Japan Chronic Pain Therapeutics Market Analysis

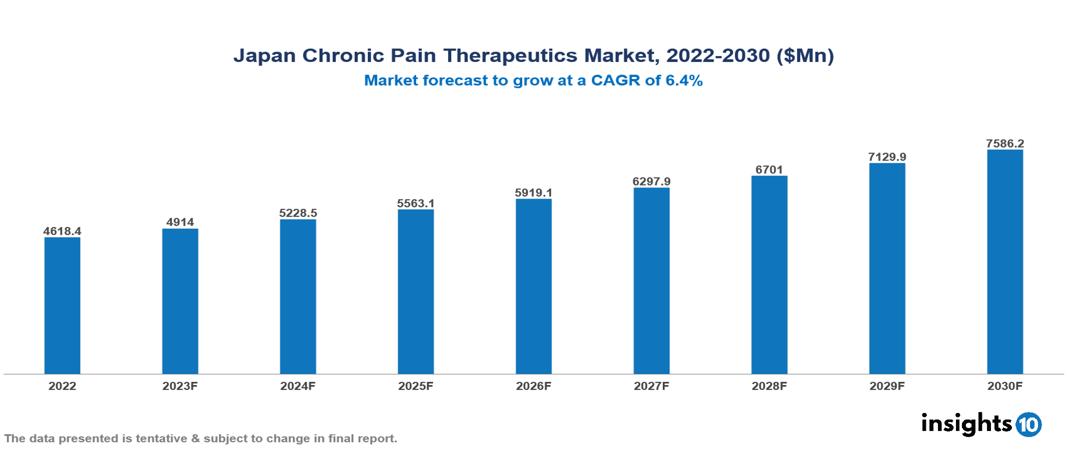

The Japan Chronic Pain Therapeutics Market is anticipated to experience a growth from $4.618 Bn in 2022 to $7.586 Bn by 2030, with a CAGR of 6.4% during the forecast period of 2022-2030. The market is primarily driven by the rapidly aging population leading to an increased prevalence of chronic pain conditions, augmented healthcare expenditure, government support prioritizing pain management accessibility, and a growing demand for non-opioid alternatives. The Japan Chronic Pain Therapeutics Market encompasses various players across different segments, including Pfizer, AstraZeneca, Sanofi, Merck, Roche, AbbVie, Astellas, Chugai Pharmaceuticals, Daiichi Sankyo, Eisai, etc., among various others.

Buy Now

Japan Chronic Pain Therapeutics Market Analysis Executive Summary

The Japan Chronic Pain Therapeutics Market is anticipated to experience a growth from $4.618 Bn in 2022 to $7.586 Bn by 2030, with a CAGR of 6.4% during the forecast period of 2022-2030.

Chronic pain, characterized by persistent or recurring discomfort lasting beyond the typical healing period, can stem from various conditions such as arthritis, fibromyalgia, neuropathy, back pain, and migraines. Rather than being solely a symptom, chronic pain is a multifaceted condition that can profoundly affect an individual's quality of life, mental health, and overall well-being. The management of chronic pain often involves a comprehensive approach, incorporating pharmacological interventions, physical therapy, cognitive-behavioral therapy, and interventional procedures like nerve blocks or spinal cord stimulation. Furthermore, innovative technologies are offering promising alternatives for pain management, including novel drug delivery systems, neuromodulation techniques, and non-invasive therapies.

A large proportion of Japan's population suffers from chronic pain. The prevalence among the Japanese population was estimated to be around 40%. It grows with age, with the elderly having the highest frequency, and has a substantial influence on work and everyday social life, as well as catastrophic consequences for psychological health.

The market is primarily driven by the rapidly aging population leading to an increased prevalence of chronic pain conditions, augmented healthcare expenditure, government support prioritizing pain management accessibility, and a growing demand for non-opioid alternatives.

Global companies such as AbbVie, Pfizer, and Johnson & Johnson have the biggest market share in Japan in terms of overall revenue due to their wide pain treatment portfolios and global reach. Domestic players like Astellas Pharma, Chugai Pharmaceutical, and Daiichi Sankyo may dominate sectors such as non-opioid pain medicines or arthritis pharmaceuticals. Both foreign and domestic firms carry out continuous innovation and pipeline development.

Market Dynamics

Market Growth Drivers

Aging Population and Rising Prevalence of Chronic Conditions: Japan has one of the fastest aging populations globally, leading to a higher prevalence of chronic pain conditions like osteoarthritis, rheumatoid arthritis, and back pain. This age-related increase in demand drives the market for pain management solutions.

Increased Healthcare Expenditure and Government Support: Despite being cost-conscious, Japan boasts a relatively high healthcare expenditure compared to other developed nations. Additionally, the government prioritizes improving pain management accessibility, and incentivizing research and development in the field.

Growing Demand for Non-Opioid Pain Relief: Concerns about opioid addiction and its side effects are fueling the demand for safer and more effective non-opioid pain management options. This opens doors for novel therapeutic approaches like neuromodulation devices and targeted drug delivery systems for market expansion.

Market Restraints

Stringent Regulatory Landscape: Japan's drug approval process is known for its strictness and lengthy timelines, potentially delaying the market entry of innovative pain therapeutics. This can hinder patient access to new treatment options as the process takes more time than expected.

Limited Reimbursement for Therapies: While the government promotes the management of pain, insurance reimbursement for these therapies, especially those that are considered innovative and novel often lags behind traditional options. This creates a cost barrier for some patients with low economic conditions and thus limits market growth.

Cultural Stigma and Underdiagnosis of Chronic Pain: Societal stigma associated with pain and a tendency to downplay symptoms can lead to underdiagnosis and undertreatment of chronic pain conditions. People often tend to ignore certain conditions and if not, tend to try out alternative therapies instead of medical management. This can affect market potential by reducing the identified patient population.

Healthcare Policies and Regulatory Landscape

The Pharmaceuticals and Medical Devices Agency (PMDA) plays a crucial role in ensuring the safety and efficacy of medical products in Japan. As the regulatory agency responsible for reviewing applications for marketing approval of drugs, medical devices, and regenerative medical products, the PMDA conducts thorough scientific assessments to ensure that these products meet the necessary standards before they can be made available to the public. In addition to its review services, the PMDA also provides clinical trial consultations to help researchers and manufacturers navigate the approval process effectively. The PMDA also plays a significant role in international collaborations, working closely with regulatory organizations around the world to contribute to global healthcare. Operating under the Ministry of Health, Labour, and Welfare (MHLW), the PMDA works in tandem with the ministry on a wide range of activities, from approval reviews to post-market surveillance.

Competitive Landscape

Key Players:

- Pfizer

- AstraZeneca

- Sanofi

- Merck

- Roche

- AbbVie

- Astellas

- Chugai Pharmaceuticals

- Daiichi Sankyo

- Eisai

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Chronic Pain Therapeutics Market Segmentation

By Indication

- Neuropathic Pain

- Back Pain

- Headaches

- Arthritis Pain

- Muscular Pain

- Idiopathic Pain

- Others

By Drug Class

- Analgesics

- Opioids

- NSAIDs

- Anaesthetics

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.