Latin America HIV Therapeutics Market Analysis

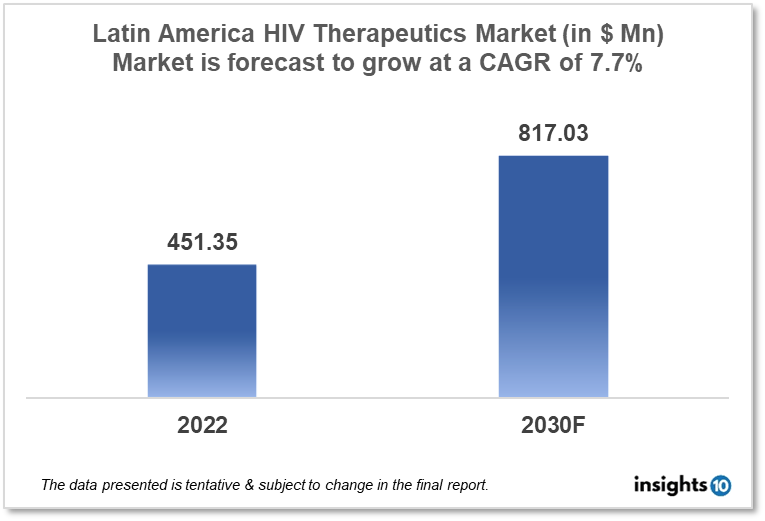

The Latin America HIV therapeutics market is expected to reach $817.03 Mn by 2030, up from $451.35 Mn in 2022, with a CAGR of 7.7% from 2022 to 2030. Latin America players such as Laboratorios Biogen, Laboratorios Liomont, Eurofarma Laboratórios, and Ache Laboratorios Farmacéuticos dominate the Latin America HIV therapeutics market. The Latin American government policies, funding, poverty, and initiatives by international organizations to manage HIV infections propel the market. The Latin America HIV therapeutics market is divided into 5 segments type, product, geography, end user, and distribution channel.

Buy Now

Latin America HIV Therapeutics Market Analysis Summary

The Latin America HIV therapeutics market is expected to reach $817.03 Mn by 2030, up from $451.35 Mn in 2022, with a CAGR of 7.7% from 2022 to 2030.

Since 2000, Latin America has made little progress in reducing new HIV infections in the region, with the number increasing by 5% from 2010 to 2021. As of 2021, the region had 2.2 Mn HIV-positive people (1.5 Mn-2.8 Mn). In 2021, 82 % of those living with HIV knew their HIV status, 69 % were receiving treatment (85 % of those who knew their HIV status), and 63 % were virally suppressed (91 % of those on treatment).

Men continue to have lower coverage for diagnosis and treatment than women, though this gap is closing. Some countries, such as El Salvador, Guatemala, Honduras, and Paraguay, continue to rely on external support for some HIV programmes, particularly those targeting key populations, and it will be critical for these countries to increase their efforts.

Market Dynamics

Market Growth Drivers Analysis

Domestic resources were the primary drivers of resource growth in the region, increasing by 67 % between 2010 and 2021, despite a 38 % decrease from international sources. Domestic resources will account for 97 % of all HIV resources in the region by 2021. One of the most significant achievements in Latin America and the Caribbean over the last decade has been the push to expand access to universal antiretroviral therapy. In countries such as Brazil, health ministries have launched initiatives to use treatment as prevention (PrEP) while also ensuring access to innovative ARVs through public-private partnerships. Access to this new generation of innovative medicine, often integrase inhibitors, which would normally only be used in cases of resistance or highly treatment-experienced patients, has resulted in a significant reduction in AIDS-related deaths. These elements may entice new entrants into the Latin American HIV therapeutics market.

Market Restraint

Despite significant progress in expanding access to HIV treatment in the region, efforts to ensure timely diagnosis and enrolment in care remain insufficient, treatment adherence remains a challenge, and antiretroviral medicine stock-outs worsen HIV treatment outcomes. In 2021, 31% of people living with HIV in Latin America did not receive antiretroviral therapy, and the %age of newly diagnosed people with advanced HIV infection ranged from 10% in Uruguay to 44% in Paraguay. Coverage of preferred dolutegravir-based regimens for first-line antiretroviral therapy varies, ranging from 0% in Colombia to 100% in Venezuela. Latin America is still dealing with some of the world's worst humanitarian crises, which affect many countries, including the Bolivarian Republic of Venezuela, Haiti, and the northern Caribbean. These factors may discourage new entrants to enter Latin America's HIV therapeutics market.

Competitive Landscape

Key Players

- Ache Laboratorios Farmacéuticos (BRA)

- Eurofarma Laboratórios (BRA)

- EMS (BRA)

- Cristália (BRA)

- Silanes Laboratories (MEX)

- Laboratorios Liomont (MEX)

- PiSA Farmaceutica (MEX)

- Gador S.A (ARG)

- Richmond Laboratories (ARG)

- Laboratorios Biogen (ECU)

- Merck & Co.

- AbbVie

- Bristol Myers Squibb

Recent Notable Updates

March 2022: The first injection that provides long-term HIV protection is being introduced as an alternative to daily medication in South Africa and Brazil. In Brazil, 30% of transgender people have HIV, and 18% of men who have sex with men are receiving long-acting antiretroviral therapy. injections containing cabotegravir.

Healthcare Regulations

In Latin America, HIV therapeutics are typically regulated by national regulatory agencies such as Brazil's Agencia Nacional de Vigilancia Sanitaria (ANVISA) or Colombia's Instituto Nacional de Vigilancia de Medicamentos y Alimentos (INVIMA). Before HIV medications can be approved and marketed in their respective countries, these agencies must ensure that they meet safety, efficacy, and quality standards. Aside from national regulatory agencies, some Latin American countries are involved in regional initiatives aimed at improving access to HIV treatment and care. The Pan American Health Organization (PAHO), for example, has established the "Strategic Fund," which negotiates prices for antiretroviral drugs and other essential medicines used to treat HIV and other diseases in order to make them more affordable and accessible to countries in the region.

Reimbursement Policies

Access to HIV treatment and care in Latin America has improved significantly in recent years, but challenges remain, and HIV therapeutic reimbursement varies across the region. Many countries, including Brazil, Mexico, and Argentina, have national health insurance schemes or other programmes that cover HIV treatment, including antiretroviral therapy (ART) and other HIV-related medications. These programmes are frequently supported by a mix of government, international aid, and private insurance funds.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

HIV Therapeutics Segmentation

By Types (Revenue, USD Billion):

- Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- Coreceptor Antagonists

- Entry and Fusion Inhibitors

- Integrase Inhibitors

- Protease Inhibitors (PIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.