Japan Hepatitis A Therapeutics Market Analysis

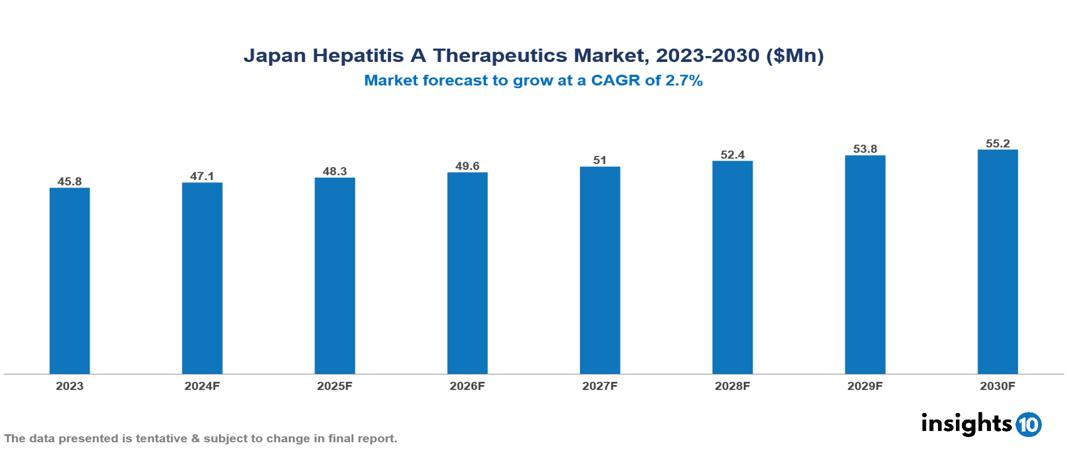

The Japan Hepatitis A Therapeutics Market was valued at $45.82 Mn in 2023 and is predicted to grow at a CAGR of 2.7% from 2023 to 2030 to $55.22 Mn by 2030. The market's growth is fuelled by an increase in the prevalence of Hepatitis A, evidenced by 162 confirmed cases and the inaugural report of a death from an acute hepatitis variant as of 2023. Leading companies in this sector include Takeda and GlaxoSmithKline (GSK), among others.

Buy Now

Japan Hepatitis A Therapeutics Market Executive Summary

The Japan Hepatitis A Therapeutics Market was valued at $45.82 Mn in 2023 and is predicted to grow at a CAGR of 2.7% from 2023 to 2030 to $55.22 Mn by 2030.

Hepatitis A is a liver infection caused by the Hepatitis A virus. While typically mild, the severity of the disease tends to increase with age. In developed nations, transmission primarily occurs through person-to-person contact. Conversely, in regions with inadequate sanitation, infection often results from ingesting contaminated food or water containing fecal matter. Foodborne outbreaks of Hepatitis A are known to happen, usually linked to infected food handlers contaminating ready-to-eat foods. Additionally, outbreaks have been traced back to contamination at various stages of food production, including shellfish and fresh/frozen produce. Transmission of Hepatitis A can also occur through sexual intercourse, especially among men who have sex with men, leading to recent outbreaks within this demographic. The virus can also spread through the use of injected drugs.

The escalating prevalence of Hepatitis A in Japan, with 162 confirmed cases and a reported death as of 2023, highlights the significant disease burden and pressing need for efficacious treatments and strategic management approaches to mitigate the public health ramifications of the disease. Market growth is driven by advancements in medical technology, an increase in prevalence, and strong government initiatives and support. However, healthcare workforce shortage, stringent regulatory landscape, and reimbursement complexity restrain the market.

Market Dynamics

Market Growth Drivers

Advancements in Medical Technology: Japan's sophisticated medical technology landscape plays a pivotal role in advancing the development of treatments for Hepatitis A, fostering the creation of more efficient and groundbreaking therapeutic solutions, thus driving the market.

