Japan Artificial Intelligence (AI) in Diagnostics Market Analysis

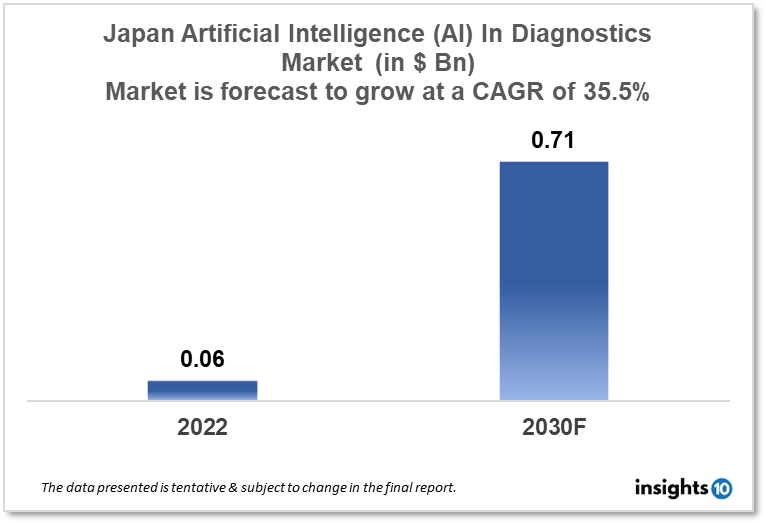

Japan's Artificial Intelligence (AI) in the diagnostics market is projected to grow from $0.06 Bn in 2022 to $0.71 Bn by 2030, registering a CAGR of 35.5% during the forecast period of 2022-30. The market will be driven by supportive government initiatives and a heavy emphasis on technological innovations. The market is segmented by component & by diagnosis. Some of the major players include Fujifilm, Toshiba & NEC Corporation.

Buy Now

Japan Artificial Intelligence (AI) in Diagnostics Market Executive Summary

Japan's Artificial Intelligence (AI) in the diagnostics market is projected to grow from $0.06 Bn in 2022 to $0.71 Bn by 2030, registering a CAGR of 35.5% during the forecast period of 2022-30. In general, health care in Japan is free for Japanese residents, immigrants, and foreigners. In Japan, medical treatment is given through universal health care. This program is open to all nationals and non-Japanese citizens who have been in Japan for more than a year. According to the most recent WHO statistics published in 2020, the number of Coronary Heart Disease fatalities in Japan reached 163,905, accounting for 14.84% of all deaths. In 2021, the number of breast cancer cases among women in Japan was predicted to be the highest, at around 94.4 thousand.

Medical imaging, which includes computed tomography (CT) and magnetic resonance imaging (MRI), is one of the key concentration areas for AI in diagnostics in Japan. AI-based diagnostic systems for radiology and cardiology are being developed by companies such as Fujifilm, Hitachi, and Toshiba, which employ deep learning algorithms to evaluate medical pictures and deliver reliable diagnoses. AI is already being deployed in many hospitals and clinics in Japan. Fujita Health University Hospital in Aichi Prefecture is utilizing AI-based diagnostic tools to assist radiologists in interpreting diagnostic imaging, while the National Cancer Center Hospital in Tokyo is using AI to detect patients at high risk of getting lung cancer.

Market Dynamics

Market Growth Drivers

In December 2022, Japan announced to accelerate the approval process of AI diagnostic imaging equipment and ease regulations on medical AI software. The government created the "Society 5.0" program, which aspires to develop a society that incorporates cutting-edge technology like artificial intelligence (AI) and the Internet of Things (IoT) to improve people's quality of life. In addition, the government has built a new regulatory framework to analyze and license AI-based medical devices, which includes clinical trial criteria and safety. RIKEN Center for Advanced Intelligence Project researchers has created an AI system that can forecast the development of Alzheimer's disease with 94% accuracy. Japan has a well-developed healthcare system and a heavy emphasis on technological innovation, which has been a key driving force in the development and implementation of artificial intelligence (AI) in diagnostics.

Market Restraints

The use of AI in diagnostics in Japan is still in its early phases, and there are challenges to overcome. They include the need for more stringent regulatory restrictions, data format standardization, and AI system interoperability. Furthermore, the high cost of deploying AI-based diagnostic tools, as well as the possible influence on the employment market for healthcare workers, are considerations that may limit AI's use in diagnostics in Japan.

Competitive Landscape

Key Players

- Fujifilm

- Toshiba

- IBM Watson Health

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Google Health

- NEC Corporation (JPN)

- Sysmex (JPN)

- AI Medical Service (JPN)

- Medmain (JPN)

Notable Deals

- February 2023, GE HealthCare to Acquire Caption Health The acquisition adds AI-enabled image guiding to the ultrasound device portfolios of GE HealthCare's $3 billion Ultrasound division

- December 2022, Riverian and Thynk Health Join Together to Combat Lung Cancer Using Powerful AI and Deep Learning Technology

- November 2022, Google Health reached an agreement with iCAD to commercialize mammography AI

Healthcare Policies and Regulatory Landscape

In Japan, the Ministry of Health, Labour, and Welfare (MHLW) is largely responsible for developing healthcare policy and funding for artificial intelligence (AI) diagnostics. The Pharmaceutical and Medical Devices Agency, which assesses the quality, effectiveness, and safety of medicines and medical devices plays an important role in the regulatory approval of AI-based diagnostic devices in Japan.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Artificial Intelligence (AI) in Diagnostics Market Segmentation

- By Component Outlook Type (Revenue, USD Billion):

- Software

- Hardware

- Services

- By Diagnosis Outlook Type (Revenue, USD Billion):

- Cardiology

- Oncology

- Pathology

- Radiology

- Chest and Lung

- Neurology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.