Japan Central Nervous System (CNS) Therapeutics Market Analysis

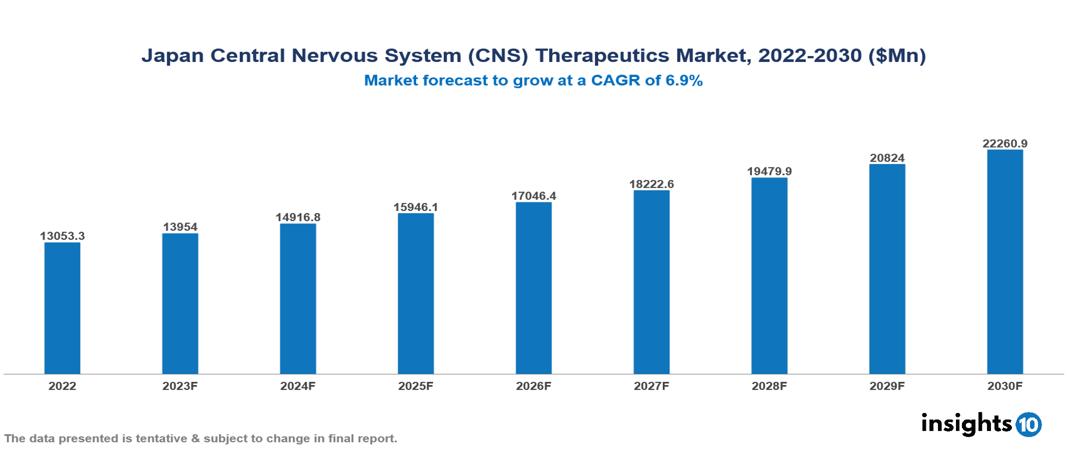

The Japan Central Nervous System (CNS) Therapeutics Market was valued at $13.053 Bn in 2022 and is predicted to grow at a CAGR of 6.9% from 2023 to 2030, to $22.261 Bn by 2030. The key drivers of this industry include the rising prevalence of CNS disorders, supportive government initiatives, and the evolving treatment landscape. The industry is primarily dominated by players such as Abbott, Eli Lilly, Astellas, Merck, Eisai, AstraZeneca, Otsuka, and Shionogi among others.

Buy Now

Japan Central Nervous System (CNS) Therapeutics Market Analysis

The Japan Central Nervous System (CNS)Therapeutics Market is at around $13.053 Bn in 2022 and is projected to reach $22.261 Bn in 2030, exhibiting a CAGR of 6.9% during the forecast period.

Diseases of the Central Nervous System (CNS) encompass a broad spectrum of medical conditions impacting the normal functioning of the brain and spinal cord. These disorders are categorized into various groups, such as neurodegenerative diseases like Alzheimer's and Parkinson's, psychological conditions like depression and schizophrenia, and neurological disorders such as epilepsy and multiple sclerosis. The causes of CNS disorders are diverse, ranging from genetic factors and environmental influences to infections, injuries, or autoimmune responses. Symptoms vary based on the specific disorder but commonly involve changes in cognitive function, motor skills, mood, or sensory perception. Current approaches to treating CNS conditions aim to alleviate symptoms, slow disease progression, or manage complications. Treatment options include medication, psychotherapy, and, in certain cases, surgery. Pharmaceutical industry leaders, including Pfizer, Eli Lilly, and Johnson & Johnson, play an active role in developing medications for CNS disorders. For example, Pfizer focuses on medications for Alzheimer's disease, while Eli Lilly is renowned for its contributions to psychiatric medications.

Japan is experiencing a rising burden of neurological disorders such as depression whose prevalence exceeds 10% of the population. The market therefore is propelled by important factors like the increasing prevalence of neurological conditions, supportive government initiatives, and the evolving treatment landscape. However, high costs of healthcare, stringent regulatory environment, and limited availability of generics restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of CNS conditions: The increasing aging demographic in Japan plays a crucial role in the rising prevalence of CNS disorders. Aging individuals are at a heightened risk of developing neurodegenerative conditions such as Alzheimer's and Parkinson's, and these disorders are anticipated to witness a steady increase in the forecasted period. Moreover, mental health issues like depression and anxiety are on the rise, especially among the younger population with an estimated prevalence exceeding 10%.

