Japan Anemia Therapeutics Market Analysis

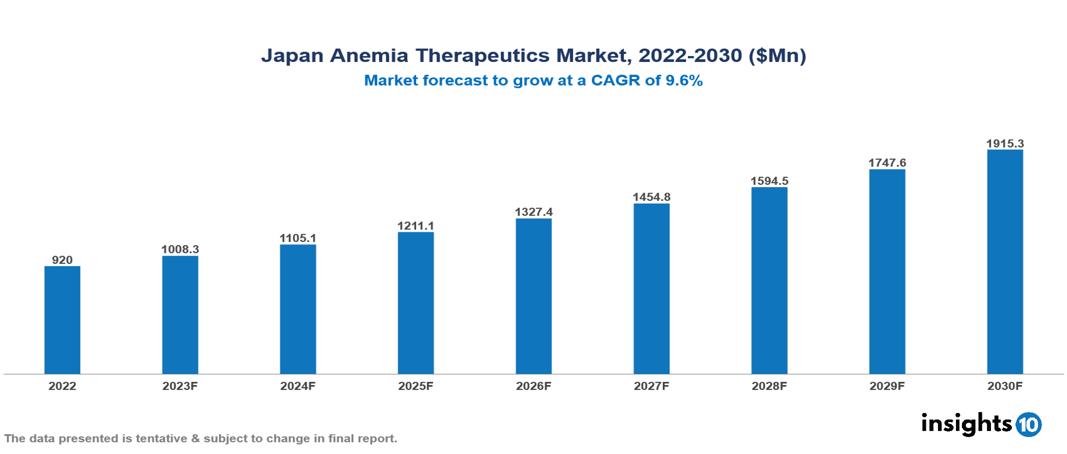

The Japan Anemia Therapeutics Market is anticipated to experience a growth from $0.92 Bn in 2022 to $1.915 Bn by 2030, with a CAGR of 9.6% during the forecast period of 2022-2030. Japan's aging population, at the forefront of global life expectancy, prompts demand for specialized anemia therapies due to increased risks, while the nuanced market segments and supportive societal and economic factors further contribute to strategic considerations and overall growth. The Japan Anemia Therapeutics Market encompasses various players across different segments, including Pfizer, Novartis, Bayer, FibroGen, AstraZeneca, Eisai Co., Chugai Pharmaceuticals, Otsuka, Kyowa Hakko Kirin, Zeria Pharmaceuticals, etc, among various others

Buy Now

Japan Anemia Therapeutics Market Analysis Executive Summary

The Japan Anemia Therapeutics Market is anticipated to experience a growth from $0.92 Bn in 2022 to $1.915 Bn by 2030, with a CAGR of 9.6% during the forecast period of 2022-2030.

Anemia is a disorder caused by a lack of red blood cells, or hemoglobin, in the blood. It manifests as weakness, exhaustion, and shortness of breath. Anemia comes in several forms, the most prevalent of which is Iron-Deficiency Anemia (IDA). Aplastic anemia, sideroblastic anemia, and megaloblastic anemia are a few instances of uncommon anemias. Treatment options for aplastic anemia, a rare and dangerous disorder in which the body stops making enough new blood cells, include drugs, stem cell transplants, and blood transfusions. Supplemental vitamins B9 and B12 can help treat a category of blood disease known as sideroblastic anemia, in which the body is unable to utilize iron to produce hemoglobin. They are also used to treat megaloblastic anemia, which is characterized by the development of big, abnormal red blood cells. Generally, pharmaceuticals, nutritional supplements, and blood transfusions are treatment options for anemia. Although, certain types may even require stem cell transplants,.

Japan has a relatively high incidence of anemia when compared to other developed nations such as the US (12%) and Australia (17%). It is most common, particularly in women (22 % of non-pregnant women aged between 15 to 49). Iron deficiency is the most common cause, attributed to low dietary iron intake and other factors like menstrual bleeding, and pregnancy. Japan's aging population, at the forefront of global life expectancy, prompts a demand for specialized anemia therapies due to increased risks, while the nuanced market segments and supportive societal and economic factors further contribute to strategic considerations and overall growth.

