Japan Dental Care Market Analysis

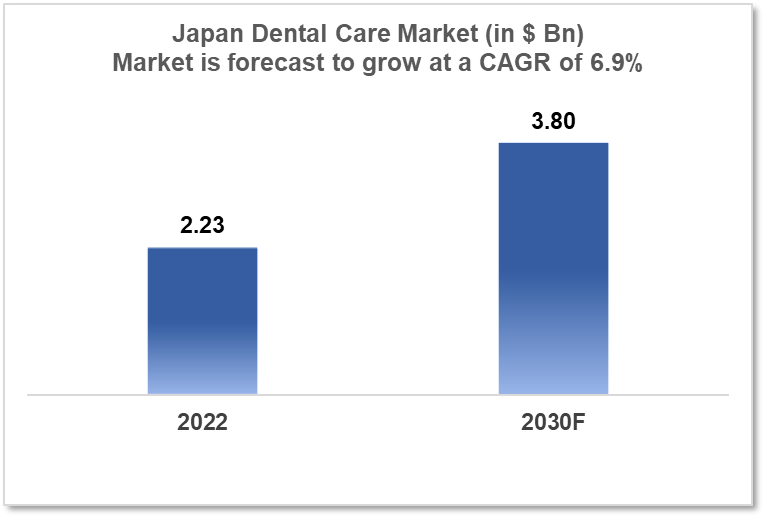

Japan's dental care market size is at around $2.23 Bn in 2022 and is projected to reach $3.80 Bn in 2030, exhibiting a CAGR of 6.9% during the forecast period. The largest market of dental care in Asia, driven by aesthetic sensitive needs and a growing ageing population Japan is dominated by huge corporations J. Morita Corporation, Mitsui & Co., and GC Corporation. This report is segmented by treatment type, age group, clinical setup, and by demography and provides in-depth insights into opportunities for expansion.

Buy Now

Japan Dental Care Market Executive Summary

Japan's dental care market is regarded as advanced and sophisticated. Dental care in Japan is of high quality, and dental services are readily available throughout the country. Dental implants, orthodontics, cosmetic dentistry, and regular dental care are among the products and services available in Japan's dental care market. The current market of dental care is valued at $2.23 Bn (2022) and is projected to increase to $3.80 Bn (2030) at a CAGR of 6.9% over the forecasted period of 2022-30. The market is dominated by huge corporations, although there are numerous small and medium-sized businesses as well.

The Japan dentistry community is comprised of over 75,000 oral medical institutions, 160,000 dentists, and 300,000 oral hygienists, and has the world's second-largest dental market after the United States dental market. It features one of the most stable dental markets in the world, as well as the finest quality dental practitioners. In 2020, the number of dentists per 100,000 people was 83.

Because of growing consumer knowledge and better information transmission in emerging nations, the relevance of dental care and oral care products has expanded considerably in recent years. The underlying need for oral health care products derives from the fact that the vast majority of oral health disorders are avoidable and/or treatable using readily available commercial available solutions. The World Health Organization (WHO) has raised awareness in Japan about a variety of oral health issues, such as dental caries (2.9 Mn people were treated in 2020), which can cause tooth decay, periapical abscess, it may cause pain, chronic systemic illness, or abnormal growth patterns. Tooth decay is a common reason for missing school or work.

Market Dynamics

Market Growth Drivers

The Japanese government has good reason to be concerned about the pace of population ageing and the challenges it presents - not just to the medical sector, but also to the dental industry - as a result of a dropping birth rate and an increasing proportion of older individuals. Japan's over-75s now account for more than 15% of the population, having increased by 720,000 to 19.37 Mn people, according to government figures released in 2022, demonstrating the country's rapidly greying society. When compared to other industrialized countries, the usage of medical insurance claims to offset dental care expenditures is unusually high as a proportion of total medical insurance coverage. As a result, Japanese individuals have developed the habit of visiting their dentist on a regular basis. Patients would typically visit a private clinic rather than a public one. Japan is a prominent dental tourism destination, attracting patients from all over the world who travel to take advantage of the high-quality dental care provided in Japan. The rise in disposable money is driving up demand for cosmetic dentistry and orthodontics.

Market Restraints

Although Japanese people's oral health has improved, there are still numerous issues to be addressed. These include regional differences in oral health and total healthcare costs, particularly for the elderly. Furthermore, because Japan is prone to natural disasters, we must build an emergency oral healthcare system to deal with calamities and train dental personnel to handle appropriate intervention programs. It appears that the technological development of a new tele-dental system that may be employed in rural and remote areas of Japan without easy access to dental experts to receive diagnostic and preventive care is equally vital.

Competitive Landscape

Key Players

- J. MORITA Corporation (JPN)

- Mani, Inc. (JPN)

- GC Corporation

- Mitsui & Co. (JPN)

- Tokuyama Dental Corporation (JPN)

- DenTech Corporation

- The Yoshida Dental Mfg. Co. Ltd. (JPN)

- Dentsply Sirona

- Nissin Dental Products Inc. (JPN)

- Nakanishi Inc. (JPN)

Notable Recent Deals

October 2022 - The Tokyo Institute of Technology and the Tokyo Medical and Dental University said that they will merge to form a new national university by the end of fiscal 2024, with the goal of increasing their global research competitiveness. The two universities, both of which are regarded as top-tier in their respective professions in Japan, plan to apply for a government grant to fund the integration. The grant is part of the government's new $68 Bn funding package to assist universities in producing internationally competitive research results. The agreement set the stage for the first merger of national institutions classified as globally competitive.

Healthcare Policies and Regulatory Landscape

The Japan Dental Association (JDA) is the congress of all practicing dentists across provinces in Japan. Persons intending to practice dentistry in Japan must pass the National Dental Practitioner's Examination and obtain a license from Japan's Minister of Health, Labour, and Welfare. The JDA is committed to the following activities in order to improve the ethics of the dental profession, develop dental sciences, and improve public oral health, thereby boosting the welfare of JDA members and the community. Pharmaceuticals and Medical Equipment Agency (PMDA) in Japan is in charge of manufacturer litigation and regulatory compliance, as well as a medical device, regenerative medical goods, dental equipment, in-vitro diagnostics, and clinical trial standards.

Reimbursement Scenario

Japan has a universal health system that was established in 1961 and has been commended for its accomplishment in good population health at a low cost. With the exclusion of dental implants, orthodontic treatments, and treatments employing newer materials that might be substituted by more conventional materials, the insurance system covers a wide range of dental treatments. The government has made a concerted effort to ensure that all Japanese people, regardless of work position, residency, or age, have access to health care at a reasonable cost. Japan recorded the largest number of dental visits among the Organization for Economic Cooperation and Development (OECD) countries, with approximately half the level of edentulism among its seniors compared to numerous European countries.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.