Kenya Cardiovascular Diseases Therapeutics Market Analysis

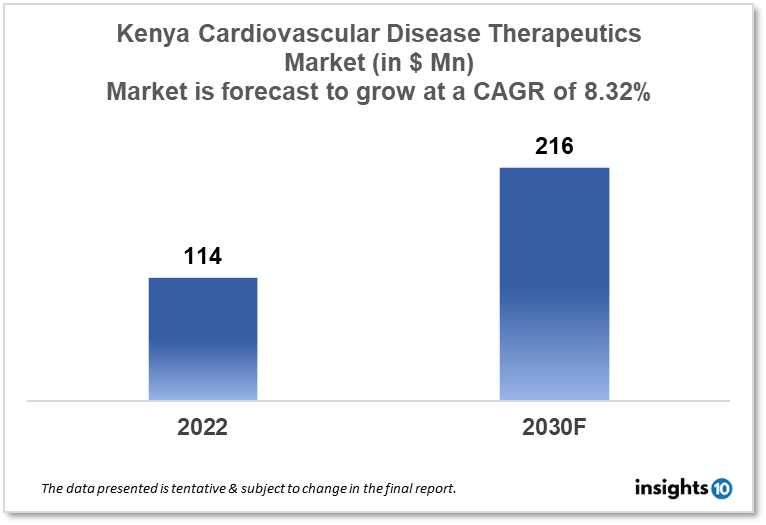

Kenya's cardiovascular disease therapeutics market is projected to grow from $114 Mn in 2022 to $216 Mn in 2030 with a CAGR of 8.32% for the year 2022-30. The rise in prevalence of the cardiovascular diseases in Kenya and the increasing awareness about different therapeutic options in Kenya are the major growth drivers of the market. The Kenya cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by end user. Kenton, Jaskam, and Lupin are the major players in the Kenya cardiovascular disease therapeutics market.

Buy Now

Kenya Cardiovascular Disease Therapeutics Market Executive Analysis

Kenya's cardiovascular disease therapeutics market is projected to grow from $114 Mn in 2022 to $216 Mn in 2030 with a CAGR of 8.32% for the year 2022-30. In the 2022–23 fiscal year, $1.27 Bn will be allocated to the healthcare industry in Kenya, of which $540 Mn will go towards Universal Health Coverage (UHC). The estimated cost of the 2022–23 budget is $29 Bn, which is $3.03 Bn less than the estimated cost of the 2021/22 fiscal year, which was $32 Bn, of which the health sector got $1.05 Bn.

In Kenya, hypertension is now the most prevalent cardiovascular condition, affecting more than 20 Mn individuals, according to estimates. Hypertensive end-organ damage is a significant cause of morbidity and death in Kenya. Statins are drugs that lower cholesterol and lower the chance of heart attack and stroke. In Kenya, atorvastatin and simvastatin are two common statins. In addition to lowering blood pressure, beta-blockers lower the chance of heart attack and stroke. Metoprolol and atenolol are two beta-blockers that are frequently used in Kenya. Blood pressure is lowered by using ACE inhibitors, which also lower the chance of heart attack and stroke. Lisinopril and enalapril are two ACE inhibitors that are frequently prescribed in Kenya. Blood pressure is lowered by calcium channel blockers, which also lower the chance of heart attack and stroke. Amlodipine and nifedipine are two calcium channel blockers that are frequently used in Kenya. Blood pressure is lowered and excess bodily fluid is reduced by the use of diuretics. In Kenya, diuretics like furosemide and hydrochlorothiazide are frequently prescribed. The possibility of blood clots and stroke is decreased by the antiplatelet drug aspirin. Patients with a history of cardiovascular disease are frequently provided with it. A drug called nitroglycerin is used to address angina, which is chest pain brought on by inadequate heart blood flow. It increases blood flow by relaxing blood arteries.

Market Dynamics

Market Growth Drivers

The Kenya cardiovascular disease therapeutics market is being driven by a steady rise in the prevalence of cardiovascular diseases in Kenya in recent years. Changing lifestyles are related to the increase in frequency. The population of Kenya is becoming more conscious of the dangers and effects of cardiovascular diseases. In Kenya, the market for therapeutics for cardiovascular disease is expanding as a result of technological advancements. For instance, it is anticipated that in the upcoming years, there will be a rise in the use of mobile health technology to monitor and manage cardiovascular disease.

Market Restraints

Kenya's healthcare system is underdeveloped which may restrict patient access to treatments for cardiovascular illness, which might in turn restrict the Kenya cardiovascular disease therapeutics market expansion. The cost of cardiovascular disease therapies may restrict entry for patients who cannot afford treatment. If the expense of the treatment is not covered by insurance or the government, this may slow market expansion. Kenya suffers from a shortage of qualified healthcare workers, which may affect their capacity to identify and manage cardiovascular diseases. By lowering the number of patients who receive treatment, may slow market development.

Competitive Landscape

Key Players

- Regal Pharmaceuticals (KEN)

- Transwide Pharmaceuticals (KEN)

- Biodeal Laboratories (KEN)

- Kentons (KEN)

- Jaskam (KEN)

- Lupin

- Silvergate Pharmaceuticals

- TSH Biopharm

- Novartis

- Relypsa

- Vectus Biosystems

- Phasebio Pharmaceuticals

- Ablative Solutions

Healthcare Policies and Regulatory Landscape

A government-run health insurance program called the National Hospital Insurance Fund (NHIF) covers both inpatient and outpatient treatments, including those for cardiovascular disease. Members of the program pay a monthly premium and have access to medical care at institutions that have earned NHIF accreditation. The government-sponsored Linda Mama Program offers free maternal and child health services, such as cardiovascular disease screening and therapy, to women who are expecting young children. Community Health Workers (CHWs) are educated people of the community who offer basic healthcare services, such as cardiovascular disease screening and management, in underserved regions of the nation. The CHW initiative is funded by the government to increase access to healthcare services. The Essential Medicines List (EML), established by the Kenyan government, contains drugs for cardiovascular disease. By doing this, patients are guaranteed access to and affordability of these medicines.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.