Malaysia Central Nervous System (CNS) Therapeutics Market Analysis

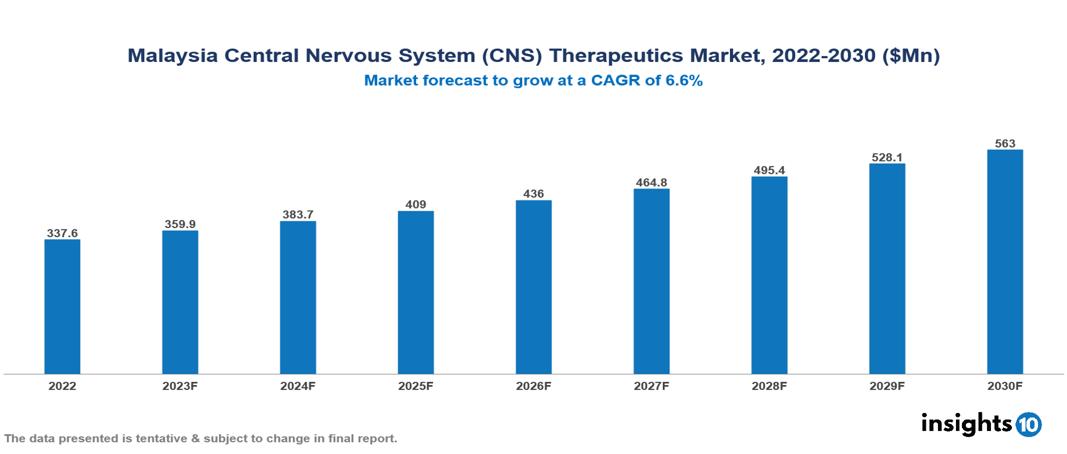

The Malaysia Central Nervous System (CNS)Therapeutics Market was valued at $338 Mn in 2022 and is predicted to grow at a CAGR of 6.6% from 2023 to 2030, to $563 Mn by 2030. The key drivers of this industry include the rising prevalence of CNS disorders, supportive government initiatives, and rising disposable income. The industry is primarily dominated by players such as Abbott, Novartis, Merck, Eisai, AstraZeneca, Otsuka, Duopharma, and Pharmaniaga among others.

Buy Now

Malaysia Central Nervous System (CNS) Therapeutics Market Analysis

The Malaysia Central Nervous System (CNS)Therapeutics Market is at around $338 Mn in 2022 and is projected to reach $563 Mn in 2030, exhibiting a CAGR of 6.6% during the forecast period.

CNS disorders include conditions that affect the brain and spinal cord's ability to function effectively, impairing common neurological functions. This subset includes neurological diseases like multiple sclerosis and epilepsy, mental disorders like depression and schizophrenia, and neurodegenerative disorders like Alzheimer's and Parkinson's. Variables such as infections, traumas, autoimmune reactions, and environmental and hereditary factors contribute to these conditions. Symptoms frequently include abnormalities in mood, motor function, cognitive function, or sensory perception. The purpose of therapeutic approaches is to control related consequences, reduce disease progression, or mitigate symptoms. Medication, psychotherapy, and, in specific situations, surgery are examples of treatment modalities.

Malaysia is experiencing a rising burden of mental health disorders whose prevalence is approximately 40% of the population. The market therefore is driven by important factors like a surge in the prevalence of neurological conditions, supportive government initiatives, and rising disposable income. However, limited local manufacturing, stringent regulatory environment, and workforce shortage restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of CNS conditions: The aging population in Malaysia is on the rise, elevating the likelihood of age-related neurodegenerative disorders such as Alzheimer's and Parkinson's. Mental health diseases affect about 40% of people. It is expected that this demographic transition will continue, increasing the demand for CNS treatments. The rising incidence of mental health conditions including depression and anxiety in Malaysia is partly due to changes in lifestyle, such as greater urbanization, sedentary behavior, and unhealthy eating habits.

Government initiatives: The Malaysian government is placing a strong emphasis on healthcare spending, directing increased resources to enhance the accessibility of high-quality healthcare services and medications. This entails allocating funds to improve the mental health system and initiate awareness campaigns. The market for CNS therapies could be significantly increased by initiatives like government-sponsored programs that promote early detection and treatment of CNS disorders.

Rising disposable income: An increase in spending power is being driven by Malaysia's growing economy, which may make CNS therapies more affordable for patients. Additionally, the growth of patient support groups improves accessibility to alternate forms of therapy, and raises public awareness—all of which support the market's ongoing growth.

Market Restraints

Limited local manufacturing: Due to its reliance on imported CNS therapies, Malaysia is susceptible to fluctuations in global prices and supply chain disruptions. The limited local manufacturing capacity for CNS drugs diminishes market competitiveness and innovation prospects. Inadequate investment in research and development (R&D) for CNS therapeutics in Malaysia additionally impedes the market's capacity to provide solutions tailored to local needs and specific patient requirements.

Stringent regulatory landscape: In Malaysia, obtaining regulatory approval for novel CNS pharmaceuticals is a procedure with stringent requirements. This causes a delay in the product's release into the market and patients' access to these therapies. Regulatory authorities experience capacity constraints that lengthen the approval process, which impedes market expansion.

Workforce shortage: The industry's potential is limited by a shortage of neurologists, psychiatrists, and other specialists in CNS disorders, restricting access to precise diagnosis and treatment. Uneven access to high-quality CNS treatment can result from differences in the distribution of healthcare professionals between urban and rural locations, impeding market growth.

Healthcare Policies and Regulatory Landscape

The Malaysian National Pharmaceutical Regulatory Agency (NPRA), which is under the Ministry of Health, is the primary regulatory organization in charge of monitoring medications and pharmaceuticals in Malaysia. The nation's pharmaceutical products must be safe, effective, and of high quality, and this is the responsibility of NPRA.

Manufacturers and distributors of medications, pharmaceuticals, and related items are required to go through a rigorous regulatory clearance process in order to get a license. The NPRA assesses these submissions to ascertain whether the product satisfies the necessary requirements and does not present a serious risk to the public's health. After being accepted, the product is given a license or marketing permission that permits it to be distributed and sold lawfully in Malaysia. Strict restrictions must be followed by new entrants, and they must also prove that their products are safe, effective, and of high quality.

Competitive Landscape

Key Players

- Pfizer

- Novartis

- AstraZeneca

- Johnson & Johnson

- Merck & Co

- Abbott Laboratories

- Eisai Co Ltd

- Otsuka Pharmaceuticals

- Pharmaniaga Berhad

- Duopharma Biotech Berhad

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Malaysia Central Nervous System (CNS) Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.