Japan Medication Access Programs Market Analysis

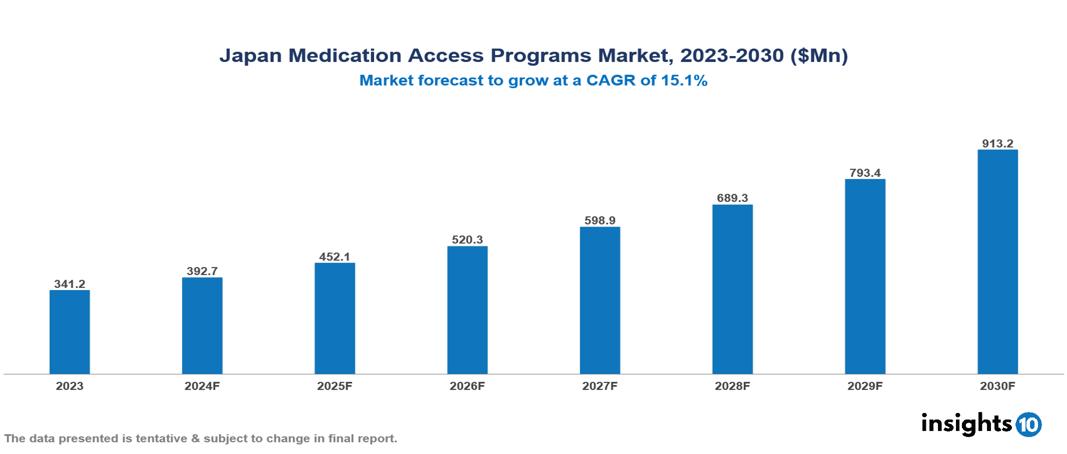

The Japan Medication Access Programs Market was valued at $341.2 Mn in 2023 and is predicted to grow at a CAGR of 15.1% from 2023 to 2030, to $913.2 Mn by 2030. The key drivers of this industry include an aging population, government support, and a high prevalence of diseases. The industry is primarily dominated by players such as Gilead Sciences, Takeda Pharmaceuticals, Pfizer, Novartis, and Merck among others.

Buy Now

Japan Medication Access Programs Market Executive Summary

The Japan Medication Access Programs Market was valued at $341.2 Mn in 2023 and is predicted to grow at a CAGR of 15.1% from 2023 to 2030, to $913.2 Mn by 2030.

Patient Support Programs (PSPs) are initiatives launched by pharmaceutical companies to improve patient access, utilization, and adherence to prescribed medications. These programs typically include financial assistance, clinical guidance, educational resources, or a combination of these components. Within PSPs, Medication Access Programs (MAPs) play a critical role as they facilitate essential connections between patients and the medications they require. Managed Access Programs specifically focus on providing early access to investigational medicines or treatments for patients facing serious or life-threatening conditions who have exhausted other treatment options and are ineligible for clinical trials. MAPs offered by pharmaceutical firms aim to alleviate financial obstacles to accessing crucial medications. Implementing a centralized, pharmacy-driven MAP can lead to enhanced patient outcomes, reduced unnecessary healthcare expenses, increased satisfaction among patients and healthcare providers, smoother patient management processes, and potentially higher revenue through improved prescription fulfillment.

According to a study in Japan, the compassionate use (CU) or expanded access clinical trial (EACT) program achieves an approval rate of 77.4% for drugs included in these initiatives. The market is driven by significant factors like an aging population, government support, and a high prevalence of diseases. However, regulatory hurdles, cost containment, and limited awareness restrict the growth and potential of the market.

Prominent players in this field include Gilead Sciences and Takeda Pharmaceuticals which provides Medication Access or Access to Medicine Program. Pfizer, Novartis, Merck, and AstraZeneca among others are some of the pharmaceutical companies providing patient support programs and are potential players for the Medication Access Program in Japan.

Market Dynamics

Market Growth Drivers

Aging Population: By 2040, individuals aged 65 and above are forecasted to constitute 34.8% of Japan's population, as reported by the National Institute of Population and Social Security Research. This demographic shift is a significant market driver for the medication access program market in Japan, increasing the demand for medications and necessitating robust access programs to ensure older adults receive necessary treatments as healthcare needs grow with the aging population.

Government Support: Governmental policies and initiatives that prioritize enhancing healthcare access and affordability serve as a market driver for medication access programs in Japan. These efforts stimulate market growth by fostering a supportive environment for the development and expansion of programs that ensure broader and more equitable access to essential medications, thereby meeting the healthcare needs of the population effectively.

High Prevalence of Diseases: The estimated prevalence rates of non-communicable diseases like diabetes mellitus (12.2%) and hypertension (20.9%) serve as market drivers for the medication access program market in Japan. These high prevalence rates underscore the increasing demand for effective medications and access programs that can provide timely and consistent treatment options to manage these prevalent health conditions among the population.

Market Restraints

Regulatory Hurdles: Stringent regulatory requirements and lengthy approval processes pose a market restraint for medication access programs in Japan by slowing down the introduction of new medications. This delay can limit timely patient access to innovative treatments, potentially reducing the overall effectiveness and responsiveness of access programs in meeting healthcare needs promptly.

Cost Containment: High healthcare costs and budget constraints can restrict the availability of funds necessary to expand and sustain medication access initiatives. This acts as a market restraint for the medication access program market in Japan by potentially curbing the resources needed to effectively scale these programs, hindering their ability to reach a broader population and provide essential medications to those in need.

Limited Awareness: Limited public awareness of medication access programs can reduce patient participation and hinder their effectiveness in Japan, acting as a market restraint.

Regulatory Landscape and Reimbursement Scenario

The PMDA (Pharmaceuticals and Medical Devices Agency) serves as Japan's regulatory body, working alongside the Ministry of Health, Labour, and Welfare to uphold public health by ensuring the safety, effectiveness, and quality of pharmaceuticals and medical devices. Japan implemented the "Expanded Access Clinical Trials" (EACTs) system in 2013, allowing patients with severe, life-threatening conditions and no alternative treatments to access unapproved drugs. Under this system, provisional approval may be granted based on estimated efficacy, even without complete clinical trial data, with strict conditions and short-term validity. Additionally, the Ministry of Health, Labour, and Welfare established the Central Social Insurance Medical Council (Chuikyo) to determine reimbursement rates for healthcare services, reviewing these fees every two years.

Competitive Landscape

Key Players

Here are some of the major key players in the Japan Medication Access Programs Market:

- Gilead Sciences

- Takeda Pharmaceuticals

- Pfizer

- Novartis

- Merck

- AstraZeneca

- Bristol-Myers Squibb

- Sanofi

- Eli Lilly

- AbbVie

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Medication Access Programs Market Segmentation

By Disease Type

- Chronic

- Acute

By Therapeutic Areas

- Oncology

- Cardiology

- Rheumatology

- Others

By Patient Type

- Geriatric

- Pediatric

- Adult

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.