Japan HIV Diagnostic Market Analysis

Japan HIV Diagnostics Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The market for HIV diagnostics is expanding as a result of rising prevalence of the disease and increased blood transfusions. This demand is fueling the development of better diagnostic tools and methods for the early detection and accurate diagnosis of HIV. Some of the key players in the global HIV Diagnostics Market include Thermo-Fisher Scientific Inc., Hologic, Inc., Abbott, Alere Inc., Bio-Rad Laboratories, Inc., OraSure Technologies, Inc, F. Hoffmann-La Roche Ltd., Siemens Healthineers, Chembio Diagnostics, Inc., Danaher Corporation, and Becton, Dickinson and Company.

Buy Now

Japan HIV Diagnostic Market Executive Summary

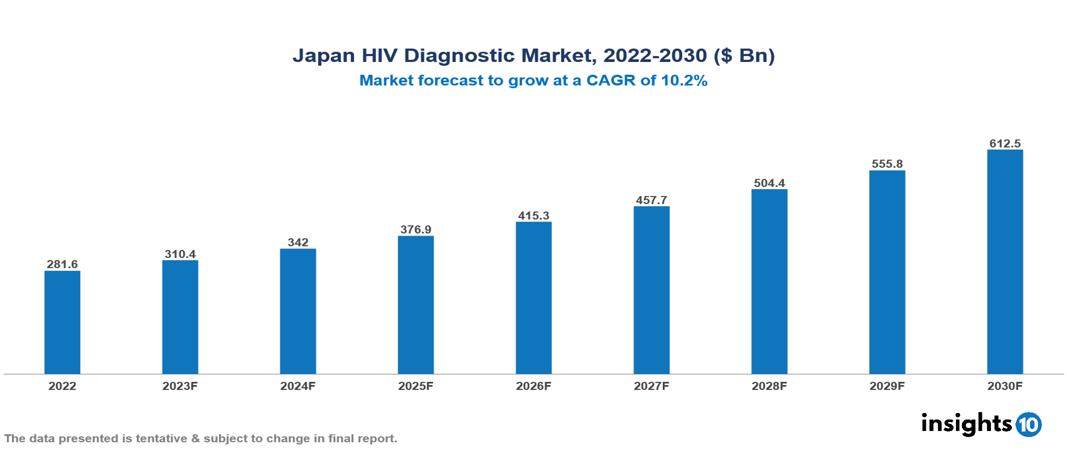

Japan HIV Diagnostic Market is valued at around $281.6 Bn in 2022 and is projected to reach $612.4 Bn by 2030, exhibiting a CAGR of 10.2% during the forecast period 2023-2030.

The HIV Diagnostics Market refers to the market for tools and methods used to diagnose HIV for AIDS, a chronic immune system disease cause by human immunodeficiency virus. The market includes software and platforms for analysing and interpreting the findings of diagnostic tests, imaging methods, and biomarkers used to detect the disease.

The increased prevalence of HIV, which has a huge impact on people globally, has contributed to the growth of the global market for HIV diagnostics in recent years. Advances in diagnostic technologies and imaging methodologies are also driving the market.

Pharmaceutical and biotechnology firms like Thermo-Fisher Scientific Inc., Hologic, Inc., Abbott, Alere Inc., Bio-Rad Laboratories, Inc., OraSure Technologies, Inc, F. Hoffmann-La Roche Ltd., Siemens Healthineers, Chembio Diagnostics, Inc., Danaher Corporation, and Becton, Dickinson and Company., are some of the major players in the HIV Diagnostics Market.

HIV is diagnosed using a variety of diagnostic procedures and tests, including rapid antigen/antibody tests, ELISA tests, and imaging examinations like NAT. For use in HIV diagnosis, biomarkers including high sensitivity CRP (hsCRP) and CD4+ T-cells level in the blood are detected.

The increasing government initiatives, blood donations and early detection of HIV are projected to fuel the market for diagnostics for the condition in the years to come. The market may yet have difficulties with regard to obtaining regulatory permission as well as the high price of various diagnostic methods and instruments.

Market Dynamics

Drivers of Japan HIV Diagnostics Market:

Growing Incidence and Prevalence of HIV: The prevalence of HIV is growing each day. This is raising the demand for diagnostic methods and technologies that can successfully identify the illness.

Increasing Number of Blood Transfusions and Blood Donations: Th demand for HIV Diagnostics is increasing each day by the increasing number of blood transfusions and blood donations.

Benefits Offered by Point-of-Care Instruments and Kits: Benefits from the POC kit like convenience and quick results is driving the HIV Diagnostics Market.

Increasing Government Initiatives: Programs by government for prevention, awareness, and screening is leading to the growth of HIV Diagnostics Market.

Restraints of Japan HIV Diagnostics Market:

High Cost of Nucleic Acid Test (NAT): NAT can detect if the actual virus is present in the blood. It can either detect its presence or show how much virus is present in the blood. The higher cost of NAT can hamper the growth of HIV Diagnostics Market.

Stringent Rules of Regulatory Bodies: The improper functioning of regulatory bodies can negatively affect the growth of HIV Diagnostics Market.

Notable Deals in HIV Diagnostics Market:

In 2022, Abbott introduce the Panbio HIV Self-Test for more reliable and discrete testing at home.

In 2022, Amref Health Africa-Tanzamia launched “Afya Kamilifu” project in Mara Region to prevent HIV. Under this, HIV Self-Test kits were made available at all health centers in the region.

In 2022, Roche partnered with The Global Fund to improve the diagnosis of HIV by building local capacity to tackle fundamental infrastructure challenges for generating and delivering diagnostic results and managing healthcare waste.

In 2002, Siemens Healthineers and the UNICEF announced partnership to help optimize Point-of-Care (POC) diagnostics networks and strengthen fragile health system in sub-Saharan Africa by improving access to diagnostics and linkage to treatment.

Key players

Sysmex Corporation Fujirebio Inc. Roche Diagnostics Abbott Laboratories Siemens Healthineers Shimadzu Corporation Tosoh Corporation Sekisui Medical Co., Ltd. Wako Pure Chemical Industries, Ltd. (subsidiary of FUJIFILM Corporation) Mitsubishi Chemical Medience Corporation1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Japan HIV Diagnostics Market

By Product:

- Consumables

- Instruments

- Software

- Services

- Kits and Reagents

- Assays

By Test-type:

- Anti-body Tests

- Viral Load Test

- CD4 Test

- Early Infant

- Viral Identification

By End-user:

- Hospitals & Clinics

- Home Care Settings

- Diagnostics Laboratories

- Blood Banks

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.