Japan Diabetes Therapeutics Market Analysis

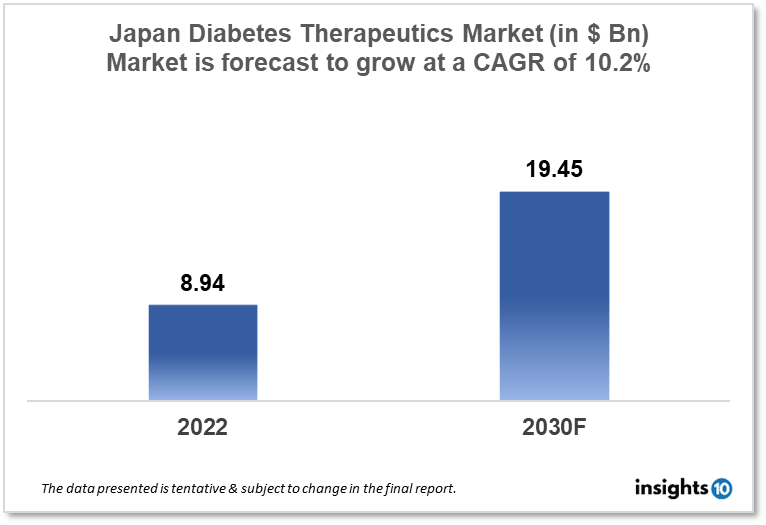

Japan's diabetes therapeutics market is expected to grow from $8.94 Bn in 2022 to $19.45 Bn in 2030 with a CAGR of 10.2% for the forecasted year 2022-30. The rise in the ageing population and obesity among the Japanese population is responsible for the growth of the market. The Japan diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Eisai, Otsuka Holdings, and Roche are the major players in the Japanese diabetes therapeutics market.

Buy Now

Japan Diabetes Therapeutics Market Executive Analysis

Japan's diabetes therapeutics market is expected to grow from $8.94 Bn in 2022 to $19.45 Bn in 2030 with a CAGR of 10.2% for the forecasted year 2022-30. Government organizations of Japan spent $784 Bn, during the fiscal year. The health ministry made the biggest budgetary request, asking for $0.25 Tn, as a result of skyrocketing medical costs and pension payments in a rapidly ageing society. Given that Japan has the longest healthy life expectancy in the world, its early adoption of Universal Health Coverage (UHC) has garnered interest from all over the world. As part of the One Prefecture, One Medical School policy, which was authorized by the Cabinet in 1973, the Japanese government has also increased the number of medical schools, particularly in rural areas, to increase the number of doctors. Additionally, this has added to the nation's high standard of healthcare.

In Japan, diabetes has recently grown significantly. International Diabetes Federation (IDF) predicts that 11 Mn adults in Japan will have diabetes by 2021. The high prevalence of diabetes is linked to a heavy financial load and can be attributed to lifestyle modifications and longer lifespans.

By inhibiting SGLT2 in the kidney's proximal tubule and causing glucosuria, the sodium-glucose co-transporter 2 (SGLT2) inhibitor empagliflozin improves glycemic management in T2D patients by reducing the amount of glucose that is reabsorption by the kidneys. Additionally, the EMPA-REG OUTCOME trial demonstrated that empagliflozin plus standard of care had cardioprotective and renoprotective benefits, reducing cardiovascular death, all-cause mortality, hospitalization for heart failure, and kidney disease progression in patients with T2D and established cardiovascular disease; these findings were consistent among the subset of Japanese participants. Linagliptin, a dipeptidyl peptidase-4 (DPP4) inhibitor, blocks the protease activity of the DPP4 enzyme. This lowers plasma glucose levels by increasing beta cell secretion of insulin and decreasing alpha cell secretion of glucagon in the pancreas. In the CARMELINA and CAROLINA trials, including among the Japanese community, the cardiovascular safety of linagliptin among patients with T2D and elevated cardiovascular risk was established.

Market Dynamics

Market Growth Drivers

Ageing and obesity are factors in Japan's rising diabetes incidence. As a result, managing the disease is difficult due to the rapidly ageing population, which is a significant concern. The Japanese Ministry of Health, Labor, and Welfare launched a national health screening and intervention program that focuses particularly on metabolic syndrome in April 2008. The scheme included yearly physical exams. The Japanese diabetes therapeutics market is expanding as a result of these efforts. According to popular belief, one of the main factors increasing Japanese people's risk of type 2 diabetes is their Westernized food. A shift in people's preferences for processed food, particularly food high in animal fat and calories, is said to have increased abdominal adiposity and ultimately led to type 2 diabetes hence leading to the increasing demand for diabetes medications.

Market Restraints

Public knowledge and education are crucial in the campaign against diabetes, but in Japan, there aren't many tools available to support diabetes education. Additionally, people's lack of time and passion as well as the stigma associated with the disorder are some other obstacles. Although Japan routinely conducts employee- and community-based diabetes screening tests, there are still no mechanisms in place for treating patients as soon as a diagnosis is made, which results in the loss of the most crucial phase of treatment and the emergence of complications thereby limiting the growth of Japan diabetes therapeutics market.

Competitive Landscape

Key Players

- Daiichi Sankyo (JPN)

- Takeda Pharmaceutical (JPN)

- Chugai Pharmaceutical (JPN)

- Eisai (JPN)

- Otsuka Holdings (JPN)

- Roche

- Astrazeneca

- Boehringer Ingelheim

- Eli Lilly

- Glaxosmithkline

- Novartis

- Novo Nordisk

Notable Deals

March 2023- In order to create and market an integrated diabetes self-management solution with BlueStar®, Astellas and Roche Diabetes Care Japan have signed a partnership deal. By capturing, storing, and transmitting blood glucose data from Roche Diabetes Care's Accu-Chek® Guide Me system and tracking medication, diet, activity, and exercise in Welldoc's BlueStar, the combined medical product solution, which is being developed in Japan, is expected to assist patients with managing their diabetes (app). Additionally, it is anticipated to assist patients in managing their diabetes through the use of a special AI-designed algorithm and tailored digital coaching messages that encourage the development of improved habits over time. The combined medical product's clinical studies, which are set to begin in 2023, will be handled by Astellas.

Healthcare Policies and Regulatory Landscape

The Independent Administrative Institution known as the Pharmaceuticals and Medical Devices Agency (PMDA) is in charge of assuring the efficacy, safety, and quality of pharmaceuticals and medical devices in Japan. By funding efforts in research and development and advising businesses on regulatory matters, the PMDA also contributes to the growth of the pharmaceutical industry in Japan. The organization also works with academics and businesses to foster innovation in pharmaceutical research and medical technology. A regulatory body under the Ministry of Health, Labour, and Welfare (MHLW), the PMDA oversees determining whether novel pharmaceutical products should be approved for marketing in Japan. To guarantee the efficacy and safety of pharmaceutical products that are already on the market, the agency also carries out post-marketing surveillance. Along with foreign regulatory organizations like the US Food and Drug Administration (FDA) and the European Medicines Agency, the PMDA closely collaborates with the MHLW. (EMA). This guarantees that Japan's regulation framework complies with global norms.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Eisai, Otsuka Holdings, and Roche are the major players in the Japanese diabetes therapeutics market.

The Japan diabetes therapeutics market is expected to grow from $8.94 Bn in 2022 to $19.45 Bn in 2030 with a CAGR of 10.2% for the forecasted year 2022-2030.

The Japan diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.