Kenya Addiction Therapeutics Market Analysis

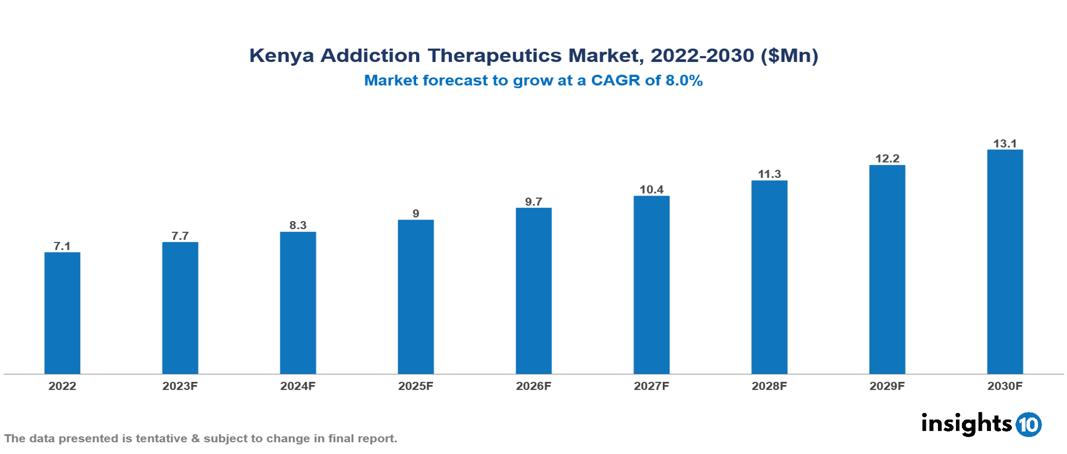

Kenya addiction therapeutics market was valued at $7 Mn in 2022 and is estimated to reach $13 Mn in 2030, exhibiting a CAGR of 8% during the forecast period. The anti-drug campaigns and supportive government initiatives have increased public awareness, which has led to a notable expansion of the addiction therapeutic industry. AbbVie, Indivior, Reckitt Benckiser Pharmaceuticals, Mylan Pharmaceuticals, Teva Pharmaceuticals, Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Alkermes, Lupin Pharmaceuticals, and Cipla are some of the leading companies operating in the market

Buy Now

Kenya Addiction Therapeutics Market Executive Summary

Kenya addiction therapeutics market was valued at $7 Mn in 2022 and is estimated to reach $13 Mn in 2030, exhibiting a CAGR of 8% during the forecast period.

Compulsive drug seeking and use despite negative consequences is a characteristic of addiction, a chronic and recurring condition. In order to treat the root causes of an individual's addiction and assist them in quitting drugs and alcohol, addiction therapies combine psychological interventions and medicine that have been proven to be effective in scientific studies. The kind of addiction, the severity of the substance use disorder, co-occurring mental health issues, social support networks, individual preferences, and any underlying medical concerns are all considered in personalized care for addiction treatment. Behavioral therapy, medication, counseling, support groups, and other scientifically established treatments are all part of the comprehensive treatment plan of addiction therapies combined to create long-term recovery.

The 3 substances with the highest awareness rates were tobacco, alcohol, and khat, at 97%, 95%, and 88%, respectively. The initiation age of different substances varied from 6 to 20 years, with heroin and cocaine showing the highest initiation ages. Between the ages of 15 and 65, about 1 in 6 Kenyans used drugs at least once, with notable gender disparities of 1 in 3 males and 1 in 16 females. Substance addiction, including alcohol (23.8%), chang'aa (11.4%), and traditional liquor (12.9%), was most common in the Western region. Notably, the prevalence of tobacco use was greater in Central Kenya (11.9%), while the rates of khat usage were higher in Eastern and North Eastern Kenya (10.7% and 7.2%, respectively). Over the past 5 years, there has been a notable 90% increase in cannabis use, with Nairobi having the greatest frequency (6.3%). There is also a concerning problem of polydrug use, which affects roughly 1 in 15 Kenyans and 1 in 8 men. The Coast area has the greatest frequency of polydrug use (10.5%). There is widespread substance addiction in Kenya, where the most often misused substance is still alcohol due to a rising desire for less expensive alternatives, including spirits, chang'aa, and indigenous brews. Notably, cannabis use has almost doubled in frequency during the last five years, especially among young people, who may have been motivated by false beliefs about its harmful effects. Teens aged 25 to 35 who are not enrolled in school are particularly vulnerable to drug use, and minors continue to take drugs despite their recognized negative effects.

