Malaysia Oncology Clinical Trials Market Analysis

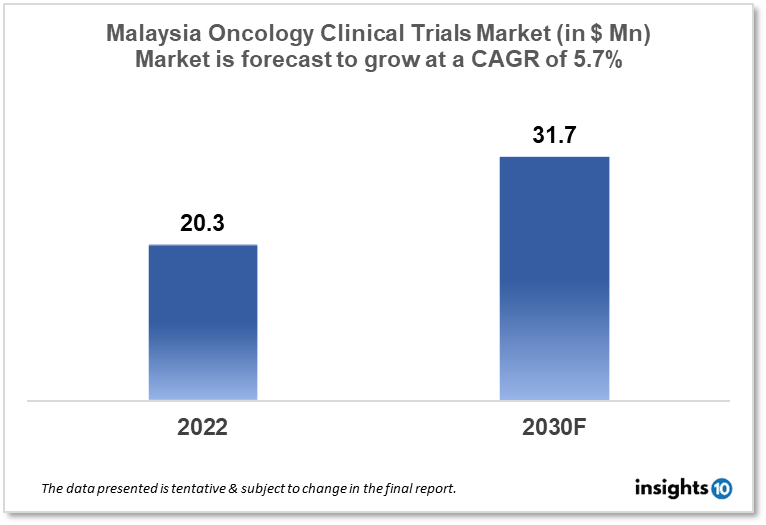

Malaysia's oncology clinical trials market is projected to grow from $20.3 Mn in 2022 to $31.7 Mn by 2030, registering a CAGR of 5.7% during the forecast period of 2022-30. The market will be driven by the rise of oncology clinical trials in Malaysia, a well-established clinical research infrastructure, and government funding. The market is segmented by phase, by study design & by indication. Some of the major players include Pfizer Inc., Novartis International AG & Biocon Malaysia.

Buy Now

Malaysia Oncology Clinical Trials Market Executive Summary

Malaysia's oncology clinical trials market is projected to grow from $20.3 Mn in 2022 to $31.7 Mn by 2030, registering a CAGR of 5.7% during the forecast period of 2022-30. Malaysia conducted 215 clinical trials in 2021, the most ever recorded, putting the country second only to Singapore in Southeast Asia in terms of industry-supported research. Clinical trials are mostly conducted in university and government hospitals across Malaysia, as these facilities receive the bulk of cancer patients. The National Pharmaceutical Regulatory Agency is a Ministry of Health agency that has the power to investigate issues about investigational product registration and approval for a Clinical Trial Import Licence (CTIL) or Clinical Trial Exemption (CTX). In Malaysia, 48,639 new cancer cases were recorded in 2020 with Breast cancer, Colorectal cancer, Lung cancer & Liver cancer being the top most occurring ones. Cancer incidence in Malaysia is expected to more than double by 2040. One in every ten Malaysians will be diagnosed with cancer throughout their lifetime.

According to the National Medical Research Registry, 87 oncology clinical trials were filed in Malaysia in 2019, an increase from 53 in 2015. The Malaysian government has proved its commitment to fostering clinical research via a number of efforts, including clinical research tax breaks and the creation of the Malaysia Clinical Research Center (CRC). The regulatory climate in Malaysia is considered favorable for clinical research, with the country's regulatory body, the National Pharmaceutical Regulatory Agency (NPRA), introducing expedited procedures for clinical trial applications and approvals. With an increasing number of studies being undertaken in the nation and a good regulatory framework and clinical research infrastructure, the oncology clinical trials picture in Malaysia is promising.

Market Dynamics

Market Growth Drivers

Many reasons are driving the rise of oncology clinical trials in Malaysia, including the country's advantageous regulatory environment, well-established clinical research infrastructure, and government funding for clinical research. The National Pharmaceutical Regulatory Agency (NPRA) of Malaysia has shortened clinical trial application and approval procedures, making it simpler for pharmaceutical and biotechnology businesses to conduct clinical studies in the nation. Moreover, Malaysia has a well-established clinical research infrastructure, with multiple government and commercial hospitals and research organizations providing cutting-edge facilities and clinical trial expertise. The Malaysian government has also proved its commitment to fostering clinical research via a number of measures, including clinical research tax breaks and the creation of the Malaysia Clinical Research Center (CRC).

Market Restraints

There are certain barriers to the expansion of oncology clinical trials in Malaysia. One of the most significant issues is the country's lack of skilled clinical research workers. This limitation might cause delays in trial start-up and recruitment, affecting the total timing and expense of the experiment. Other nations in the area, such as Singapore and South Korea, have well-established clinical research infrastructure and favorable regulatory regimes. Moreover, cultural and linguistic obstacles may need to be addressed, since many prospective clinical trial volunteers may not speak English or Malay, the major languages utilized in clinical research in Malaysia.

Competitive Landscape

Key Players

- Pfizer Inc.

- Novartis International AG

- AstraZeneca plc

- Merck & Co., Inc.

- Roche Holding AG

- Eli Lilly and Company

- Biocon Malaysia (MYS)

- Pharmaniaga Berhad (MYS)

- Hovid Berhad (MYS)

Notable Insights

- September 2022, Clinical Research Malaysia and Novartis Malaysia have signed an agreement to make Sarawak General Hospital a preferred location for clinical trials

- August 2022, The Minister of Health (MOH), Yang Berhormat (YB) Khairy Jamaluddin, officially opened Hematogenix, Malaysia's first central cancer laboratory for clinical trials

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Oncology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.