Malaysia Clinical Nutrition for Chronic Kidney Diseases Market Analysis

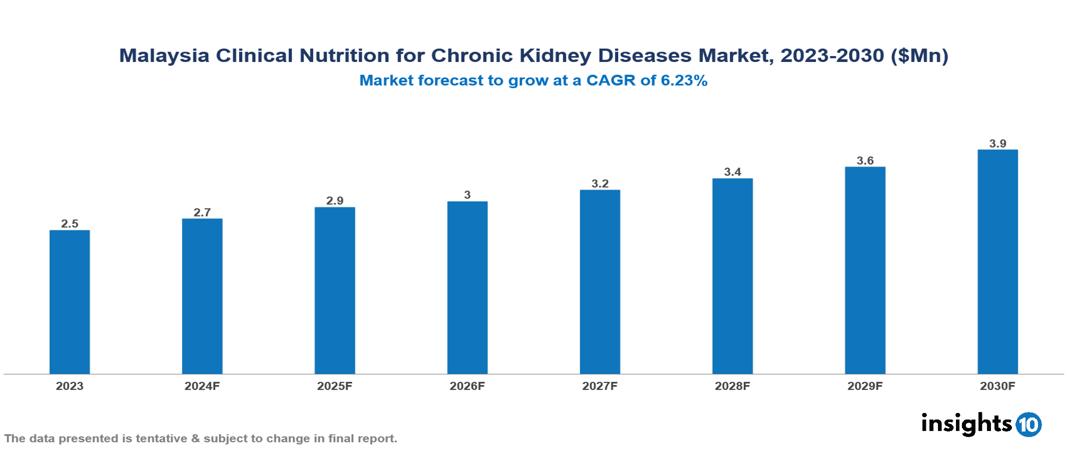

Malaysia Clinical Nutrition for Chronic Kidney Diseases Market was valued at $2.50 Mn in 2023 and is predicted to grow at a CAGR of 6.23% from 2023 to 2030, to $3.90 Mn by 2030. The key drivers of this industry include the rising prevalence of CKD, increased awareness and education, and technological advancements. The industry is primarily dominated by Abbott Nutrition, Pfizer Inc., Bayer AG, and Nestlé Health Science among others.

Buy Now

Malaysia Clinical Nutrition for Chronic Kidney Diseases Market Executive Summary

Malaysia Clinical Nutrition for Chronic Kidney Diseases Market was valued at $2.50 Mn in 2023 and is predicted to grow at a CAGR of 6.23% from 2023 to 2030, to $3.90 Mn by 2030.

Chronic kidney disease (CKD) is a gradual loss of kidney function over at least three months, often progressing silently due to the absence of early symptoms. The main causes include diabetes and high blood pressure, though family history and other conditions also contribute. As CKD advances through stages, it may necessitate dialysis or a kidney transplant and is associated with increased risks of heart disease, stroke, and bone issues. Management focuses on slowing disease progression, symptom management, and preventing complications through dietary changes, medications, and blood pressure control. Key dietary adjustments include moderating protein intake, managing fluid levels, controlling electrolytes like sodium, potassium, and phosphorus, and ensuring sufficient calorie intake to avoid malnutrition. Early detection and screening are crucial for those at risk.

The prevalence of chronic kidney disease (CKD) in Malaysia is reported to be around 0.5% according to the National Basic Health Survey. Another study found a slightly lower prevalence of 0.38%, with regional variations showing the highest prevalence in North Kalimantan at 0.64% and the lowest in West Sulawesi at 0.18%. The market therefore is driven by significant factors like the rising prevalence of CKD, increased awareness and education, and technological advancements. However, the high cost of treatment, limited healthcare infrastructure, and scarcity of qualified dietitians restrict the growth and potential of the market.

Prominent players in this field are Abbott Nutrition, Pfizer Inc., Bayer AG, and Nestlé Health Science among others.

