Japan Financial Assistance Programs Market Analysis

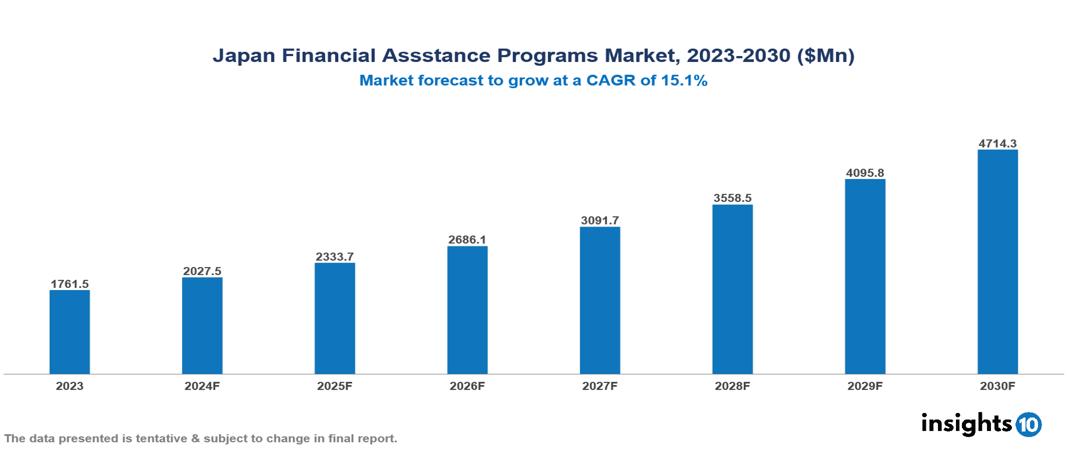

The Japan Financial Assistance Programs Market was valued at $1,761.5 Mn in 2023 and is projected to grow at a CAGR of 15.1% from 2023 to 2023, to $4,714.3 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Daiichi Sankyo Co Ltd, Takeda, Bayer, Baxter, GSK, Johnson & Johnson, Sanofi among others.

Buy Now

Japan Financial Assistance Programs Market Executive Summary

The Japan Financial Assistance Programs Market is at around $1,761.5 Mn in 2023 and is projected to reach $4,714.3 Mn in 2030, exhibiting a CAGR of 15.1% during the forecast period 2023-2030.

Financial assistance programs offered by pharmaceutical companies, also known as Patient Assistance Programs (PAPs) or Patient Support Programs (PSPs), are initiatives designed to help patients access necessary medications that they might otherwise struggle to afford. These programs typically consist of several components: direct financial aid to cover out-of-pocket costs, co-pay assistance to reduce insurance copayments, free drug programs for uninsured or underinsured patients, and sometimes additional support services like nursing assistance or educational resources. The benefits of these programs are manifold: they improve medication access and adherence, potentially leading to better health outcomes; they reduce the financial burden on patients, particularly those with chronic or rare diseases requiring expensive treatments; and they can help pharmaceutical companies maintain market share and build brand loyalty. Implementation of these programs usually involves an application process where patients demonstrate financial need and meet specific eligibility criteria. Pharmaceutical companies often partner with third-party administrators or foundations to manage these programs, ensuring compliance with legal and regulatory requirements.

According to WHO report, there is an increasing prevalence of chronic diseases in Japan, there were around 1.73 Mn deaths in Japan from Noncommunicable diseases. The major diseases are Cancer, cardiovascular disease, COPD, Kidney disease, with prevalence rate of 167, 129.1, 61.5 and 35.3 deaths per 100,000 population respectively. Therefore, the market is predominately driven by factors such as chronic disease prevalence, aging demographic and advanced pharmaceutical market where factors such as health system structure, budgetary concerns and price control mechanisms restrict the market

Pharmaceutical companies providing financial assistance to patient are such as Daiichi Sankyo Co Ltd, Takeda, Bayer, Baxter, GSK, Johnson & Johnson, Sanofi among others.

Market Dynamics

Market Drivers

Aging population: Japan has the world's oldest population, with over 28% aged 65 or older, this demographic shift increases demand for medications and treatments for age-related conditions, creates a larger pool of potential patients needing financial assistance, ultimately boosting the market growth rate.

Advanced pharmaceutical market: Japan is the world's third-largest pharmaceutical market. Presence of both domestic and international pharmaceutical companies, Competitive market may drive companies to offer patient assistance programs as a differentiator

Chronic disease prevalence: There is an increasing prevalence of chronic diseases in Japan, in 2022, there were around 197 deaths in Japan from major cardiovascular diseases per 100,000 population and 3.7 Mn people were living with diagnosed diabetes out of which 10.1% were males and 8.7% were females. The increasing number of patients with chronic conditions necessitates long-term, often expensive treatments. This creates a sustained need for financial assistance over extended periods. Chronic disease management is a priority in healthcare, driving support for assistance programs.

Market Restraints

Healthcare system structure: While universal, the system is complex with multiple insurers. Coordination of assistance programs across different insurance schemes can be challenging, thus limiting the market growth rate.

Price control mechanisms: Strict government regulations on drug pricing, limit pharmaceutical companies' financial flexibility to offer extensive assistance programs, limiting the extension and availability of financial assistance to patient.

Budgetary pressures: Pharmaceutical companies need to manage the expense of assistance programs while keeping profit margins intact. Economic slumps or shifts in company strategy might cause funding for these programs to decrease, potentially leading to more selective or restricted assistance options.

Regulatory Landscape and Reimbursement Scenario

PMDA (Pharmaceuticals and Medical Devices Agency) is Japanese regulatory agency, working together with Ministry of Health, Labour and Welfare. Our obligation is to protect the public health by assuring safety, efficacy and quality of pharmaceuticals and medical devices. PMDA conducts scientific reviews of marketing authorization applications (MAA) for medicinal products and monitors post-marketing safety data. PMDA works with the Ministry of Health, Labour, and Welfare (MHLW) to protect the public health safety of Japan. Within PMDA, the Office of Cellular and Tissue-based Products is responsible for regulating cellular therapy products. Health Insurance Bureau develops ideas and plans on medical insurance systems including health insurance, national health insurance, seamen's insurance and medical care for the elderly to stabilize the medical insurance system for long time so that all people can access medical care without worries in a full-fledged aging society with fewer children in the future.

Competitive Landscape

Key Players

Here are some of the major key players in the Japan Financial Assistance Programs Market:

- Daiichi Sankyo Co

- Takeda

- Johnson & Johnson

- Cipla

- Bayer

- Baxter

- GSK

- Roche

- Pfizer

- Bayer

- Sanofi

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.