Japan Blood Disorder Therapeutics Market

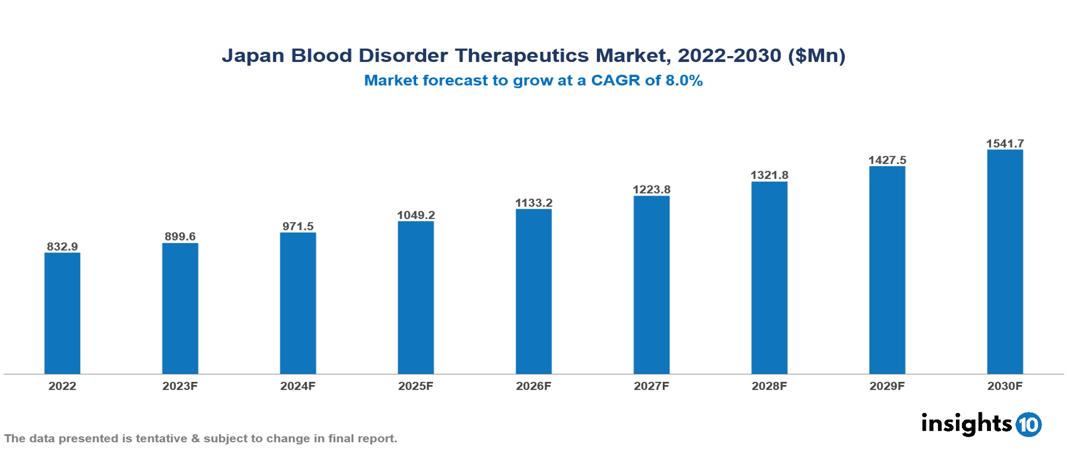

Japan Blood Disorder Therapeutics Market valued at $833 Mn in 2022, projected to reach $1,542 Mn by 2030 with a 8% CAGR. The key drivers of market growth include the higher prevalence of hemophilia A, improved awareness and diagnoses, growing adoption of advanced therapies, and government efforts to support the pharmaceutical industry. The Japan Blood Disorder Therapeutics Market encompasses various players across different segments, including Takeda, Pfizer, Roche, Bayer, Novartis, KM Pharmaceuticals, Chugai Pharmaceuticals, Eisai, Kyowa Kirin, Daiichi Sankyo, etc, among various others.

Buy Now

Japan Blood Disorder Therapeutics Market Executive Summary

Japan Blood Disorder Therapeutics Market valued at $833 Mn in 2022, projected to reach $1,542 Mn by 2030 with a 8% CAGR.

Blood Disorders are a wide range of ailments that impair the essential activities of blood cells and other bodily components. They can result from autoimmune responses, infections, malnutrition, genetic errors, and occasionally even drug side effects. They may be broadly divided into two groups: those that interfere with clotting processes (such as hemophilia and thrombosis) and those that alter blood cell generation and function (such as anemia and leukemia). The precise kind and degree of blood problems determine how they should be treated. Iron supplements or vitamin B12 injections are common ways for anemia to flourish. Chemotherapy and immunotherapy are effective treatments for certain leukemias. Clotting factor concentrates or medicines can be lifesaving for patients with bleeding problems. In circumstances of acute care, transfusions can be required. The field of hematology, dedicated to blood disorders, constantly innovates. Trials involving gene therapy show promise in treating hereditary blood disorders including thalassemia. Utilizing the immune system to combat blood malignancies, CAR-T treatment has demonstrated impressive outcomes. Additionally, researchers are investigating customized medicine strategies that adjust medicines based on the genetic profiles of specific individuals.

The number of instances of blood disorders varies by region and by demographic segment. Compared to other developed nations, the prevalence of anemia among Japanese women of reproductive age is greater at 22%. In the general population, there are one in 600 cases of beta-thalassemia and one in 400 cases of alpha-thalassemia. Leukemia is responsible for around 3% of cancer-related deaths in Japan.

The key drivers of market growth include the higher prevalence of hemophilia A, improved awareness and diagnoses, growing adoption of advanced therapies, and government efforts to support the pharmaceutical industry.

