Japan Cystic Fibrosis (CF) Therapeutics Market Analysis

Japan Cystic Fibrosis (CF) Therapeutics Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 ? 2030. Cystic fibrosis (abbreviated CF) is a genetic disorder that causes mucus to build up in certain organs of the body, particularly the lungs and pancreas, resulting in breathing problems, respiratory infections and faulty digestion. The increasing prevalence of Cystic Fibrosis (CF) coupled with the rising treatment rate is one of the key factors anticipated to propel the demand for cystic fibrosis therapeutics over the forecast period. The key players are consistently involved in the development of new or combination of products to treat cystic fibrosis. Investment in the R&D is one of the strategic measures to beat the competition. The key players in this market are AbbVie Inc.; F. Hoffmann-La Roche Ltd; Gilead; Novartis AG; Vertex Pharmaceuticals Inc.; AIT (Advanced Inhalation Therapies); Alaxia; Teva Pharmaceutical Industries Ltd; Merck & Co. Inc.; Alcresta Therapeutics Inc.; Allergan; and AstraZeneca.

Buy Now

Japan Cystic Fibrosis (CF) Therapeutics Market Analysis Summary

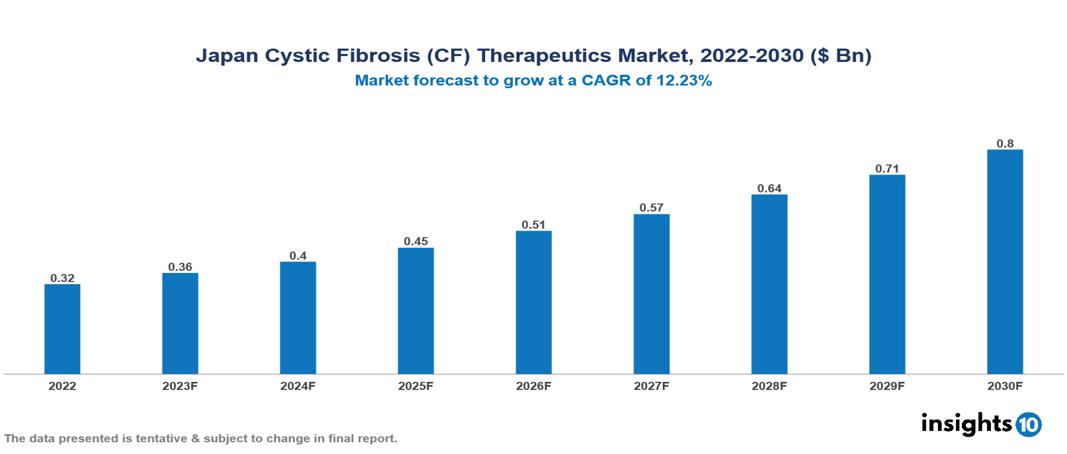

Japan Cystic Fibrosis (CF) Therapeutics Market is valued at around $0.32 Bn in 2022 and is projected to reach $0.8 Bn by 2030, exhibiting a CAGR of 12.23% during the forecast period 2023-2030.

Cystic fibrosis (abbreviated CF) is a genetic disorder that causes mucus to build up in certain organs of the body, particularly the lungs and pancreas, resulting in breathing problems, respiratory infections and faulty digestion. Caused by a mutation in a single gene (called CFTR), the disorder is inherited as an autosomal recessive trait, meaning that an affected individual inherits two mutated copies of the gene, one from each parent. In the past, CF was almost always fatal in childhood. About 1 in 10 children with cystic fibrosis are diagnosed shortly after birth. This is due to a condition called meconium ileus where in some cases the gut becomes blocked with meconium. Researchers are developing new medicines to help clear and target the thick mucus found in cystic fibrosis lungs and improve how well the lungs work. People with cystic fibrosis have abnormally high salt levels in sweat.

The increasing prevalence of Cystic Fibrosis (CF) coupled with the rising treatment rate is one of the key factors anticipated to propel the demand for cystic fibrosis therapeutics over the forecast period. The key players are consistently involved in the development of new combinations of products to treat cystic fibrosis. Investment in R&D is one of the strategic measures to beat the competition. The key players in this market are AbbVie Inc.; F. Hoffmann-La Roche Ltd; Gilead; Novartis AG; Vertex Pharmaceuticals Inc.; AIT (Advanced Inhalation Therapies); Alexia

Market dynamics

Market Drivers

According to a report released in July 2022 by the cystic fibrosis (CF) Foundation, a US-based NGO, the prevalence of cystic fibrosis has increased; about 105,000 new cases of the disease have been reported globally in 2022. Consequently, the CF Therapeutics Market is being driven by a rise in illness prevalence.

The CF Therapeutics Market is seeing a rise in the popularity of product innovations. Bramitob, an alternative TIS for the treatment of cystic fibrosis, has been announced by Safeline Pharmaceuticals, the preferred partner of CHIESI Farmaceutici S.p.An in Southern Africa. It is a recognised advanced TIS that makes life better for CF patients.

Market Restraints

Healthcare resource use and costs associated with cystic fibrosis (CF) care have increased dramatically over the past two decades. The cost of CF care can vary widely depending on a number of factors, including the health status of the CF population, practise patterns, availability of treatments (e.g., cystic fibrosis conductance transmembrane [CFTR] modulators) and the type of healthcare system (public vs. private) of each country.

Key players

Vertex Pharmaceuticals AbbVie Genentech (Roche) PTC Therapeutics Inc. Gilead Sciences AstraZeneca Johnson & Johnson Amgen Shire plc Catalyst Biosciences1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market segmentations for Japan Cystic Fibrosis (CF) Therapeutics Market

By Drug Class

- Pancreatic Enzyme Supplements

- Mucolytics

- Bronchodilators

- CFTR Modulators

By Route of Administration

- Oral

- Inhaled

By Diagnosis

- Sweat test

- Genetic test

- Screening test

- Other tests- X- rays, Ultrasounds, Biopsy

By End Users

- Hospital

- Clinics

- Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.