Kenya Cardiac Arrhythmia Therapeutics Market

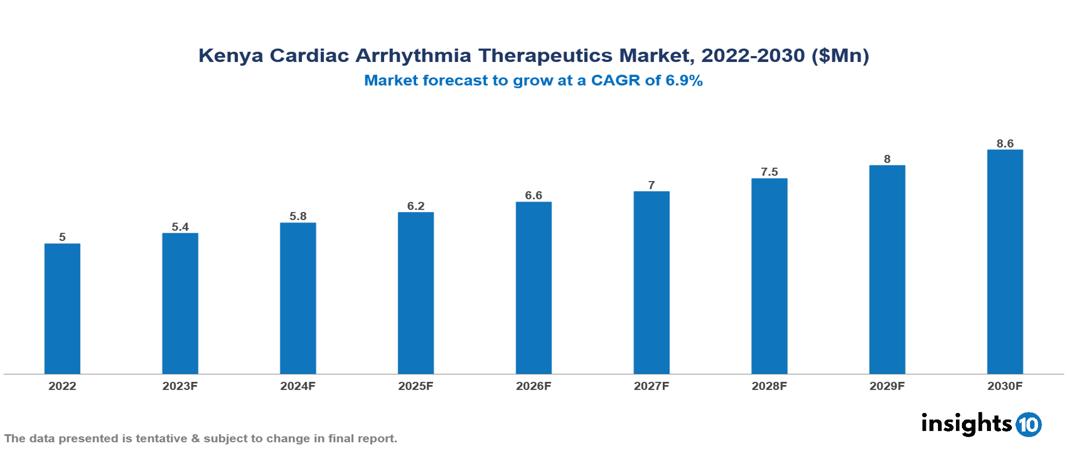

Kenya Cardiac Arrhythmia Therapeutics Market valued at $5 Mn in 2022, projected to reach $9 Mn by 2030 with a 6.9% CAGR. The key drivers of this industry include the rising prevalence of cardiovascular diseases, expanding healthcare infrastructure, and evolving treatment landscape. The industry is primarily dominated by players such as Abbott, Pfizer, Metropolis, Mediheal, Chemicare, Johnson & Johnson, and Medtronic among others.

Buy Now

Kenya Cardiac Arrhythmia Therapeutics Market Analysis Executive Summary

Kenya Cardiac Arrhythmia Therapeutics Market valued at $5 Mn in 2022, projected to reach $9 Mn by 2030 with a 6.9% CAGR.

Cardiac arrhythmia, commonly referred to as an irregular heartbeat, is a condition characterized by abnormal heart rhythms that may lead to the heart beating too fast, too slowly, or in an irregular manner. This can manifest through symptoms like fluttering, pounding, or rapid heartbeats. Various factors, including heart disease, high blood pressure, diabetes, smoking, excessive alcohol or caffeine consumption, stress, and certain medications, can contribute to the development of arrhythmias. Treatment options for cardiac arrhythmia encompass medication, cardioversion, catheter ablation, pulmonary vein isolation, and the use of implantable devices such as pacemakers and defibrillators. In some cases, surgical intervention may be necessary. Companies like Abbott, Medtronic, Philips, Hillrom, Nuubo, and others manufacture these treatments. The market for cardiac arrhythmia therapeutics is expanding, driven by the development of innovative pharmaceuticals and non-invasive therapeutic approaches.

Cardiovascular diseases are the primary cause of mortality in Kenya affecting around 23% of the population. The market is being driven by significant factors such as the increasing burden of cardiovascular diseases, expanding healthcare infrastructure, and evolving treatment landscape. However, conditions such as high costs of treatment for the Kenyan population, lack of human resources, and limited research opportunities restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increasing prevalence of CVDs: Kenya struggles with a considerable burden of CVDs, which constitute a significant share of both fatalities and health issues. In 2019, the World Health Organization (WHO) reported that CVDs ranked as the primary cause of death in the country, causing the death of more than 178,000 individuals. The surge in risk factors such as hypertension, obesity, diabetes, and tobacco usage in Kenya is on the rise, fuelled by factors like urbanization, changes in lifestyle, and insufficient access to preventative healthcare. These elements play a direct role in the emergence of arrhythmias. Furthermore, the aging Kenyan population is becoming more vulnerable to age-related cardiac conditions, including arrhythmias.

