Malaysia Lipid Disorder Therapeutics Market Analysis

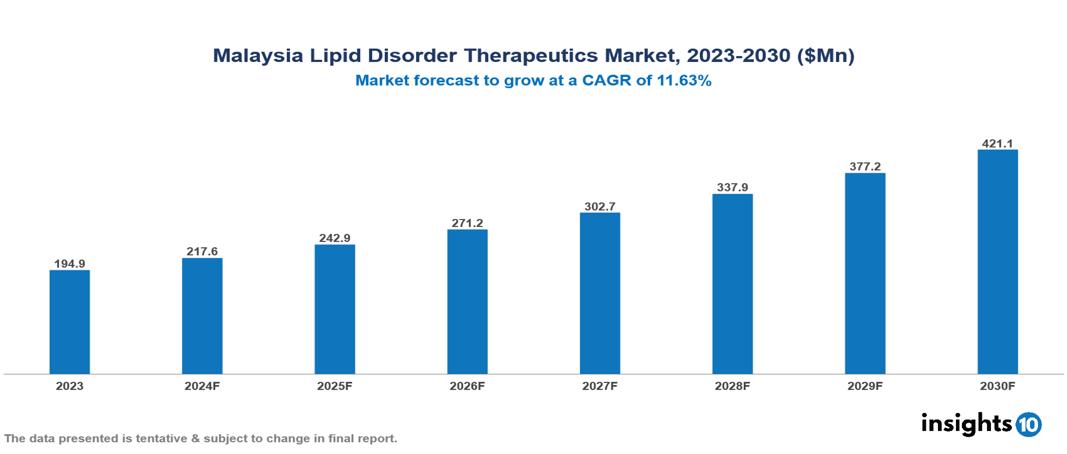

The Malaysia Lipid Disorder Therapeutics Market was valued at $194.9 Mn in 2023 and is predicted to grow at a CAGR of 11.63% from 2023 to 2030, to $421.1 Mn by 2030. Malaysia Lipid Disorder Therapeutics Market is growing due to Sedentary Lifestyles, Public Awareness and Early Intervention, Innovation, and New Treatment Options. The industry is primarily dominated by players such as Pharmaniaga Berhad, Sanofi, Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., AbbVie Inc., Viatris, AstraZeneca PLC, and Dr. Reddys Laboratories Ltd.

Buy Now

Malaysia Lipid Disorder Therapeutics Market Executive Summary

Malaysia Lipid Disorder Therapeutics Market is at around $194.9 Mn in 2023 and is projected to reach $421.1 Mn in 2030, exhibiting a CAGR of 11.63% during the forecast period.

Lipids, also known as lipoproteins, are the types of fats that are present in the blood. A wide range of metabolic illnesses that impact blood lipid levels are referred to as lipid disorders. Their common characteristic is the presence of elevated blood levels of lipoproteins, triglycerides, and/or cholesterol, which are linked to a higher risk of (or existence of) cardiovascular disease. Lowering low-density lipoproteins (LDLs) can be achieved in several simple ways, such as avoiding foods rich in saturated fat, dietary cholesterol, and excess calories; exercising; keeping a healthy weight; and giving up smoking. The most widely recommended medications for treating lipids are statins.

One of the risk factors for cardiovascular diseases (CVD) is dyslipidemia, which is highly prevalent among Malaysians, where 64% and 56.7% of Malaysian adults had elevated total cholesterol and low-density lipoprotein cholesterol (LDL-c), respectively. Lipid-lowering medications (LLM), combined with therapeutic lifestyle changes are the cornerstone of dyslipidemia management. Local and international guidelines recommend the use of LLM, specifically statins for secondary prevention, as well as for primary prevention among those with a high risk of developing CVD. The market, therefore, is driven by significant factors like sedentary lifestyles, public awareness and early intervention, innovation, and new treatment options. However, limited access to healthcare services, rising cost of drugs, and adverse effects restrict the growth and potential of the market.

In March 2023, the US Food and Drug Administration (FDA) authorized the extended use of Regeneron Pharmaceuticals, Inc.'s Evkeeza medication in children aged 5 to 11 years to treat an extremely rare condition that raises cholesterol levels.

