Malaysia ENT Devices Market Analysis

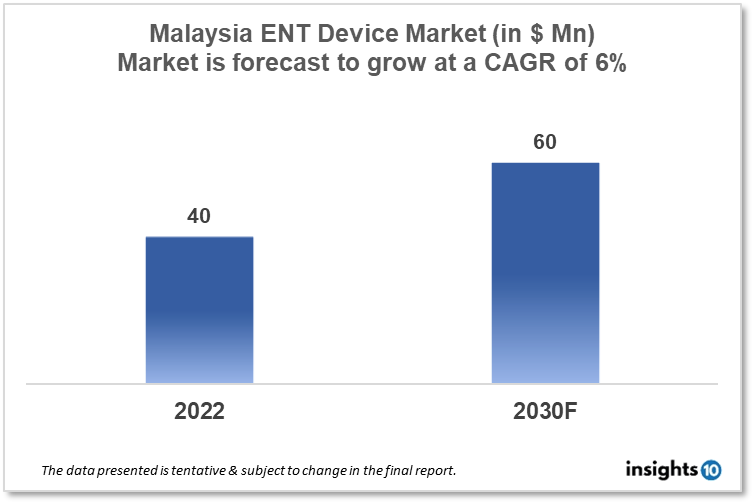

Malaysia's ENT Devices Market is projected to grow from $40 Mn in 2022 to $60 Mn by 2030, registering a CAGR of 6% during the forecast period of 2022-30. The rising prevalence of ENT disorders, such as hearing loss, sinusitis, and tonsillitis, is a major driver of the ENT device market. The market is highly competitive, with a large number of players operating in the space, ranging from small, specialized companies to large multinational corporations. The domestic key players in the Malaysia ENT devices market include Meditop, Meditrade, and ENTtech Medical Solutions.

Buy Now

Malaysia ENT Devices Market Analysis Summary

Malaysia's ENT Devices Market is projected to grow from $40 Mn in 2022 to $60 Mn by 2030, registering a CAGR of 6% during the forecast period of 2022-30.

Malaysia is a Southeast Asian federation of 13 states and three federal areas. It is a developing country with an upper-middle income. The country is evolving as a regional manufacturing center for medical devices. Malaysia's medical device market is continuously expanding, with a projected market size of USD 1.2 billion in 2020, and it is expected to expand further in the future years. Malaysia's government devoted 4.1% of its GDP to healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

In Malaysia, there is a growing desire for more innovative and creative ENT devices. The need will increase as the elderly population consumes more ENT devices. Malaysia is dedicated to raising healthcare delivery standards in order to provide world-class medical items and technologies. More than 30 medical device MNCs producing higher-value-added medical devices have chosen Malaysia as their offshore production location. These aspects could boost Malaysia's ENT Devices Market.

Market restrains.

Over 90% of the medical supplies and equipment used in the country are imported. Despite having a limited healthcare budget, the Malaysian government has increased healthcare spending in recent years, potentially opening up opportunities for ENT device manufacturers. While there are several hospitals and clinics in Malaysia that offer ENT services, there are not many specialised ENT clinics, which may limit demand for ENT devices. These factors may deter new entrants into the Malaysia ENT Devices Market.

Competitive Landscape

Key Players

- ENTtech Medical Solutions: This company produces a range of medical devices, including ENT instruments such as nasal forceps, ear curettes, and laryngoscopes

- Meditrade Sdn Bhd: This company produces a variety of medical equipment and supplies, including ENT devices such as otoscopes, endoscopes, and laryngoscopes

- Paragon Medical Sdn Bhd: This company produces medical devices, including ENT instruments such as suction tips, ear specula, and biopsy forceps

- YSP Industries (M) Sdn Bhd: This company produces a range of medical equipment and supplies, including ENT devices such as endoscopes, laryngoscopes, and otoscopes

- Meditop Sdn Bhd: This company produces a variety of medical devices and supplies, including ENT instruments such as nasal specula, ear forceps, and scissors

Recent Notable Updates

November 2022: Malaysia's Medical Device Authority (MDA) has amended its guidance on the necessity for medical device labelling and the handling of authorised product modification notifications. MDA released the fifth edition of the labelling guidance in June but has since detected a few changes, resulting in a sixth edition released this week that closely resembles its predecessor.

Healthcare Policies and Reimbursement Scenarios

In Malaysia, the regulatory oversight of medical devices, including ENT devices, is overseen by the Medical Device Authority (MDA), which is responsible for the registration, licensing, and post-market surveillance of medical devices in the country. Foreign producers must additionally appoint a Malaysian authorised representative to operate as the importer of record and assure compliance with local rules. The Ministry of Health's Drug Control Authority (DCA) is in charge of defining the list of approved pharmaceuticals and medical equipment that are eligible for reimbursement under the government's healthcare financing schemes, such as the MySalam scheme, under the public healthcare system.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ENT Device Market Segmentation

The ENT Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Co2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices (Revenue, USD Billion):

- Endocsopes

- Hearing Screening Devices

By Surgical Device (Revenue, USD Billion):

- Powered Surgical Instruments

- Radiofrequency (RF) Handpieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End Users (Revenue, USD Billion):

- Hospitals and Ambulatory Settings

- Home Use

- ENT Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.