Japan Dental Caries Detectors Market Analysis

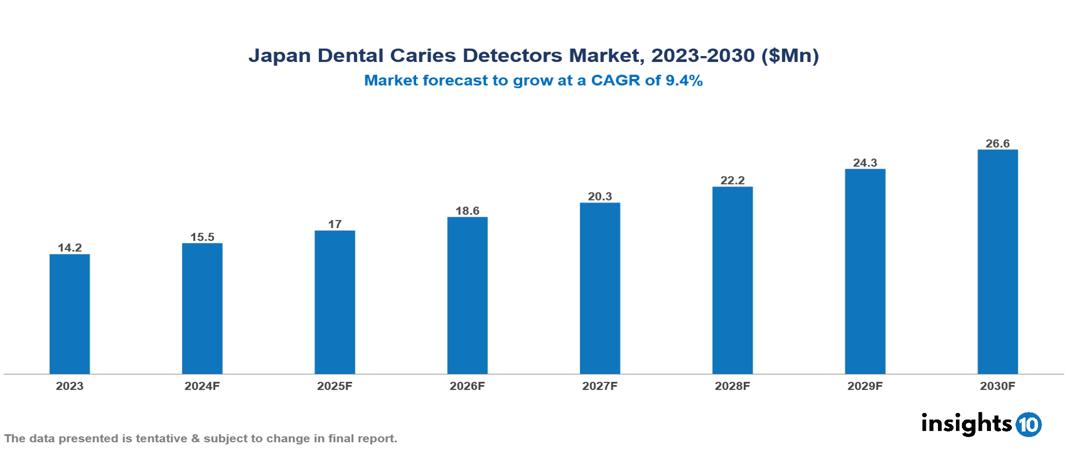

The Japan Dental Caries Detectors Market was valued at $14.2 Mn in 2023 and is predicted to grow at a CAGR of 9.4% from 2023 to 2030, to $26.6 Mn by 2030. Japan Dental Caries Detectors Market is growing due to Increasing Dental Awareness and Education, Government Initiatives and Funding and Technological Advancements. The market is primarily dominated by players such as Acteon Group, AdDent Inc., Air Techniques Inc, Dentlight Inc., DEXIS, Sirona Dental Systems, Dentsply Sirona, KaVo Kerr, Ivoclar Vivadent, Planmeca Oy, Adec Technologies, 3M ESPE, Morita Corporation, Woodpecker Medical Instruments Co., Softdent.

Buy Now

Japan Dental Caries Detectors Market Executive Summary

Japan Dental Caries Detectors Market is at around $14.2 Mn in 2023 and is projected to reach $26.6 Mn in 2030, exhibiting a CAGR of 9.4% during the forecast period.

Dental caries detectors are instruments or apparatuses that dentists employ to detect and treat dental caries, also referred to as cavities or tooth decay. Several methods are used by these detectors, including tactile assessment, visual inspection, and the use of diagnostic tools including dental probes and caries detection dyes. Furthermore, early diagnosis of tooth decay allows for timely intervention and preventative actions to stop the formation of cavities. This is the principal purpose of these technologies. Dental caries detectors help determine the extent and type of decay, so dentists can diagnose and treat patients with more thorough programs that include fillings or root canal therapy, or with less intrusive techniques like fluoride treatments and dental sealants.

Between 1957 and 2016, there was a significant decline in the prevalence of dental caries among 5 year-olds (from 94.5% to 39.0%) and 3-year-olds (from 81.8% to 8.6%) in Japan, highlighting substantial improvements in oral health over the decades. However, prevalence of dental caries remains high, particularly among the aging population, necessitating effective detection methods. Healthcare expenses in Japan are substantial, with significant spending on dental care, driven by a comprehensive national health insurance system. Demographic factors such as an increasing elderly population, who are more susceptible to dental issues, further fuel the demand for advanced caries detection technologies. The market, therefore, is driven by significant factors like Increasing Dental Awareness and Education, Government Initiatives and Funding, and Technological Advancements. However, Reliability and Accuracy Concerns, Regulatory and Approval Challenges, and Limited Reimbursement Policies restrict the growth and potential of the market.

Ortek Therapeutics, Inc. announced the official commercial launch of the Ortek-ECD, an electronic early cavity detection system certified for professional use by the Food and Drug Administration.