A major five-year agreement between MSD (Merck Sharp & Dohme) and Kenya's Ministry of Health (MoH) has been launched with the goal of expanding access to buprenorphine, a critical therapy for opioid dependence. Together, they have established treatment facilities, trained medical personnel, and facilitated pilot initiatives that will increase accessibility nationwide by distributing buprenorphine at pharmacies.

The International Centre for Drug Policy (ICDP) and Reckitt Benckiser have partnered to launch the "Buprenorphine Affordability and Access Initiative" in six Kenyan counties. With a focus on strengthening addiction treatment services and expanding access to affordable buprenorphine, this ambitious endeavour highlights a deliberate effort to improve addiction care and support in the area.

Market Dynamics

Market Growth Drivers

Increasing Substance Abuse: There is a growing need for efficient treatment medications in the nation as a result of the rising incidence of substance misuse, including the usage of opioids, cocaine, and other addictive substances. Many variables have been linked to this increase in drug usage cases, such as stress, social isolation, and limited access to healthcare. The rise in addiction rates benefits the addiction therapeutics market, which will expand rapidly.

Public Health Awareness: Increasingly, campaigns, educational initiatives, and community campaigns aim to lower the stigma attached to addiction, which in turn motivates those who are affected to seek treatment and, in turn, increases the demand for addiction therapeutics.

Changing Societal Attitude: The stigma associated with addiction has gradually decreased as a result of society's growing acceptance of addiction as a medical illness rather than a moral failing. This shift increases the likelihood that people will seek treatment, which drives up demand for all-encompassing, conveniently accessible addiction therapy and supports the expansion of the market.

Market Restraints

Limited Healthcare Infrastructure: Addiction treatment drug availability and extensive distribution are hampered by a lack of adequate healthcare infrastructure, especially in rural areas. The efficient distribution of these drugs is hampered by the absence of facilities with the necessary equipment and healthcare workers with the necessary training.

Accessibility and Affordability: For many patients, the cost of addiction treatment medications continues to be a major obstacle. For a significant proportion of the population, the cost of these medications may be unaffordable, thereby impeding their access to essential medical care.

Stigma and Perception: Addiction is stigmatized in society, which may keep some people from receiving the necessary care. Social views and misconceptions that consider addiction a moral failing rather than a medical condition may prevent addicts from seeking treatment, which may have an effect on the market for drugs used in addiction therapy.

Healthcare Policies and Regulatory Landscape

Kenya has implemented a National Policy on Alcohol and Drug misuse with the objective of preventing substance misuse, offering treatment, and fostering rehabilitation. This policy establishes tactics for mitigating drug demand, minimizing harm, and providing rehabilitation programs.

Pharmacy and Poisons Board (PPB): PPB is in charge of regulating and licensing drugs in Kenya. Drugs used in addiction therapy are classified as controlled substances, meaning they need special authorization and strict compliance with laws to avoid abuse and diversion.

Treatment Guidelines: The Ministry of Health (MoH) creates guidelines for the management of a range of illnesses, including diseases related to substance misuse. These guidelines provide information on drug usage protocols, evidence-based practices, and addiction treatment approaches to healthcare providers.

Competitive Landscape

Key Players

- AbbVie

- Indivior

- Reckitt Benckiser Pharmaceuticals

- Mylan Pharmaceuticals

- Teva Pharmaceuticals

- Sun Pharmaceutical Industries

- Glenmark Pharmaceuticals

- Alkermes

- Lupin Pharmaceuticals

- Cipla

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Kenya Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.