Japan Allergy Therapeutics Market Analysis

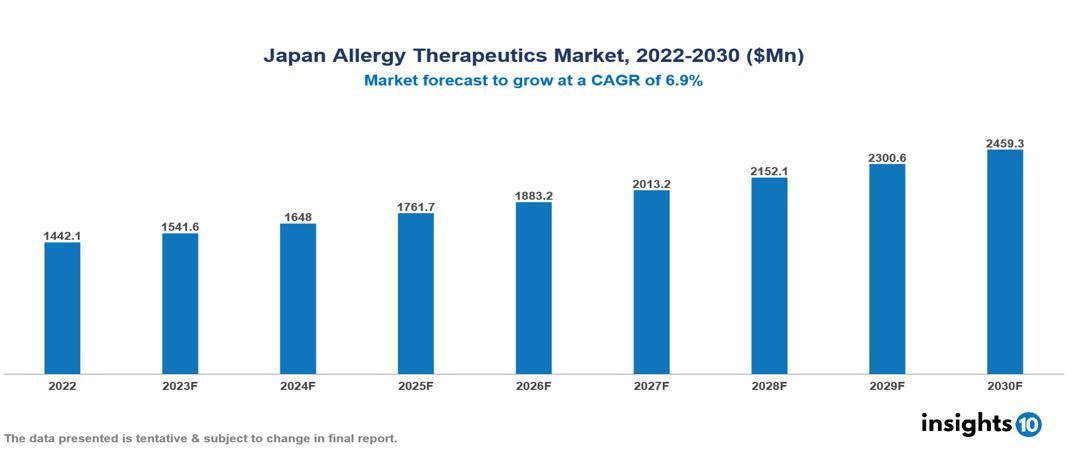

Japan Allergy Therapeutics Market was valued at $1442 Mn in 2022 and is estimated to reach $2459 Mn in 2030, exhibiting a CAGR of 6.9% during the forecast period. The increased incidence of allergic illnesses and associated health issues is driving the need for allergy therapy medications. The major pharmaceutical players that are presently functioning in the market are Eisai Co., Takeda Pharmaceutical Company Limited, Novartis AG, Sanofi, GlaxoSmithKline (GSK), AstraZeneca, Mitsubishi Tanabe Pharma Corporation, Shionogi & Co., Kowa Pharmaceutical Co., and Daiichi Sankyo Co.

Buy Now

Japan Allergy Therapeutics Market Executive Summary

Japan Allergy Therapeutics Market was valued at $1442 Mn in 2022 and is estimated to reach $2459 Mn in 2030, exhibiting a CAGR of 6.9% during the forecast period.

Allergies are immune responses that are periodically triggered by environmental chemicals known as allergens. Dust mites, pollen, mildew, and specific foods like milk, eggs, soy, and almonds are examples of common allergies. Allergy reactions can manifest in a variety of ways, ranging from mild symptoms like runny nose and itchy eyes to more serious ones like anaphylaxis, which can cause unconsciousness and breathing problems. A few potential treatment options include immunotherapy, avoiding allergens, and prescription medications such antihistamines and nasal corticosteroids.

Significantly, 62.2% of Japanese people suffer from an allergic illness. Approximately 47.4% of the population suffers from allergic rhinitis (AR), a condition that is more common in males and children. The symptoms of allergic rhinitis include runny nose, itchy eyes, congestion, and sneezing. About 14.7% of people have asthma, which is more common in boys and children. The illness causes coughing, chest tightness, wheezing, and shortness of breath. About 15.6% of people have atopic dermatitis, with prevalence greater in women and adults. The condition is characterized by symptoms such as dry, itchy, and inflammatory skin.

An innovative anti-IL-31 receptor antibody called MT8856 is being developed by Mitsubishi Tanabe Pharma Corporation with the goal of treating severe atopic dermatitis and persistent spontaneous urticaria. In order to avoid peanut allergies, Chugai Pharmaceutical Co., Ltd. is leading the way in research on nimotuzumab, a humanized anti-FcεRI monoclonal antibody. Additionally, Kyowa Kirin Co., Ltd. is advancing clinical studies for KSK39251, a small-molecule oral JAK inhibitor, as a potential treatment for severe atopic dermatitis.

Market Dynamics

Market Growth Drivers

Prevalence of Allergies: The rising incidence of respiratory allergies and other allergic illnesses, such as hay fever, is creating a need for effective allergy therapy drugs. Urbanization, changes in lifestyle, and environmental factors may all contribute to an increase in the prevalence of allergies.

Advancements in Allergen Immunotherapy (AIT): Sublingual immunotherapy (SLIT) patches and pills are examples of innovative replacements that have been developed, and they may provide longer-lasting relief with fewer side effects. This creates new business opportunities for these cutting-edge treatments.

Increased Awareness and Diagnosis: More access to healthcare, public health campaigns, and educational programs result in earlier and more accurate allergy diagnoses, which encourage people to seek treatment.

Market Restraints

High Cost of Treatment: The cost of allergy treatment can be very prohibitive for some people, particularly when it comes to AIT procedures like immunotherapy injections and SLIT tablets. The high price of allergy medications may prevent them from being widely used and made accessible, which would limit their market penetration.

Treatment Compliance and Adherence: Consistent commitment to long-term regimens is crucial for the efficacy of allergy treatments, especially immunotherapy therapies. Obstacles including exorbitant expenses, complexity, or unfavourable outcomes resulting in insufficient patient compliance possess the capacity to reduce therapy effectiveness and hinder the market's growth.

Cultural and Behavioural Factors: Market penetration may be hampered by certain groups preference for traditional medications or home cures over contemporary treatments. Decreased public awareness could make it harder to identify and comprehend allergy symptoms, which could cause a delay in diagnosis and treatment. Despite these drawbacks, using non-pharmaceutical methods like air filters to lower allergens and/or get rid of allergy symptoms is growing in popularity.

Healthcare Policies and Regulatory Landscape

The primary regulatory body in charge of assessing and approving allergy treatment medications and guaranteeing compliance with strict safety and efficacy standards is the Pharmaceuticals and Medical Devices Agency (PMDA). Collaborating with the PMDA, the Ministry of Health, Labour and Welfare (MHLW) influences recommendations pertaining to drug safety and accessibility and helps formulate broad healthcare policy. In the areas of allergy research, treatment recommendations, and more general healthcare advocacy, professional associations like the Japan Medical Association (JMA) and the Japan Society of Allergology (JSA) may be involved. Reimbursement decisions are influenced by the National Health Insurance (NHI) System, which is managed by local governments. This has an effect on how affordable and accessible allergy treatments are for patients throughout Japan.

Competitive Landscape

Key Players

- Eisai Co.

- Takeda Pharmaceutical Company Limited

- Novartis AG

- Sanofi

- GlaxoSmithKline (GSK)

- AstraZeneca

- Mitsubishi Tanabe Pharma Corporation

- Shionogi & Co.,

- Kowa Pharmaceutical Co.

- Daiichi Sankyo Co.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Japan Allergy Therapeutics Market Segmentation

By Treatment Type

- Anti-allergy drugs

- Immunotherapy

By Type of Allergy

- Eye allergy

- Asthma

- Skin allergy

- Food allergies

- Rhinitis

- Other allergy types

By Route of Administration

- Oral

- Inhalers

- Intranasal

- Other routes of administration

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.