Market Dynamics

Market Growth Drivers

Sedentary Lifestyles: lack of physical activity is a significant risk factor for lipid disorders. This is concerning as rapid urbanization and demanding work schedules in Malaysia are leading to a more sedentary population, with estimates suggesting over 40% of adults don't get enough exercise. As a consequence, the market for lipid-lowering therapeutics is experiencing a surge to address this growing health concern.

Public Awareness and Early Intervention: Partnerships among pharmaceutical corporations, academic institutions, and healthcare organizations promote information sharing, funding for research, and the creation of novel treatment approaches. These collaborations spur innovation in the treatment of lipid disorders and quicken the conversion of research findings into practical applications.

Innovation and New Treatment Options: The field of pharmaceutical research is constantly evolving, with companies developing novel lipid-lowering drugs with improved efficacy and targeted action. This goes beyond just statins, the traditional class of cholesterol-lowering medications. Newer medications like PCSK9 inhibitors offer more personalized treatment options for patients with specific needs or those who are intolerant to statins.

Market Restraints

Limited Access to Healthcare Services: Disparities in healthcare services and infrastructure still exist in Malaysia, despite efforts to increase access to care. A study found that only 69% of rural residents in Malaysia live within 3 kilometers of a healthcare facility compared to 92% of urban residents [source needed]. This lack of access to specialized lipid problem therapies and healthcare facilities in rural areas and for underprivileged people frequently results in underdiagnosis and undertreatment of lipid disorders.

Rising Cost of the drug: Since lipid synthesis is complicated and requires high-quality raw materials, developing and producing lipid-based medications comes at a significant financial expense. A study by the Alliance for Affordable Innovation found that lipid-based drugs can cost on average three times more than traditional medications, making them unaffordable for many patients. Because customers frequently pay for these expenses out of pocket, fewer people can access these therapies. This is a major obstacle, particularly for patients who lack sufficient insurance coverage. In fact, a study published in by the Malaysian Journal of Pharmaceutical Sciences found that close to 40% of patients in Malaysia skip or delay necessary doses of lipid-based medications due to high costs. Generally, the Malaysia lipid market expansion might be restricted by the high cost.

Adverse effects: The side effects of cholesterol-lowering drugs are one of the main obstacles facing the lipid disease therapeutics market. Common medications like statins can have side effects such as elevated blood sugar, hepatic damage, and muscular soreness. These repercussions discourage patients and restrict market growth. These side effects necessitate continual monitoring and control of patients, which drives up healthcare costs and complicates treatment regimens.

Regulatory Landscape and Reimbursement Scenario

Malaysia has a well-established regulatory framework for the pharmaceutical industry, with several key regulatory bodies responsible for ensuring the safety and efficacy of drugs and medical devices. The National Pharmaceutical Regulatory Agency (NPRA) is the main regulatory body, responsible for implementing quality control of drugs and medical devices, ensuring compliance with regulatory requirements, and collaborating with international regulatory bodies The Drug Control Authority (DCA) is responsible for the registration of pharmaceutical products, including evaluating the safety and efficacy of new drugs and issuing licenses for the import, export, and manufacture of drugs.

The Ministry of Health (MOH) is the principal governmental authority responsible for protecting people's health and well-being, as well as overseeing the whole healthcare system. The reimbursement process in Malaysia involves several steps, including the submission of documents, evaluation by the NPRA, and approval by the MOH. Reimbursement rates vary depending on the type of product, the patient's condition, and the healthcare provider.

Competitive Landscape

Key Players

Here are some of the major key players in the Malaysia Lipid Disorder Therapeutics Market:

- Pharmaniaga Berhad

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- AstraZeneca PLC

- Pfizer, Inc.

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co., Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AbbVie, Inc.

- Viatris

- Dr. Reddy’s Laboratories Ltd.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Malaysia Lipid Disorder Therapeutics Market Segmentation

By Drug Type

- Atorvastatin

- Fluvastatin

- Simvastatin

- Pravastatin

- Others

By Indication

- Hypercholesterolemia

- Dysbetalipoproteinemia

- Familial Combined Hyperlipidemia

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.