Market Dynamics

Market Growth Drivers

Increasing Dental Awareness and Education: The need for sophisticated diagnostic equipment is significantly increasing in Japan due to growing awareness of the significance of early identification and treatment of dental caries. 70% of Japanese patients now place a high value on early caries identification while seeing the dentist. Dental professionals are prompted to invest in cutting-edge technologies, such caries detectors, in order to satisfy patient expectations and deliver exceptional care as a result of this proactive approach to routine check-ups and treatments.

Government Initiatives and Funding: Growth in the market is also fueled by government programs that support dental care access and oral health promotion. Dentistry clinics, both public and private, frequently have plans to upgrade dental equipment, including caries detectors, as part of public health initiatives that prioritize early detection and treatment of dental caries.

Technological Advancements: The market for dental caries detectors is mostly driven by ongoing developments in dental imaging technologies, such as the creation of more sensitive and precise diagnostic instruments like digital radiography and laser fluorescence devices. With the use of these technology, dentists may more precisely and early identify dental cavities, which improves treatment outcomes and patient care.

Market Restraints

Reliability and Accuracy Concerns: The effectiveness of dental caries detectors in accurately identifying early-stage caries lesions is crucial. If these devices are perceived as unreliable or their accuracy is questioned, dental professionals may hesitate to incorporate them into diagnostic protocols. Issues such as false positives or negatives can undermine trust in the technology, leading to slower adoption rates and reluctance among potential users.

Regulatory and Approval Challenges: The approval process for new dental devices by regulatory bodies can be lengthy and stringent. This regulatory scrutiny ensures safety and efficacy but can delay the introduction of innovative caries detection tools to the market. The time and resources required for compliance with regulatory standards can be a barrier for manufacturers, potentially slowing down the availability of new technologies and impeding the market growth.

Limited Reimbursement Policies: Insurance companies often provide limited around 30% or no reimbursement for dental procedures involving advanced caries detection technologies. This lack of coverage can discourage both dentists and patients from opting for these modern diagnostic tools. The financial burden of out-of-pocket expenses can lead to a preference for traditional, less expensive methods, thereby restricting the widespread adoption of advanced detection devices in the market.

Regulatory Landscape and Reimbursement Scenario

The regulatory landscape in Japan for the dental caries detectors market is stringent and follows the Pharmaceutical and Medical Device Act (PMD Act). Devices must adhere to rigorous standards set by the Pharmaceuticals and Medical Devices Agency (PMDA) to ensure safety, efficacy, and quality. Manufacturers must obtain certification and approvals, including pre-market approval (PMA) or pre-market certification (PMD Act certification), depending on the device classification. Compliance with Good Clinical Practice (GCP) guidelines for clinical trials is mandatory. Additionally, ongoing post-market surveillance and reporting of adverse events are required to maintain market authorization. These regulatory measures aim to safeguard public health and maintain high standards of product performance in detecting dental caries, ensuring patient safety and product efficacy in the Japanese market.

Japan is called a welfare country and public healthcare systems are well developed. Japan introduced a universal health insurance system for the entire population in 1961. It covers almost all medical and dental treatment and pharmacy care required by the population. People can receive treatment at a relatively low cost, and the same fee is applied throughout the nation. As technology evolves, updating reimbursement policies becomes crucial to ensure they accommodate new diagnostic methods effectively. The reimbursement landscape thus plays a critical role in driving the uptake and utilization of modern caries detection technologies throughout Japan's dental industry.

Competitive Landscape

Key Players

Here are some of the major key players in the Japan Dental Caries Detectors Market:

- Acteon Group

- AdDent Inc.

- Air Techniques Inc

- Dentlight Inc.

- DEXIS

- Sirona Dental Systems

- Dentsply Sirona

- KaVo Kerr

- Ivoclar Vivadent

- Planmeca Oy

- Adec Technologies

- 3M ESPE

- Morita Corporation

- Woodpecker Medical Instruments Co.

- Softdent

- Elmeco

- Anthogyr

- Bien Air Dental

- FONA Dental

- Genoray International Co.

- I.N. Dental

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Dental Caries Detectors Market Segmentation

Based on Type

- Laser Fluorescent caries detector

- Fiber Optic

- Trans-Illumination Caries Detector

- Others

Based on the Distribution Channel

- Online Platforms

- Offline Platforms

Based on End-user

- Hospitals

- Dental clinics

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.