Japan Cholesterol Therapeutics Market Analysis

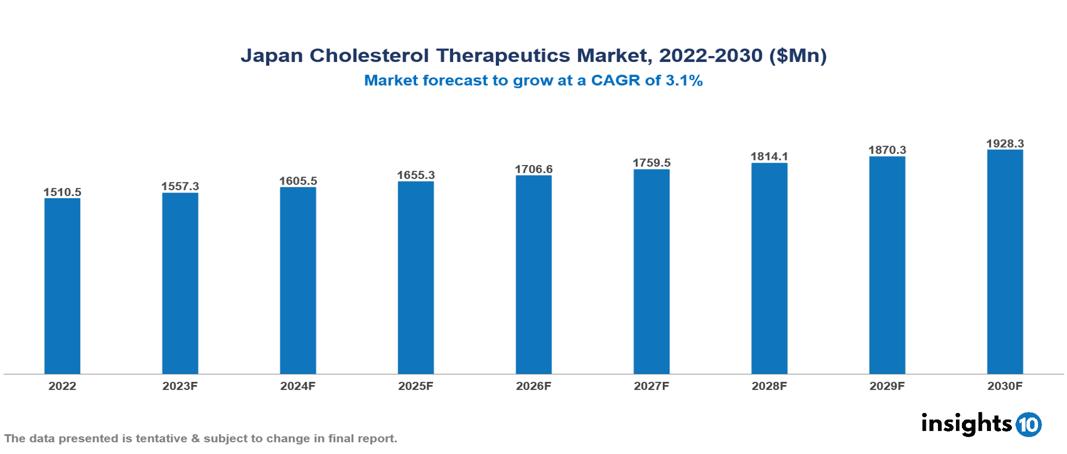

The Japan Cholesterol Therapeutics Market is anticipated to experience a growth from $1.51 Bn in 2022 to $1.928 Bn by 2030, with a CAGR of 3.1 % during the forecast period of 2022-2030. Japan's rapidly aging population, drives an increased demand for cholesterol therapeutics, further fueled by heightened public awareness and ongoing research and development, exemplified by the recent approval of Inclisiran, a promising alternative in the field. The Japan Cholesterol Therapeutics Market encompasses various players across different segments such as AstraZeneca, Daiichi Sankyo, Eisai, Merck & Co., Novartis, Pfizer, Bayer, Sanofi, Takeda, Chugai Pharma, etc, among various others.

Buy Now

Japan Cholesterol Therapeutics Market Analysis Executive Summary

The Japan Cholesterol Therapeutics Market is anticipated to experience a growth from $1.51 Bn in 2022 to $1.928 Bn by 2030, with a CAGR of 3.1 % during the forecast period of 2022-2030.

Cholesterol, a critical fatty molecule required for basic bodily activities, is involved in cellular structure and hormone production. There are two forms of cholesterol: HDL (high-density lipoprotein) and LDL (low-density lipoprotein). Elevated cholesterol levels, particularly LDL cholesterol, increase the risk of atherosclerosis and cardiovascular disease. The delicate nature of elevated cholesterol, which frequently lacks visible signs, highlights the importance of constant monitoring to address possible health risks. Fortunately, there are several therapy options available for controlling cholesterol levels. Lifestyle changes, such as eating a heart-healthy diet, exercising regularly, and keeping a healthy weight, are critical for cholesterol regulation. Conventional drugs such as statins, which efficiently limit cholesterol synthesis in the liver, are routinely used to lower LDL cholesterol levels. Beyond these well-established approaches, current research has resulted in novel medications such as PCSK9 inhibitors and RNA-based therapeutics, which show promise for more precisely targeting cholesterol metabolism.

Japan appears to have a higher prevalence of hypercholesterolemia than other developed countries. The incidence of coronary heart disease has grown among middle-aged men living in Japan's suburbs. Furthermore, cardiovascular diseases (CVDs) are among the leading causes of death, with over 310,000 individuals dying each year.

Japan's rapidly aging population, drives an increased demand for cholesterol therapeutics, further fueled by heightened public awareness and ongoing research and development, exemplified by the recent approval of Inclisiran, a promising alternative in the field.

