Japan Cardiac Resynchronization Therapy Market

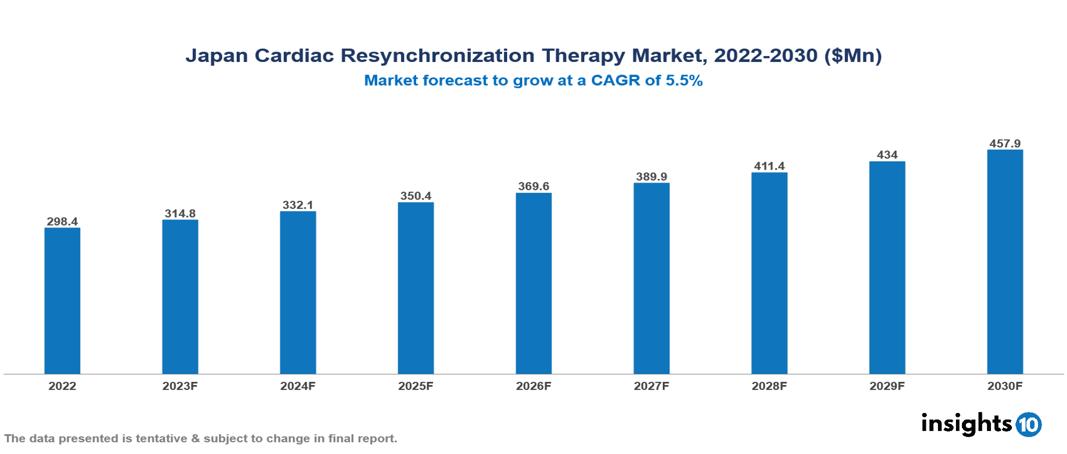

Japan Cardiac Resynchronization Therapy Market valued at $298 Mn in 2022, projected to reach $458 Mn by 2030 with a 5.5% CAGR. The global surge in heart failure cases, driven by aging populations and lifestyle-related cardiovascular diseases, is a significant catalyst contributing to the expansion of the Cardiac Resynchronization Therapy (CRT) market. Currently, major contributors to this market include companies such as Abbott, Biotronik, Boston Scientific, Medtronic, Nihon Kohden, Oscor, Siemens Healthineers, Sorin Group, MicroPort CRM, and Osram Health.

Buy Now

Japan Cardiac Resynchronization Therapy Market Executive Summary

Japan Cardiac Resynchronization Therapy Market valued at $298 Mn in 2022, projected to reach $458 Mn by 2030 with a 5.5% CAGR.

Cardiac resynchronization therapy (CRT) is a medical procedure involving the utilization of a pacemaker to rectify the heart's rhythm through a minimally invasive surgical procedure. The CRT pacemaker, positioned beneath the skin, harmonizes the timing between the upper and lower heart chambers, ensuring synchronization between the left and right sides of the heart. This therapeutic approach holds particular significance for individuals experiencing heart failure, as it addresses insufficient pumping and fluid accumulation in the lungs and legs resulting from the asynchronous beating of the heart's lower chambers. In instances of severe heart rhythm irregularities, CRT therapy may be complemented by the integration of an implantable cardioverter-defibrillator (ICD). The CRT device connects wires from the pacemaker to both sides of the heart, employing biventricular pacing to guarantee coordinated contractions and optimize overall heart function.

Heart disease and cerebrovascular illness rank as the second and fourth leading causes of death in Japan, respectively. Cardiovascular diseases (CVDs) contribute to over 310,000 deaths annually, with heart disease alone accounting for about 30% of health insurance claims. In 2021, heart-related deaths reached a ten-year high of over 214.7 thousand cases, underscoring the growing incidence of cardiovascular conditions in Japan. Addressing these challenges requires a sustained effort to mitigate the impact of CVDs on public health and healthcare infrastructure.

MicroPort CRM's Alizea pacemakers with Bluetooth technology have received regulatory approval from Japan's PMDA, enhancing remote monitoring capabilities for cardiac patients. Similarly, Medtronic's Micra AV transcatheter pacing system, the world's first leadless pacemaker, has also gained PMDA approval and launched in Japan. These advancements represent a significant leap forward in cardiac care, providing innovative tools for effective patient management and improving the overall quality of care and quality of life for patients in Japan.

Market Dynamics

Market Growth Drivers

Expanding Aging Population: As of 2023, Japan holds the distinction of being the world's most aged country, with over 30% of its population aged 65 and above, a figure anticipated to rise to 40% by 2060. This demographic shift, characterized by a growing elderly population, particularly susceptible to heart-related conditions, highlights an expanded pool of potential candidates for interventions like Cardiac Resynchronization Therapy (CRT).

Increasing Incidence of Heart Failure: The rising rate of heart failure in Japan is a serious health concern, primarily due to an aging population and increased risks like obesity, diabetes, and hypertension. This results in a larger group of patients who could potentially experience benefits from CRT therapy.

Technological Advancements: Continuous improvements in CRT technology are yielding systems that are more durable and smaller, along with new features like data analysis and remote monitoring. These advancements have the potential to enhance patient comfort, treatment efficacy, and the overall delivery of healthcare services.

Market Restraints

Infrastructure and Resource Constraints: In certain areas, the limited healthcare infrastructure and a shortage of skilled medical professionals may impede the widespread adoption of CRT. The lack of specialized facilities and well-trained personnel can restrict access to these advanced therapies.

Limited Awareness and Education: Limited awareness among healthcare professionals and the general public regarding the benefits and applications of CRT has the potential to hinder its acceptance. It might be essential to introduce educational campaigns and training programs aimed at improving awareness and understanding.

High Cost of CRT Devices and Procedures: The expenses linked to CRT devices and the procedures for their implantation can pose a notable obstacle, especially in areas with constrained financial resources. Challenges related to affordability and reimbursement may restrict accessibility for a substantial segment of the population.

Healthcare Policies and Regulatory Landscape

In Japan, the regulatory framework overseeing therapeutic medications is administered by the Pharmaceuticals and Medical Devices Agency (PMDA). The PMDA assesses the safety, effectiveness, and quality of pharmaceuticals, including therapeutic drugs, before granting market approval. Working in conjunction with the PMDA, the Ministry of Health, Labor, and Welfare (MHLW) plays a crucial role in formulating healthcare policies and ensuring that drugs comply with national health standards. Conditional approvals may be issued based on preliminary results, and companies are required to conduct post-marketing assessments to gather additional data on the efficacy and safety of the drugs. The MHLW is responsible for overseeing the national health insurance system, shaping coverage policies, and determining reimbursement guidelines for therapeutic drugs. To foster international collaboration in drug development and distribution, Japanese pharmaceutical firms often engage in global partnerships and licensing agreements.

Competitive Landscape

Key Players

- Abbott

- Biotronik

- Boston Scientific

- Medtronic

- Nihon Kohden

- Oscor

- Siemens Healthineers

- Sorin Group

- MicroPort CRM

- Osram Health

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Cardiac Resynchronization Therapy Market Segmentation

By Product

- CRT-Defibrillator

- CRT-Pacemaker

By Age

- Below 44 years

- 45-64 years

- 65-84 years

- Above 85 years

By End-Users

- Hospitals

- Cardiac care Centres

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.