Kenya Blood Disorder Therapeutics Market

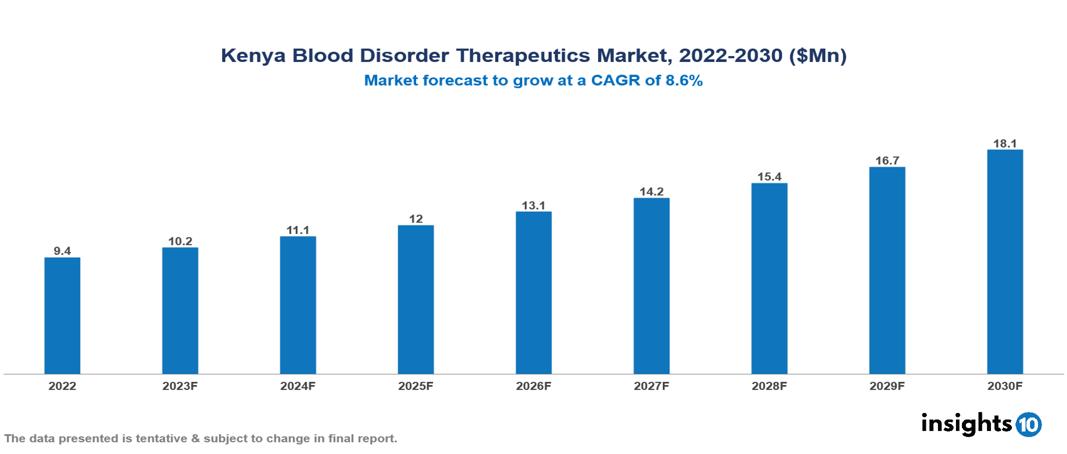

Kenya Blood Disorder Therapeutics Market valued at $9 Mn in 2022, projected to reach $18 Mn by 2030 with a 8.6% CAGR. The market in Kenya is fuelled due to certain factors such as the increasing prevalence of blood disorders, higher expenditure on healthcare by the government, and the rise in technological innovations leading to safer and personalized medications. The Kenya Blood Disorder Therapeutics Market encompasses various players across different segments, including Takeda, Pfizer, AstraZeneca, Sanofi, Roche, Novartis, Sun Pharmaceuticals, Regal Pharmaceuticals, Nextgen Pharmaceuticals, Transwide Pharmaceuticals etc, among various others.

Buy Now

Kenya Blood Disorder Therapeutics Market Executive Summary

Kenya Blood Disorder Therapeutics Market valued at $9 Mn in 2022, projected to reach $18 Mn by 2030 with a 8.6% CAGR.

A blood disorder is a health condition characterized by irregularities in white blood cells, red blood cells, or platelets, which can cause symptoms like fatigue and weight loss. Many of these conditions are linked to genetic factors, often due to gene mutations. The severity of blood disorders varies, and their seriousness depends on the underlying causes. Various factors such as medical conditions, medications, and lifestyle choices can contribute to their development. Treatment options include drug therapy, antibiotics, and dietary supplements. In severe cases, interventions like blood transfusion, chemotherapy, radiation therapy, immunotherapy, and stem cell transplantation may be necessary.

Blood diseases are quite common in Kenya, especially in the west of the country. It is estimated that more than two out of three children have at least one measured blood disorder or sickle cell trait. Approximately 18% of newborns in western Kenya have the sickle cell trait, and 4.5% have sickle cell disease (SCD) (HbAS). This corresponds to over 150,000 people with SCD living in Kenya.

The market in Kenya is fuelled due to certain factors such as the increasing prevalence of blood disorders, higher expenditure on healthcare by the government, and the rise in technological innovations leading to safer and personalized medications.

The company with the most market share in Kenya currently is Takeda Pharmaceutical Company Limited. The market is fragmented between several blood illnesses, including aplastic anemia, sickle cell disease, and hemophilia. In the market for hemophilia A medications, Novo Nordisk is a dominant player, but Pfizer made a big splash when it acquired Global Blood Therapeutics, a sickle cell disease-focused company.

Market Dynamics

Market Growth Drivers

Increasing Blood Disorder Burden: The high prevalence of illnesses including hemophilia, thalassemia, and sickle cell disease puts an increasing burden on healthcare systems. The market is growing because of the rising need for therapy. Better awareness and diagnostics are also making it easier to identify instances, which is fueling the market's growth.

Increasing Investment in and Access to Healthcare: Access to necessary medications and healthcare facilities are receiving more funding from the Kenyan government and development agencies. This includes programs like the Sickle Cell Disease Control Program that are specifically focused on blood illnesses. Increased patient access to healthcare, especially in remote regions, increases the potential patient base for treatments for blood disorders.

Changing Medical Landscape and Innovation: As new and better treatments for blood diseases, such as gene therapy for sickle cell disease, become available, the market is becoming more and more exciting. The hunt for new treatments and cures for blood diseases is the focus of increased local and international research and development activities, which is propelling the market's expansion.

Market Restraints

Limitations on the Healthcare Infrastructure: Early diagnosis and treatment are hampered by the lack of hospitals, clinics, and qualified medical workers, particularly in rural regions. Inadequate supplies of vital equipment, such as imaging machines and blood analyzers, cause delays in diagnosis and improper treatment of blood problems. In Kenya, it might be challenging to guarantee the constant availability of pharmaceuticals, particularly in rural areas, due to ineffective distribution networks and cold chain logistics.

Lack of Awareness and Stigma: There is a dearth of fundamental public information about blood problems, which causes misdiagnosis, lost treatment chances, and delayed therapy. Unfavorable societal attitudes toward specific blood illnesses, including sickle cell disease, may deter people from getting treatment and assistance. Isolation and problems with mental health may also result from this. There are situations where evidence-based medical techniques conflict with traditional practices and beliefs, leading to resistance to treatment adherence and the best possible care.

Cost of Treatment: Since many essential medications, especially newer treatment options for blood disorders are expensive, a sizable segment of the population that depends on out-of-pocket payments is unable to afford them. A large number of Kenyans do not have full health insurance, which makes them susceptible to the high cost of medical care.

Healthcare Policies and Regulatory Landscape

The Pharmacy and Poisons Board (PPB) is the drug regulating authority created under the Pharmacy and Poisons Act. In order to implement the necessary regulatory measures to achieve the highest standards of efficacy and quality for all drugs, chemicals, and medical devices, whether locally manufactured, imported, exported, distributed, sold, or used, the Board regulates the practice of pharmacy as well as the manufacture and trade in drugs and poisons. The PPB is responsible for registering pharmaceutical premises and outlets, licensing imports and exports of pharmaceuticals, approving institutions that offer pharmacy training programs, and providing pharmacovigilance and post-market surveillance. It is in charge of examining, assessing, and accepting applications for clinical trials in Kenya involving either registered or unregistered experimental medications. The PPB works to make certain that people have access to high-quality, safe, and effective medications and medical equipment.

Competitive Landscape

Key Players:

- Takeda

- Pfizer

- AstraZeneca

- Sanofi

- Roche

- Novartis

- Sun Pharmaceuticals

- Regal Pharmaceuticals

- Nextgen Pharmaceuticals

- Transwide Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Kenya Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.