Japan Physiotherapy Equipment Market Analysis

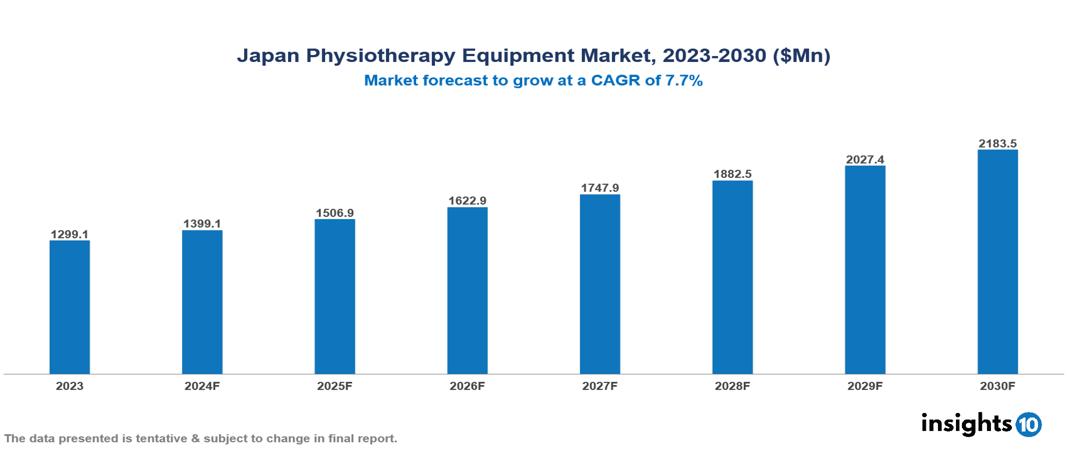

The Japan Physiotherapy Equipment Market was valued at $1,299.12 Mn in 2023 and is predicted to grow at a CAGR of 7.7% from 2023 to 2030, to $2,183.52 Mn by 2030. The key drivers of this industry include the rising prevalence of chronic diseases, expanding geriatric population, and advancements in technology. The key players in the industry are Takeda Medical, Fujirebio, Nihon Kohden, and Enraf-Nonius BV among others.

Buy Now

Japan Physiotherapy Equipment Market Executive Summary

The Japan Physiotherapy Equipment Market is at around $1,299.12 Mn in 2023 and is projected to reach $2,183.52 Mn in 2030, exhibiting a CAGR of 7.7% during the forecast period.

Physiotherapy equipment refers to the instruments that physiotherapists use to help cases recover from accidents, operations, or habitual conditions. These include exercise cycles, ultrasound machines, and resistance bands. The utilization of physiotherapy equipment can help reduce the level of care required for these patients. Musculoskeletal conditions encompass a wide range of conditions and conditions affecting the muscles, bones, joints, and connective tissues, leading to pain, mobility limitations, and reduced functioning. These conditions include low reverse pain, neck pain, fractures, osteoarthritis, amputations, rheumatoid arthritis, and other musculoskeletal issues. Musculoskeletal diseases affect limited mobility and are a significant cause of disability.

Furthermore, the rising prevalence of neurological disorders in the population is the primary driver behind the increasing demand for neurology rehabilitation physiotherapy equipment. The most commonly utilized physiotherapy interventions for elderly individuals with neurological disorders include balance and gait training, occupational therapy, traditional physiotherapy techniques, walking and treadmill exercises, and upper limb robot-assisted therapy.

The market therefore is driven by significant factors like the aging population and the rising prevalence of cardiovascular, neurological, and musculoskeletal diseases. Advancements in technology, and government support also play a key role in market growth. However, limited accessibility to specialized physiotherapists, high cost of physiotherapy equipment, and strict regulatory approval limit the growth of the market

The leading pharmaceutical companies include Takeda Medical, Fujirebio, and Nihon Kohden for physiotherapy equipment. Enraf-Nonius BV and Terumo are also significant contributors to the physiotherapy equipment landscape, with continuous research and development activities.

