Malaysia Infectious Disease Drugs Market Analysis

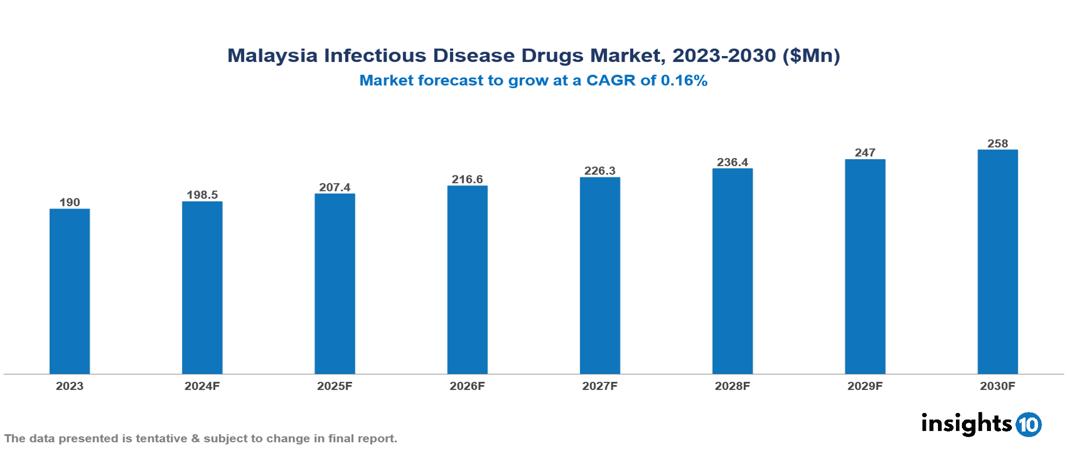

Malaysia Infectious Disease Drugs Market valued at $0.19 Bn in 2023, projected to reach $0.26 Bn by 2030 with a 4.47% CAGR. Factors such as the aging population, economic development, and rising prevalence of infectious diseases drive the industry. The market is dominated by key players like Pharmaniaga Berhad, Kotra Pharma, Duopharma Biotech Berhad, AbbVie Inc., Gilead Sciences, Merck & Co., F. Hoffman-La Roche Ltd., GlaxoSmithKline plc, Boehringer Ingelheim International GmbH, Janssen Pharmaceuticals, and Novartis AG.

Buy Now

Malaysia Infectious Disease Drugs Market Executive Summary

Malaysia Infectious Disease Drugs Market valued at $0.19 Bn in 2023, projected to reach $0.26 Bn by 2030 with a 4.47% CAGR.

In the Malaysian healthcare system, drugs used to treat illnesses brought on by bacteria, viruses, fungi, or parasites are the main focus of the infectious disease drugs market in Malaysia. This market includes a broad spectrum of medications, such as antifungals, antivirals, antibiotics, and antiparasitics. The market is impacted by several factors, including the frequency of infectious diseases, government healthcare policies, regulatory frameworks, and technological and medication development breakthroughs.

The growing prevalence of infectious diseases and the increased emphasis on the development of healthcare infrastructure in Malaysia have resulted in a robust expansion of the infectious disease drug market. Antiviral, antibiotic, and antifungal medicine demand is surging in the market due to factors such as population expansion, urbanization, and changing lifestyles. Major companies are spending money on R&D to launch novel treatments and increase their market share in the area.

In 2023, the global infectious disease drugs market was estimated at $118.75 Bn. Both, an increase in diagnoses and government-led public education initiatives on the management and prevention of infectious diseases, are responsible for this rise. The increasing level of generic competition is indicative of a changing market situation. Long-term growth, especially in emerging nations, requires lowering financial obstacles and expanding access to therapy. This will lead to increased industrial research and development.

Along with Duopharma Biotech and Kotra Pharma, Pharmaniaga Berhad is a significant player in the Malaysian infectious illness drugs market. The company provides antivirals, antibacterials, antifungals, and antiparasitics, among other medications for infectious diseases. The company's primary goal is to produce generic medications that are both high-quality and reasonably priced so that a larger population can use them.

Market Dynamics

Market Growth Drivers:

Growing Prevalence of Infectious Diseases: With the population increase and lifestyle change, there is a rise in the prevalence of infectious diseases including HIV/ AIDS, dengue fever, and tuberculosis. This leads to an increase in demand for medications to treat and prevent these illnesses.

Economic Development: As Malaysia's economy expands and disposable income rises, people are more willing and able to seek healthcare services, including treatment for infectious diseases. The market for infectious illness medications expands as a result of the rising demand for healthcare services.

Aging Population: As Malaysia's population ages, the prevalence of infectious diseases may rise among older persons, who are more vulnerable to some infections due to age-related reductions in immune function. As healthcare professionals try to fulfill the demands of this population segment, this demographic shift helps to drive the market for infectious disease medications.

Market Restraints:

Regulatory Obstacles: Malaysian medicine approval and regulation procedures can be complex and time-consuming. New medications for infectious diseases may take longer to reach the market as a result of delays in regulatory clearance, which may limit patient treatment options.

Competition from Generic Drugs: Pharmaceutical companies operating in Malaysia may face difficulties due to the availability of generic substitutes for branded infectious disease medications.

Economic Factors: People may be prevented from seeking and affording treatment for infectious diseases by economic obstacles such as unemployment, poverty, and restricted access to healthcare coverage.

Healthcare Policies and Regulatory Landscape

According to the Control of Drugs and Cosmetics Regulations of 1984, the Drug Control Authority (DCA) is the executive agency in charge of managing the registration procedure for innovative medicines and biologics in Malaysia. It is necessary to apply online through the QUEST3 system. With QUEST online membership registration, users can securely complete online tasks for product registration applications. DCA requires high-quality data and strict protocol adherence to comply with international requirements for Good Clinical Practice and Good Manufacturing Practice, such as those set forth by the International Council on Harmonization (ICH). This can add complexity and potentially extend timelines. Comprehensive assessments of the safety and effectiveness of medications across diverse populations are necessary in Malaysia, given the country's vast ethnic diversity. Additional clinical studies or data analysis might be necessary for this, which would complicate matters and increase costs.

Competitive Landscape

Key Players:

- Pharmaniaga Berhad

- Kotra Pharma

- Duopharma Biotech Berhad

- AbbVie Inc.

- Gilead Sciences

- Merck & Co.

- F. Hoffman-La Roche Ltd.

- GlaxoSmithKline plc

- Boehringer Ingelheim International GmbH

- Janssen Pharmaceuticals

- Novartis AG

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Infectious Disease Drug Market Segmentation

By Disease

- HIV

- Influenza

- Hepatitis

- Tuberculosis

- Malaria

- Other

By Treatment

- Antibacterial

- Antiviral

- Antiparasitic

- Other

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.