The Japan Cholesterol Therapeutics Market is a dynamic battleground in which foreign pharmaceutical behemoths such as AstraZeneca and Sanofi contend with long-standing domestic firms such as Daiichi Sankyo. Each business brings distinct assets to the table, with AstraZeneca using its blockbuster statin Crestor and Sanofi boasting a strong position in PCSK9 inhibitors with Praluent. Daiichi Sankyo, on the other hand, has a significant presence with well-known names like Lipitor (atorvastatin) and Zetia (ezetimibe).

Market Dynamics

Market Growth Drivers

Rapidly aging population: Japan stands out globally for having the highest life expectancy, with approximately 28% of its population aged 65 or older. This aging demographic is notably more prone to cardiovascular diseases, making cholesterol-lowering drugs a crucial focus for healthcare. The prevalence of this trend is anticipated to persist, with projections indicating that by 2040, 31.9% of Japan's population will be elderly, reinforcing the sustained demand for cholesterol therapeutics.

Increased public awareness: Extensive public awareness campaigns and media coverage have significantly enhanced understanding regarding the risks associated with high cholesterol and the advantages of early intervention. This increased knowledge translates into proactive behavior among individuals, prompting more people to actively seek diagnosis and treatment. For instance, a survey conducted by the Ministry of Health, Labour and Welfare in Japan revealed that 75% of adults now recognize high cholesterol as a risk factor for heart disease, underscoring the growing awareness in the population.

Research and development: Ongoing advancements result in the creation of novel, more efficient, and targeted drugs. These innovations attract both patients in search of improved treatment options and healthcare professionals eager to incorporate cutting-edge solutions into their practices. An illustrative example is the recent approval of Inclisiran, a long-acting injectable PCSK9 inhibitor, which presents a promising alternative to traditional therapies. This approval not only broadens the spectrum of available treatments but also has the potential to stimulate further growth in the market.

Market Restraints

Complex regulatory landscape: Japan's pharmaceutical market is known for its stringent regulatory requirements, and gaining approval for new drugs can be a lengthy and challenging process. The Pharmaceuticals and Medical Devices Agency (PMDA) meticulously evaluates applications, requiring extensive scientific and clinical data. This stringent regulatory environment may result in delays in the introduction of innovative cholesterol-lowering drugs to the market, hindering the rapid expansion of the therapeutic options available.

Financial factors: Another restraint involves the economic factors influencing healthcare expenditure. The escalating healthcare costs, coupled with the economic challenges posed by an aging demographic, may limit the resources available for investment in cholesterol therapeutics. This economic constraint could impede the market's growth by affecting the affordability and accessibility of advanced cholesterol-lowering drugs for a significant portion of the population.

Cultural factors: Cultural factors and healthcare preferences may also act as barriers to the widespread adoption of cholesterol therapeutics. Traditional approaches to healthcare, reliance on home remedies, or a preference for lifestyle modifications over pharmaceutical interventions may influence patient choices.

Healthcare Policies and Regulatory Landscape

The Pharmaceuticals and Medical Devices Agency (PMDA) plays a crucial role in Japan by overseeing the safety, efficacy, and quality of medicines and medical devices, operating as a separate administrative entity under the Ministry of Health, Labour, and Welfare. One of its primary functions involves thoroughly examining and assessing applications for marketing authorization, wherein the PMDA evaluates scientific and clinical data submitted by manufacturers to ensure compliance with regulatory standards. This rigorous review process contributes significantly to the high standards maintained in Japan's healthcare system. Additionally, the PMDA engages in post-marketing surveillance to monitor the effectiveness and safety of authorized medicines post-release. To stay informed about emerging safety issues and advancements in medicine, the agency collaborates with international regulatory organizations, industry stakeholders, and healthcare experts.

Competitive Landscape

Key Players:

- AstraZeneca

- Daiichi Sankyo

- Eisai

- Merck & Co.

- Novartis

- Pfizer

- Bayer

- Sanofi

- Takeda

- Chugai Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Cholesterol Therapeutics Market Segmentation

By Indication

- Hypercholesterolemia

- Hyperlipidaemia

- Cardiovascular Diseases

- Others

By Drug Class

- Statins

- Bile Acid Sequestrants

- Lipoprotein Lipase Activators

- Fibrates

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Academics & Research Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.