Market Dynamics

Market Growth Drivers

Rise in Geriatric Population: Geriatric physiotherapy is prioritized due to the elderly's multiple health issues like cardiovascular decline, vision and hearing loss, and diabetes. Manufacturers are investing heavily in advanced physiotherapy equipment to alleviate suffering. The prevalence of age-related physical and psychological conditions is expected to rise in the future.

Increasing Technical Progress: Companies are progressively focused on technological advancements and developing new goods to provide superior and user-friendly devices. The development of advanced physiotherapy equipment with enhanced capabilities, such as electrotherapy and cryotherapy devices, drives market growth by providing more effective treatment options.

Preventative Care: The prevalence of chronic diseases like arthritis is high in Japan, affecting around 0.5-1.7% of the population. To address this, Japan has integrated physiotherapy into its national health system, allowing physical therapists to provide preventive services such as fall prevention, frailty management, and chronic disease management without a doctor's referral

Government Support: The Japanese government's support for healthcare and medical research has significantly contributed to the growth of the physiotherapy market. By promoting universal health coverage, increasing the number of medical schools, and prioritizing preventive care, Japan has made physiotherapy more accessible and integrated into its robust healthcare system.

Market Restraints

Lack of Skilled Physiotherapists: The scarcity of qualified physiotherapists and healthcare providers restricts the utilization and adoption of physiotherapy equipment. This is because patients donot have access to skilled professionals who can operate these devices effectively and safely. Additionally, it hampers the adoption of new technologies, particularly in remote areas.

Regulatory Obstacles: Japan's stringent regulations, overseen by the Pharmaceuticals and Medical Devices Agency (PMDA), create hurdles for new physiotherapy equipment in the market. It's complex classification system is time-consuming to navigate which discourages new companies from entering the market and stifles innovation, as established players are less likely to invest in groundbreaking technologies if the approval process is overly burdensome.

Presence of Alternative Therapies: Physiotherapy equipment faces competition from alternative therapies like acupuncture and massage. These options offer pain relief and potentially a more holistic approach, appealing to some patients. This competition could limit the demand for specialized physiotherapy equipment and the therapists who use it.

Regulatory Landscape and Reimbursement Scenario

The Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA) are responsible for regulating medical devices in Japan. The MHLW handles administrative actions, while the PMDA undertakes product reviews and post-market safety measures.

Medical devices are categorized into four classes based on their risk level: Class I (Extremely low risk), Class II (low risk), Class III (medium risk), and Class IV (high risk). Japan has implemented a UDI system to enhance traceability and facilitate post-market surveillance. Medical devices are assigned a unique identifier that includes information such as the device’s model, serial number, and expiration date

Physiotherapy services are covered by the national health insurance system, which covers around 70% of the population. The exact amount reimbursed depends on the patient's specific health insurance plan and the type of treatment received. The number and duration of physiotherapy sessions authorized for reimbursement might be limited.

Competitive Landscape

Key Players

Here are some of the major key players in the Japan Physiotherapy Equipment Market:

- Nipro

- Takeda Medical

- BTL Industries

- Sysmex Corporation

- Enraf-Nonius B.V.

- Terumo

- Nihon Kohden

- Fujirebio

- DJO Global

- Zynex Medical Inc.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Physiotherapy Equipment Market Segmentation

By Equipment

- Hydrotherapy

- Electrotherapy

- Cryotherapy

- Continuous Passive Motion Units

- Multi-exercise Therapy Unit

- Heat Therapy

- Shockwave Therapy

- Laser Therapy

- Traction Therapy

- Ultrasound

- Other Equipment Types

By Application

- Cardiovascular and Pulmonary

- Neurological

- Musculoskeletal

- Paediatric

- Other Applications

By End User

- Hospitals

- Physiotherapy & Rehabilitation Centers

- Home Care Settings

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.