Alcohol consumption is a serious and expanding issue in Mexico. There is a great need for efficient treatment alternatives due to the high incidence of dependency and binge drinking. Rising spending rates, especially among youth, are a result of increased urbanization and exposure to Western lifestyles.

Government Initiatives: The Mexican government is investing more in programs for addiction treatment and extending healthcare coverage. This increases the accessibility of therapies for a greater number of people. Recognizing the business opportunity, private healthcare providers are also making investments to provide addiction treatment services.

Advancements in Technology: More efficient and individualized treatment alternatives are made possible by the creation of novel pharmaceuticals and non-pharmacological therapies like behavioural therapy and digital interventions. The community has become more and more acquainted with telemedicine and remote monitoring platforms as a result of technological improvements. By facilitating greater access to care for those with restricted mobility or in distant places, this can enhance the expansion of the industry.

Market Restraints

Lack of Resources: Underdeveloped infrastructure is typical in Mexico. In Mexico, there is a dearth of licensed addiction counsellors and specialists. Nearly everywhere in the county, there is a constant need for experts and superspecialists, especially in underprivileged communities. This may reduce the variety of therapeutic alternatives accessible and result in lengthy wait times for access to treatment.

Cost of Treatment: A significant fraction of the Mexican population cannot afford the high cost of several helpful drugs, such as acamprosate and naltrexone. Insurance for addiction treatment varies and frequently does not cover all necessary drugs or just covers a portion of it. Evidence-based therapies may face competition from traditional and informal therapy modalities, such as faith-based programs or herbal cures, which may have an adverse influence on their efficacy and reach.

Social Barriers: The stigma associated with addiction on the part of society might discourage people from getting treatment or seeking assistance. A lack of knowledge about available services and treatment alternatives may make this worse.

Healthcare Policies and Regulatory Landscape

The national health policy and the regulation of pharmaceuticals and medical devices in Mexico are within the purview of the Mexican Secretariat of Health. The decentralized and independent Federal Committee for Protection from Sanitary Risks (COFEPRIS) is in charge of policing health facilities, enforcing sanitary regulations over advertising, and keeping an eye on the production, import, and export of medical supplies. Mexico's pharmaceutical industry is governed by COFEPRIS, which also maintains a strong healthcare system and well-established regulatory framework that make it an attractive place for businesses to operate. In Mexico, COFEPRIS is also in charge of overseeing clinical research regulations. The organization is modernizing to digitize its processes and increase transparency, in line with the government's goals of thwarting corruption and enhancing the management of public resources.

Competitive Landscape

Key Players

- Elli Lily

- Roche

- AbbVie

- TEVA

- Otsuka Pharmaceuticals

- GlaxoSmithKline

- Johnson & Jhonson

- Viatris

- Grupo Ferrer

- Genomma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.