Japan Hemophilia Market Analysis

Japan Hemophilia Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The ability of a person's blood to clot is impaired by haemophilia A and haemophilia B, two rare congenital lifelong bleeding disorders that can cause excessive bleeding and spontaneous bleeding into joints, which can cause joint damage and chronic pain and have a significant impact on quality of life. The rise in haemophilia prevalence, improvements in treatment technology, and supportive governmental activities for haemophilia management are all contributing factors to the market share growth for haemophilia treatments. In the "Global Hemophilia market," the following firms are described: Baxalta, CSL Behring, Pfizer, Inc., Bayer Healthcare, BioMarin Pharmaceutical, Inc., Biogen, Chugai Pharmaceutical Co., Novo Nordisk, Shire Plc., Baxter International, Inc., and Hospira Inc.

Buy Now

Japan Hemophilia Market Analysis Summary

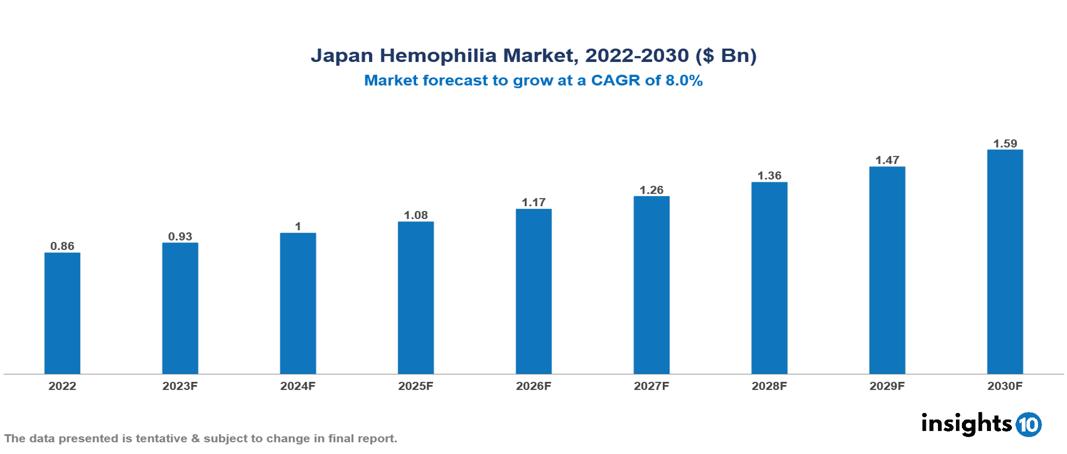

Japan Hemophilia Market is valued at around $0.86 Bn in 2022 and is projected to reach $1.59 Bn by 2030, exhibiting a CAGR of 8% during the forecast period 2023-2030.

Blood clotting takes a very lengthy time in those with haemophilia, a set of bleeding diseases. Hemophilia A and Hemophilia B are the two primary classifications. It results from a deficiency in clotting factor VIII or IX in the blood. The majority of the time, families pass on haemophilia (inherited). Hemophilia affects approximately 1 in 10,000 live births, according to estimates. The majority of the male children inherit it. Bleeding is the primary haemophilia symptom. Both haemophilia A and B are inherited via an X-linked recessive pattern in which all females born to dads with the condition are carriers and no males are affected. When a person has one of the bleeding conditions known as haemophilia, their blood clots exceedingly slowly. The two main categories are haemophilia A and haemophilia B. It is brought on by a shortage of clotting factor VIII or IX in the blood. Most often, haemophilia is passed down through families (inherited). According to estimations, one in ten thousand live newborns are affected by haemophilia. Most of the male offspring inherit it. The main sign of haemophilia is bleeding. Both haemophilia A and B are inherited through an X-linked recessive pattern in which no males are afflicted and all females born to fathers who have the disorder are carriers. Affected males and carrier females are as likely to result from female carriers as from affected females. An index of suspicion based on familial history, clinical manifestation, and laboratory tests are all combined in the diagnosis of haemophilia. The rise in haemophilia prevalence, improvements in treatment technology, and supportive governmental activities for haemophilia management are all contributing factors to the market share growth for haemophilia treatments.

The growth of the haemophilia treatment market is also influenced by the increase in R&D studies on treatment treatments in the sector, the target demographic, the rate of diagnosis, and the use of prophylactic therapy for haemophilia.

The market expansion is anticipated to be constrained by the high cost of haemophilia treatment, a lack of haemophilia medications, and major adverse effects related to plasma-derived products.

In the market for haemophilia around the globe, the following organizations are described: Hospira Inc., Grifols SA, Swedish Orphan Biovitrum AB, Medexus Pharmaceuticals Inc., Takeda Pharmaceuticals Company Ltd., Pfizer Inc., F. Hoffmann-La Roche AG, octa-pharma ag, Novo Nordisk A/S, CSL Ltd., Baxter International, Inc., CSL Behring, Pfizer, Inc., Bayer Healthcare, BioMarin Pharmaceutical, Inc.