Government initiatives: The Japanese government acknowledges the significance of CNS disorders and dedicates resources to advancing research and development in this field. This financial support aids in the progression of clinical trials, the development of pharmaceuticals, and the enhancement of infrastructure, ultimately promoting growth in the market. Furthermore, government programs focused on increasing awareness and enhancing accessibility to CNS treatments also play a role in expanding the market.

Evolving treatment landscape: The growth of the market is driven by the creation of cutting-edge medications with unique modes of operation. This encompasses fields such as personalized medicine, gene therapy, and targeted treatments designed to address specific disease pathways. Progress in drug delivery systems is also playing a role, as novel approaches enhance medication adherence, deliver drugs precisely to particular regions of the brain, and minimize side effects.

Market Restraints

High healthcare costs: While a growing elderly population may propel the need for CNS therapeutics given the higher occurrence of age-related neurological disorders, it simultaneously poses challenges for the healthcare system. The elevated expenses associated with CNS drugs, combined with a rising patient population in need of treatment, may impose a substantial financial strain on the healthcare system, potentially restricting the availability of these medications.

Stringent regulatory landscape: The Pharmaceutical and Medical Devices Agency (PMDA) in Japan imposes stringent regulations on drug approval, necessitating thorough clinical trials and extensive data analysis. This stringent process can substantially extend the time and expenses associated with pharmaceutical companies' drug development, resulting in delays in introducing new CNS therapeutics to the market and impeding overall market expansion. Additionally, the PMDA enforces rigorous post-marketing surveillance requirements, contributing to increased costs and operational complexity for companies operating in the Japanese market.

Limited availability of generic drugs: The Japanese CNS market experiences a comparatively low utilization of generic drugs. This phenomenon is attributed in part to the intricate nature of CNS medications and the difficulties associated with developing viable generic alternatives. The scarcity of generic options hinders competition, leading to elevated prices, which may consequently impede patient access to the market and pose affordability challenges for healthcare systems.

Notable Updates

September 2023, Japanese pharmaceutical company Otsuka Pharmaceuticals has finalized an agreement to purchase Mindset Pharma, a Toronto-based drug discovery and development firm. Mindset Pharma specializes in developing cutting-edge psychedelic medicines for neurological and psychiatric disorders, emphasizing optimization and patentability.

May 2023, Authorization has been granted by the Japanese Ministry of Health, Labour and Welfare (MHLW) for AstraZeneca's Ultomiris (ravulizumab) to prevent relapses in individuals diagnosed with neuromyelitis optica spectrum disorder (NMOSD), encompassing neuromyelitis optica which affects the optic nerves and spine.

April 2023, JCR Pharmaceuticals Co., Ltd. in Japan has reported the signing of a Research Collaboration, Option, and License Agreement with Alexion, AstraZeneca Rare Disease ("Alexion"). The agreement aims to collaborate on the development of an undisclosed primary therapeutic molecule utilizing JCR's exclusive J-Brain Cargo® technology, which facilitates blood-brain barrier ("BBB") penetration. The focus of this collaboration is on treating a neurodegenerative disease.

Healthcare Policies and Regulatory Landscape

In Japan, the main regulatory body overseeing the approval and licensure of drugs and pharmaceuticals is the Pharmaceuticals and Medical Devices Agency (PMDA). The PMDA operates under the Ministry of Health, Labour, and Welfare (MHLW) and is responsible for evaluating the safety, efficacy, and quality of pharmaceuticals and medical devices. The PMDA conducts thorough reviews of applications submitted by pharmaceutical companies seeking approval for their products, and the regulatory process involves clinical trials of the proposed drugs.

The process of obtaining licensure for drugs in Japan typically involves several stages, starting with preclinical studies and progressing through phases of clinical trials. Companies are required to submit a New Drug Application (NDA) to the PMDA, providing detailed data on the product's safety and efficacy. If the product meets the necessary criteria, it is granted marketing approval.

The regulatory environment for new entrants in the pharmaceutical industry in Japan is demanding, as companies must navigate strict regulatory requirements and demonstrate the quality and effectiveness of their products.

Competitive Landscape

Key Players

- AbbVie

- AstraZeneca

- Otsuka Pharmaceuticals

- Bristol Myers Squibb

- Eli Lilly

- Johnson & Johnson

- Eisai

- Astellas Pharma Inc

- Shionogi & Co

- Merck & Co

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Central Nervous System (CNS) Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.