Rise in prevalence: The escalating prevalence of Hepatitis A in Japan, evidenced by 162 confirmed cases and the inaugural report of a death from an enigmatic acute hepatitis variant as of March 2023, acts as a significant catalyst for the Hepatitis A therapeutics market. This surge in instances, particularly among children, underscores the pressing necessity for efficacious treatments and strategic management approaches to mitigate the expanding public health ramifications of the disease, thus driving the market.

Government Initiatives and Support: The Japanese government has instituted diverse initiatives to combat hepatitis, exemplified by the "National Campaign Project for Hepatitis Measures," to heighten awareness, promote testing, and advocate for early detection and treatment. These endeavors have contributed to heightened diagnosis rates and increased demand for therapeutics.

Market Restraints

Healthcare Workforce Shortage: Japan's healthcare sector grapples with a severe labour deficit, projected to reach nearly 1 Mn by 2040, with nursing care workers facing a shortage of 25.3%. This scarcity significantly impedes the Hepatitis A therapeutics market, evident in the labour shortages affecting 66.3% of nursing facilities and 83.5% of the staff lacking home visit caregiving services. Rooted in Japan's declining population, low birthrate, and restricted immigration, this shortage overwhelms healthcare professionals. The impending limitation on clinicians’ compounds challenges, stifling growth prospects for Hepatitis A therapeutics.

Stringent Regulatory Landscape: Japan's pharmaceutical regulatory framework is known for its strictness. This leads to longer approval times (more than 12 months) and higher costs for companies introducing new Hepatitis A medications, potentially hindering market entry.

Reimbursement Complexity: Japan's reimbursement framework for liver therapeutics, managed by entities like the PMDA, NHI system, and Ministry of Health, Labour and Welfare, presents formidable hurdles for the Hepatitis A therapeutics market. This intricate system, determining eligibility and coverage criteria, poses barriers for certain Hepatitis A treatments, which may not receive reimbursement or face restrictions. Negotiating this landscape demands considerable resources and expertise, potentially dissuading pharmaceutical firms from entering the Japanese market or limiting the availability of specific therapies. The reimbursement complexities, arising from multiple agency involvements and stringent eligibility criteria, compound the intricacies of the Hepatitis A therapeutics market in Japan, impeding patient access to vital treatments and thus restraining the market.

Regulatory Landscape and Reimbursement Scenario

The reimbursement scenario for Hepatitis A therapeutics in Japan is influenced by a robust healthcare system with universal health insurance coverage managed by the National Health Insurance (NHI) organization. The NHI system prioritizes coverage for medically necessary and cost-effective treatments, including some Hepatitis A therapeutics under specific circumstances. Negotiations between pharmaceutical companies and the Ministry of Health, Labour, and Welfare (MHLW) determine reimbursement prices, considering cost-effectiveness, clinical evidence, and disease severity.

Regulatory bodies like the Pharmaceuticals and Medical Devices Agency (PMDA) oversee the approval and regulation of drugs and medical devices, ensuring they meet the necessary standards for approval in the Japanese market. The PMDA's thorough evaluation process is essential for safeguarding public health and maintaining the quality and safety of pharmaceuticals available to patients in Japan. Healthcare providers are crucial in navigating the reimbursement process, staying informed about updates to reimbursement policies and drug formularies, and consulting the Ministry of Health, Labour, and Welfare (MHLW) and the Japan Pharmaceutical Information Center (JPIC) for accurate and up-to-date information.

Competitive Landscape

Key players

Here are some of the major key players in the Hepatitis A Therapeutics Market:

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- Zydus Cadilla

- Sanofi

- GlaxoSmithKline (GSK)

- Takeda

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Hepatitis A Therapeutics Market Segmentation

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

By Route of Administration

- Oral Medications

- Intravenous Therapy

By Healthcare Setting

- Outpatient Care

- Inpatient Care

By Age

- Children

- Adults

- Senior Citizens

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.