Market Dynamics

Market Growth Drivers

Rising Prevalence of CKD: Malaysia's rising incidence of diabetes and hypertension, leading causes of CKD, drives demand for specialized clinical nutrition products. A 2020 nationwide study reported a CKD prevalence of 15.48% among adults aged 18 and above, highlighting the urgent need for effective management strategies.

Increased Awareness and Education: Growing awareness among healthcare professionals and patients about the importance of clinical nutrition in managing CKD is driving demand. Educational campaigns and initiatives that highlight the benefits of specialized nutrition for CKD patients contribute to market expansion.

Technological Advancements: Advances in medical research and technology lead to the development of innovative nutritional products tailored specifically for CKD patients. These advancements enhance the effectiveness of nutritional therapies and attract more patients and healthcare providers to adopt these solutions.

Market Restraints

High Cost of Treatment: The high cost of specialized clinical nutrition products and treatments can be a significant barrier for many patients in Malaysia, especially those from lower-income backgrounds. Limited financial resources and lack of comprehensive insurance coverage can hinder access to essential nutritional interventions.

Limited Healthcare Infrastructure: Inadequate healthcare infrastructure, particularly in rural and underserved areas, poses a challenge to the effective delivery of clinical nutrition services. A shortage of healthcare professionals, including dietitians specializing in CKD nutrition, limits patient access to expert nutritional guidance.

Scarcity of Qualified Dietitians: There is a shortage of dietitians in Malaysia with expertise in CKD nutrition, which restricts patients' access to specialized nutritional guidance and tailored dietary management plans.

Regulatory Challenges: Navigating Malaysia’s regulatory landscape for clinical nutrition products can be complex and time-consuming. Stringent regulations and approval processes may delay the introduction of new products to the market, affecting the availability and diversity of nutritional options for CKD patients.

Regulatory Landscape and Reimbursement Scenario

In Malaysia, the regulatory landscape for CKD-specific clinical nutrition is managed by the Ministry of Health (MOH) and the National Pharmaceutical Regulatory Agency (NPRA). The MOH oversees the regulation of food and dietary products, including those for special medical purposes like CKD management, setting guidelines for their labeling, safety, and quality. The NPRA regulates medical devices and certain nutraceuticals with therapeutic claims, thus overseeing products categorized as medical foods or those claiming to treat or prevent CKD. Key regulations include the Food Regulations 1985, which set general food safety and labeling standards, and the NPRA's guidelines for medical devices, which may apply to specialized enteral feeding equipment used by CKD patients. The MOH is also developing draft guidelines for medical foods, which are expected to provide a clearer regulatory framework for CKD nutritional products.

The reimbursement scenario for CKD-specific clinical nutrition in Malaysia is currently limited. The National Health Service (NHS) primarily covers hospitalization and critical care, generally excluding specialized CKD nutritional products. Private health insurance plans in Malaysia may offer limited coverage for nutritional consultations or specific dietary supplements, but comprehensive coverage for CKD-specific clinical nutrition is not yet common. This limited reimbursement landscape means that many patients might need to bear out-of-pocket expenses for their CKD nutritional needs, creating a financial burden for those requiring specialized nutrition therapy.

Competitive Landscape

Key Players

Here are some of the major key players in the Malaysia Clinical Nutrition for Chronic Kidney Diseases Market

- Abbott Nutrition

- Pfizer Inc.

- Bayer AG

- Nestlé Health Science

- Otsuka Pharmaceutical

- Mead Johnson & Company, LLC

- Danone S.A.

- Victus, Inc.

- B. Braun Melsungen AG

- Fresenius Kabi AG

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Malaysia Clinical Nutrition for Chronic Kidney Diseases Market Segmentation

Product

- Oral Nutrition

- Parenteral Nutrition

- Enteral Feeding Formulas

Stages

- Adult

- Paediatric

Sales Channel

- Online

- Retail

- Institutional Sales

End-User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.