Evolving treatment landscape: Pharmaceutical firms are developing and launching novel medications and devices designed for the management of arrhythmia, providing patients with enhanced and tailored treatment choices. In Kenya, the government is enacting policies and initiatives to enhance the availability of reasonably priced cardiac care, specifically for arrhythmia treatments. These efforts involve the implementation of programs like the National Health Insurance Fund (NHIF) and mechanisms to regulate prices. Promoting the domestic production of arrhythmia therapeutics has the potential to enhance affordability and accessibility, contributing to the continued expansion of the market.

Increasing healthcare infrastructure: The government of Kenya is committed to enhancing healthcare infrastructure and ensuring better accessibility to medical services, particularly for CVDs. Notable initiatives, such as the Universal Health Coverage (UHC) program, are being implemented to make healthcare more affordable and accessible to all citizens. The improvement in diagnostic technologies, such as electrocardiograms (ECGs) and Holter monitors, is facilitating the early identification and diagnosis of arrhythmias. This early detection contributes to prompt treatment, resulting in a growing demand for therapeutic interventions. The involvement of private healthcare providers is on the rise, contributing to the expansion of access to specialized cardiac care and arrhythmia treatments, thereby creating opportunities within the market.

Market Restraints

High costs of treatment: Managing cardiac arrhythmias can incur significant costs, encompassing expenses for medications, specialized medical devices, and various procedures. This poses a significant obstacle for a considerable segment of the Kenyan population, many of whom do not have health insurance or encounter financial limitations.

Limited resources: Kenya is confronted with a deficiency of skilled healthcare practitioners, especially in the fields of cardiology and electrophysiology, specifically focusing on the management of arrhythmias. Furthermore, numerous areas in the country lack healthcare facilities that are adequately equipped with advanced technologies for diagnosis and treatment.

Limited research opportunities: Insufficient funding dedicated to local research and development in the field of cardiac arrhythmia therapeutics may impede the creation of inventive and cost-effective treatment solutions customized to meet the specific healthcare requirements of the Kenyan population.

Healthcare Policies and Regulatory Landscape

In Kenya, the regulatory authority overseeing therapeutics, including pharmaceuticals and medical devices, is the Pharmacy and Poisons Board (PPB). The PPB operates under the Pharmacy and Poisons Act and is responsible for ensuring the safety, efficacy, and quality of therapeutic products in the country. It collaborates with other relevant government agencies to uphold standards and compliance within the pharmaceutical and healthcare sectors.

To obtain licensure for therapeutics in Kenya, manufacturers or importers must submit applications to the PPB, providing comprehensive documentation on the product's formulation, manufacturing processes, and clinical data. The process involves rigorous scrutiny of the product's safety and efficacy, and applicants may be required to comply with specific labeling and packaging standards.

The environment for new entrants in the therapeutic market in Kenya is shaped by the stringent regulatory framework enforced by the PPB. While this ensures the quality and safety of therapeutic products in the market, it may pose challenges for new entrants in terms of navigating the complex regulatory requirements and investing in the necessary resources to meet compliance standards. Additionally, understanding and adhering to the regulatory landscape is crucial for success in the Kenyan therapeutic market, as non-compliance could lead to delays or denials in obtaining licensure.

Competitive Landscape

Key Players

- Abbott Laboratories

- Pfizer

- Medtronic

- Boston Scientific

- Johnson & Johnson

- AstraZeneca

- Siemens Healthineers

- Metropolis Healthcare Ltd

- Mediheal Group

- Chemicare Ltd

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Kenya Cardiac Arrhythmia Therapeutics Market Segmentation

By Test Equipment

- Electrocardiogram (ECG)

- Holter monitor

- Others

By Site of Origin

- Atrial Fibrillation

- Sinus Bradycardia

- Atrial Tachycardia

- Atrial Flutter

- Premature Atrial Contractions (PACS)

- Others

By Type

- Supraventricular Tachycardias

- Ventricular Arrhythmias

- Bradyarrhythmia’s

By Drug Type

- Antiarrhythmic drugs

- Calcium channel blockers

- Beta-blockers

- Anticoagulants

- Others

By Mode of Administration

- Injectable

- Oral

- Others

By Distribution channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.