With Ferro-Grad C and Venofer for CKD-related anemia, Pfizer dominates the oral iron sector and commands a significant portion of the market. Eisai is a major player in the home market, specializing in the treatment of IDA. Even though they currently hold smaller market shares, other up-and-coming companies like Mitsubishi Tanabe and Peptidream may grow more quickly because they are concentrating on promising markets like HIF-PHI inhibitors for CKD-related anemia and cutting-edge peptide-based therapies for uncommon and treatment-resistant anemias, respectively.

Market Dynamics

Market Growth Drivers

Demographic Shifts: Japan, boasting the highest global life expectancy, confronts the challenges of an aging population at greater risk of anemia-related chronic conditions such as chronic kidney disease (CKD) and cancer. This demographic surge propels the need for specialized remedies beyond conventional iron supplements. Furthermore, the prevalence of iron deficiency anemia (IDA) within this group is influenced by factors such as menstrual bleeding, cultural emphasis on thinness, and potentially insufficient dietary iron intake, creating a substantial cohort of patients seeking effective solutions.

Market Nuances: The market is categorized by therapy type (oral iron, injectables, etc.), therapy area (CKD-related, cancer-related, etc.), and distribution channel (hospitals, pharmacies). Each sector exhibits unique growth drivers and dynamics, necessitating an in-depth comprehension of targeted strategic approaches. New entrants introducing innovative methods like peptide-based therapies for rare anemias have the potential to disrupt the market and pose challenges to established players. It is imperative for market participants to stay informed about such advancements.

Societal and Economic Forces: Increasing awareness of the adverse impact of anemia on daily life and productivity fuels the demand for therapies that enhance well-being and alleviate the burden of disease. This resonates with both patients and healthcare providers. Supportive factors such as public health initiatives promoting anemia screening programs and favorable reimbursement policies create an environment conducive to market growth. This, in turn, stimulates research and development efforts and enhances patient access to treatments.

Market Restraints

Cost-restraints: The single-payer healthcare system in Japan places a strong emphasis on cost-effectiveness, which results in strict pricing limitations and drawn-out reimbursement procedures, especially for pricey and innovative medicines. This may limit patient access to cutting-edge medications or deter pharmaceutical companies from entering the market. The cost and profitability of newer, branded medicines are under pressure due to the increasing availability of inexpensive generic iron supplements and EPO for certain applications. This may impede market expansion and encourage businesses to concentrate on specialized markets with lower levels of rivalry.

Reduced access: Patients' access to anemia therapies is restricted by the strong dependence on hospital dispensing channels, particularly for those living in rural regions or with restricted mobility. This may make healthcare inequities worse and hinder prompt action.

Competition: A few well-established businesses with well-established distribution networks and brands control the majority of the market. This can make it challenging for up-and-coming competitors with novel medicines to establish themselves and get traction.

Healthcare Policies and Regulatory Landscape

The national health insurance system in Japan is statutory. The main sources of funding for it are individual contributions and taxes. Enrollment in either an employment-based or a residence-based health insurance plan is required. Prescription medications and hospital, general, specialized, and mental health care are included in the benefits package. Laws mandate that both national and local governments maintain an effective system for delivering high-quality healthcare. The government agency in charge of monitoring post-market safety, compensating for unfavorable health consequences, and evaluating medications and medical devices is called the Pharmaceuticals and Medical Devices Agency (PMDA). As the body tasked with conducting a thorough evaluation of these drugs' efficacy and safety, PMDA is essential to the regulatory clearance of their sale in Japan. The agency's duties are expanded to include overseeing clinical trials in order to maintain regulatory compliance and ethical standards. One important component of PMDA's duties is post-marketing surveillance, which entails always keeping an eye out for any new safety issues with authorized goods.

Competitive Landscape

Key Players:

- Pfizer

- Novartis

- Bayer

- FibroGen

- AstraZeneca

- Eisai Co.

- Chugai Pharmaceuticals

- Otsuka

- Kyowa Hakko Kirin

- Zeria Pharmaceutical

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.