Mexico ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

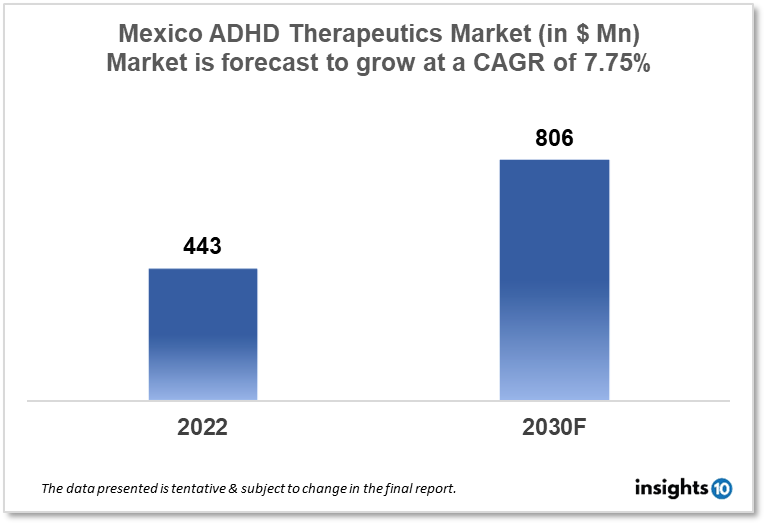

Mexico's Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is projected to grow from $443 Mn in 2022 to $806 Mn in 2030 with a CAGR of 7.75% for the year 2022-2030. Major factors responsible for the expansion of the market are an increase in ADHD prevalence in Mexico and the Mexican government’s initiatives to provide novel therapeutic options for ADHD treatment. The Mexico ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Farmacia Regina, Farmacia San Martin, and Shire are the key players in the market.

Buy Now

Mexico Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

The Mexico Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market size is at around $443 Mn in 2022 and is projected to reach $806 Mn in 2030, exhibiting a CAGR of 7.75% during the forecast period. The federal government's proposed $417 Bn 2023 budget of Mexico includes several high-ticket items, including infrastructure projects, pensions for elderly citizens, health care, and social programs. Major healthcare provider the Mexican Social Security Institute is expected to receive over $61 Bn, a rise of almost 10% from this year, while the Ministry of Health is expected to receive $11.66 Bn. The SHCP predicted that the GDP would increase by 2.4% in 2022 and that the annual inflation rate would finish the year at 7.7%, which is 1% lower than the level reached in August.

One of the most common neurodevelopmental disorders in children is attention deficit with hyperactivity disorder (ADHD). 3-5% of school-aged children can be diagnosed with ADHD, which is very common. It accounts for 1.5 Mn instances in Mexico. It accounts for more than 30% of all cases in pediatric clinical environments. There has been a correlation between an evening chronotype and sleep disturbances in 50% to 80% of Mexican adolescents with ADHD, including sleep-onset insomnia, poor or fragmented sleep, daytime sleepiness, and sleep-disordered breathing. According to recent reports from longitudinal studies, 90% of adult cases of ADHD did not have a history of childhood ADHD, despite the fact that ADHD persists into adulthood, it has not been observed in the anticipated proportion in Mexico. Thus, the clinical presentation of ADHD may follow various trajectories. It is known that other factors, such as sex, age at the time of evaluation, variations in impairment definitions, or context (such as urban vs. suburban, conventional vs. non-traditional school, etc.), can affect how ADHD manifests.

Multimodal therapies, including both pharmaceutical and non-pharmacological treatments, are advised for treating ADHD. Psychostimulants (methylphenidate and amphetamine compounds) and non-psychostimulant medications (atomoxetine and guanfacine) are used to treat ADHD. The ADHD medication lisdexamfetamine dimesylate (LDX) has attracted the greatest amount of research in recent years. With a minimal potential for abuse and a tolerability profile akin to other stimulant drugs, it offers a treatment option. In children and adults with ADHD, the effect of LDX lasts longer than that of any other long-acting stimulant drug, lasting at least 13 and 14 hours post-dose, respectively. The Food and Drug Administration (FDA) authorized LDX in February 2007 for the treatment of ADHD in children aged six to 18 years old. It was approved for use in children, teenagers, and adults with ADHD in Mexico on May 16, 2014, by the Federal Commission for Protection against Health Risks, and it went on sale in May 2016.

Market Dynamics

Market Growth Drivers

The primary drivers of the Mexico ADHD therapeutics market expansion are an increase in the population of people with learning disabilities and easier access to diagnostic tools and treatment choices for ADHD, including medications, behavioral therapy, and other interventions. The Mexican government's initiatives to embrace cutting-edge therapies for the treatment of ADHD have become the catalyst for the market's expansion.

Market Restraints

The cost of ADHD medications can be high, which may restrict entry for those who cannot afford them. This might significantly impede the expansion of the Mexico ADHD therapeutics market. Certain ADHD medicines may not be widely available in Mexico due to the complexity of Mexico's drug regulations. This might limit the market's expansion for ADHD therapeutics.

Competitive Landscape

Key Players

- ETrueba Distribuciones Farmaceuticas (MEX)

- Medicom (MEX)

- Pharmatrix México (MEX)

- Farmacia Regina (MEX)

- Farmacia San Martin (MEX)

- Shire

- Neos Therapeutics

- Eli Lily

- Pfizer

- Alcobra

- Supernus Pharma

- Noven Pharma

Healthcare Policies and Regulatory Landscape

The Federal Commission for Protection against Sanitary Risks, or COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), is an agency with the power to control and regulate drug products in Mexico. All actions pertaining to these goods and services, including production, distribution, commercialization, imports and exports, advertising, sales, and supply, are under the control of COFEPRIS. The World Health Organization named COFEPRIS as the National Regulatory Authority of Regional Reference of Pharmaceuticals and Biological Products in July 2012 through the Pan American Health Organization. The award is the result of an assessment of the commission's performance of fundamental duties suggested by WHO for assuring the quality, safety, and effectiveness of medicines in the nation.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behaviour Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.