Market Dynamics

Market Drivers

Growing Hemophilia Prevalence: The primary factor fueling the expansion of the haemophilia sector is the increase of haemophilia cases on a global scale. Additionally, beneficial government initiatives in several nations, such as reducing the cost of haemophilia treatment, have had an impact on market growth. The need for Hemophilia treatment has increased as a result of the availability of numerous therapies and medications. Inhibitor therapy, home therapy, free factor replacement, antifibrinolytic medications, gene therapy, physical therapy, and other treatments are some of the most frequently utilised therapies and pharmaceuticals in the treatment of haemophilia. The Hemophilia Treatment Market has grown significantly as a result of these causes.

Government Initiatives: In recent years, aggressive campaigning and the expansion of government programmes have contributed to the growth of the market for haemophilia treatments. Additionally, the facilities and services related to haemophilia treatments have been improved by medical recommendations based on COVID immunisation. Because of the improved life quality and overall therapy seen in Hemophilia patients, injectable administration has seen a growth rate of more than 5% in recent years. New technologies and pharmaceuticals have revolutionised the Hemophilia market perspective. Recent inventions have proven up to 80% recovery from the condition's symptoms and a 94% reduction in annual bleeding rates. These reasons have paved the way for the expansion of the Hemophilia industry.

Market Development

May 31, 2023 - The Phase 3 BASIS clinical trial assessing marstacimab, which Pfizer Inc. disclosed, has fulfilled its primary goals and shown statistically significant and clinically significant results. In the trial, marstacimab, a brand-new investigational anti-tissue factor pathway inhibitor (anti-TFPI) being investigated for the treatment of haemophilia A or B in patients lacking inhibitors to Factor VIII (FVIII) or Factor IX (FIX), was given once weekly as a subcutaneous 300 mg loading dose followed by 150 mg.

The U.S. Food and Drug Administration published final guidance on May 11, 2023, including suggestions for determining blood and plasma donor eligibility using specific risk-based questions. The final recommendation eliminates time-based donation deferrals and screening questions that are particular to men who have sex with men (MSM) and women who have sex with MSM, in line with the FDA's proposed guidance from January 2023. Instead, the FDA suggests that all donors, regardless of sex or gender, respond to individual risk-based questions intended to lower the risk of HIV transmission through transfusion.

May 11, 2023- In August 2022, concizumab was submitted for regulatory approval in the United States for the use of inhibitors in the treatment of haemophilia A and B. In order to make sure that concizumab is provided as intended, the FDA asked for more information in the letter about patient monitoring and dosing. Additionally, more details about the manufacturing process were sought. In order to provide the FDA with the necessary information, Novo Nordisk is assessing the CRL's substance. Concizumab has received approval in Canada for the use of inhibitors in the treatment of haemophilia B, and it is undergoing review for the use of inhibitors in the treatment of haemophilia A.

April 4, 2023 - The efficacy and safety of fitusiran, an investigational siRNA therapy for the prophylactic treatment of adults and adolescents with haemophilia A or B, were evaluated in two studies that were published in The Lancet and The Lancet Haematology. These studies reaffirm the potential of this investigational therapy to change the current standard of care and address unmet needs for all types of haemophilia, regardless of inhibitor status. With as little as six subcutaneous injections per year, fitusiran has the potential to offer prophylaxis for all forms of haemophilia, independent of inhibitor status.

Market Restraints

The increased costs of recombinant products and the issues with replacement therapy are currently hindering the haemophilia industry. When receiving replacement medication for their haemophilia, patients can get HIV or viral diseases such as hepatitis B and C. These detrimental treatment decisions have impeded the development of the haemophilia treatment industry. Patients have the capacity to produce inhibitors that block the action of the administered clotting factor. Patients with Hemophilia B have a 2–5% probability of developing these inhibitors, while those with severe haemophilia A have a 20–30% chance of doing so. These factors have also had an impact on the sector's expansion related to haemophilia therapy. Other characteristics include a serious absence of haemophilia medications.

Key players

Genentech (Roche) Pfizer Sanofi Shire plc Baxter International Inc. Octapharma Kedrion Grifols CSL Behring BioMarin Pharmaceutical Inc.1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Japan Hemophilia Market

By Product Types

- Hemophilia A

- Hemophilia B

- Others

By Application

- Replacement Therapy

- Gene Therapy

- Anti-tissue factor pathway inhibitor Therapy

- Others

By drug therapy

- Recombinant coagulation factor concentrates therapy

- Plasma-derived coagulation factor concentrates therapy

- on-factor replacement therapy

- Others

By End User

- Hospitals

- Diagnostic center

- Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.