Takeda's comprehensive strategy and market domination reinforce its leading position in the Japanese Blood Disorder Therapeutics Market, while other firms such as Eisai and Chugai have strong positions in particular sectors. They provide a broad spectrum of well-established and cutting-edge treatments, such as the widely used Hemophilia-A medication Advate and the first licensed bispecific antibody for Hemophilia-B, Hemlibra.

Market Dynamics

Market Growth Drivers

Growing Prevalence of Blood Disorders: When compared to other industrialized countries, Japan has a higher-than-normal prevalence of hemophilia A. This increase is partially due to improved awareness and diagnoses. There is also a rise in the identification and treatment of illnesses including immune thrombocytopenic purpura (ITP), sickle cell disease, and aplastic anemia.

Growing Adoption of Advanced Therapies: Recombinant Coagulation Factor Concentrates, which provide safer and more effective alternatives than traditional plasma-derived concentrates, are propelling market expansion. The commercial potential for hemophilia is increased by the prospect of long-term or possibly curative treatment provided by emerging gene therapy approaches. Additionally, the creation of novel targeted treatments for certain blood diseases creates opportunities for customized therapy, which enhances patient outcomes.

Government Efforts to Support the Pharmaceutical Industry: The Japanese government understands the value of the pharmaceutical sector to the nation's economy and health. They provide grants for R&D initiatives, providing both financial and policy assistance. simplification of the medication approval procedures, fostering partnerships between business and academics, and making investments in cutting-edge medical technologies.

Market Restraints

Robust Competition from Pharma businesses: As well as powerful domestic businesses like Astellas, Eisai, and Daiichi Sankyo, the market is controlled by well-known worldwide pharmaceutical giants like Roche, Novartis, and Pfizer. It is challenging for innovative cures or smaller businesses to get into this competitive industry. For already available medicines, established competitors control a sizable portion of the market, so new entrants must provide creative innovation and competitive prices. Larger rivals may outshine smaller ones with their aggressive marketing and advertising campaigns.

Dependency on Traditional Medicine: A sizable segment of the Japanese population, especially the elderly, seeks traditional remedies like Kampo for blood diseases despite breakthroughs in Western medicine. This may cause a delay in current therapeutic diagnosis and therapy. Before utilizing Western medical procedures, cultural beliefs and traditions may emphasize natural therapies and lifestyle changes. Although it is beginning to gain pace, the integration of traditional and contemporary health techniques still has to be developed further before it can be widely accepted.

Exorbitant Cost of Novel and Definitive Therapies: Although gene therapy and targeted medicines have great potential, they are extremely expensive. This limits their wider adoption by placing a financial strain on healthcare systems and patients. Insufficient insurance coverage for specific therapies, particularly those that are still in development, may further limit patient access. The healthcare system places a great priority on cost-effectiveness, which has resulted in drawn-out clearance procedures and more stringent price negotiations for expensive medications.

Healthcare Policies and Regulatory Landscape

Ensuring the safety, effectiveness, and quality of medicines and medical devices in Japan is mostly the responsibility of the Pharmaceuticals and Medical Devices Agency (PMDA). Under the Ministry of Health, Labour, and Welfare, it functions as a separate administrative organization. The examination and assessment of pharmaceutical and medical device marketing authorization applications is one of the PMDA's main responsibilities. When a manufacturer submits scientific and clinical data, the agency thoroughly evaluates it to decide if the product satisfies regulatory requirements. Japan's healthcare system continues to maintain excellent standards in part because of this stringent review procedure. Additionally, PMDA is involved in post-marketing surveillance, which involves keeping an eye on the effectiveness and safety of authorized medicines after they are put on the market. To remain up to date on new safety issues and scientific developments in medicine, the agency works with international regulatory organizations, industry stakeholders, and healthcare experts.

Competitive Landscape

Key Players:

- Takeda

- Pfizer

- Roche

- Bayer

- Novartis

- KM Pharmaceuticals

- Chugai Pharmaceuticals

- Eisai

- Kyowa Kirin

- Daiichi Sankyo

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.