Japan Acne Therapeutics Market Analysis

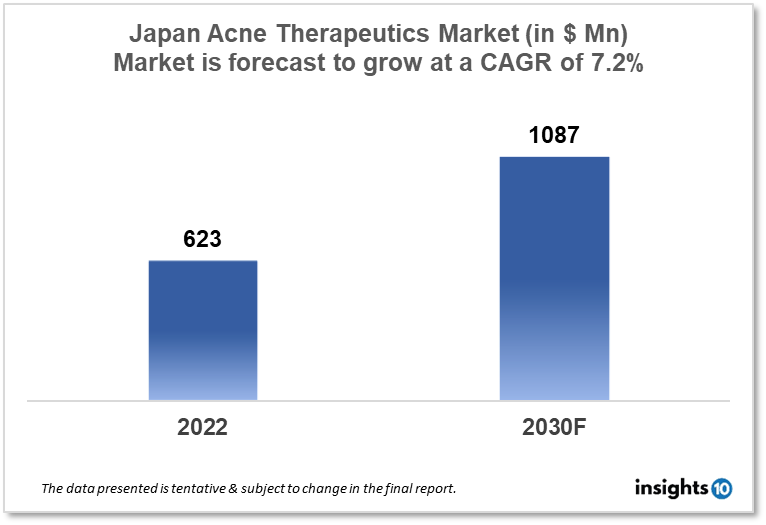

The Japan acne therapeutics market size was valued at $623 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030 and will reach $1,087 Mn in 2030. The main factors contributing to this market growth are the rising prevalence of acne and the demand for innovative treatment options in Japan. The market is segmented by treatment, route of administration, age group, and by distribution channel. Otsuka Pharmaceuticals, Torii Pharmaceuticals, and Teva Pharmaceuticals are key competitors in Japan acne therapeutics market.

Buy Now

Japan Acne Therapeutics Market Executive Analysis

The Japan acne therapeutics market size is at around $623 Mn in 2022 and is projected to reach $1,087 Mn in 2030, exhibiting a CAGR of 7.2% during the forecast period. Estimated healthcare costs paid to medical institutions in fiscal 2022 rose to a record $0.34 Tn, up $0.015 Tn (or 4.6%) from the previous year. The cost of hospitalization climbed by 2.8% to $0.13 Tn, while the cost of outpatient services, home visits, and other non-hospitalized medical care increased by 7.5% to $0.12 Tn. To reach $2683.61, average medical expenses per capita climbed by $129.61 annually. The median expenditure for those under 75 was $1791.62, but for those 75 and over, it quadrupled to $7158.84. Despite the fact that numerous health measures rank Japan as one of the world's most prosperous nations, concerns over growing regional variation are on the rise. Managing the growth of medical costs to a level that people can endure is essential as the nation transitions to a super-ageing society. With the country's transition to a super-ageing society, the complexity of variance in health outcomes, its causes, the effectiveness of regional health systems, and the results of socioeconomic determinants of health are growing.

Acne vulgaris is a chronic skin condition in which the pilosebaceous gland system is affected by a complicated interplay between faulty lipid metabolism, abnormal keratosis, and bacterial proliferation. Acne begins as comedones, which are caused by aberrant keratinocyte activation and proliferation as well as swollen hair follicles. More than 90% of Japanese people experience acne vulgaris at some point in their lives, and it is frequently seen in both adolescent males and females. Adolescents with acne may experience a negative quality of life regarding their emotional well-being due to the increased emphasis on appearance. In Japan, the traditional approach to treating acne relied on using antimicrobials both topically and systemically to treat inflammatory acne lesions. The progress of acne treatment was significantly aided by the 2008 release of adapalene, the first come-done treatment to be reimbursed by health insurance in Japan.

Moreover, the introduction of benzoyl peroxide (BPO), at the request of the Japanese Dermatological Association (JDA), allows for the prevention of rises in Propionibacterium acnes that are resistant to medication. The Japanese Ministry of Health and Welfare has recognized the traditional medicine Keigairengyoto (KRT) in the form of extracted granules for ethical use, and it is frequently administered to patients with inflammatory illnesses such as acne vulgaris, empyema, and rhinitis. According to a recent study, KRT improved bacterial clearance in innate immune cells, which in turn prevented the development of bacteria-induced dermatitis in an experimental model.

Market Dynamics

Market Growth Drivers

The Japan acne therapeutics market is being driven by the rising prevalence of acne among the Japanese population as well as the need for innovative acne treatments like phototherapy and nanotherapeutics. Furthermore, the Japan acne therapeutics market is expanding as a result of the rising stress levels among adults and adolescents who experience acne-related facial scarring.

Market Restraints

The Japan acne therapeutics market is being restricted by safety concerns related to the use of anti-acne treatments, including skin dryness and irritations as well as pregnancy risks in the case of oral therapeutic interventions. Moreover, the majority of the population in Japan relies on conventional therapeutic approaches for acne treatments, which can impact on the demand and sales of modern therapies and medications.

Competitive Landscape

Key Players

- Maruho Pharmaceuticals (JPN)

- Rohto Pharmaceuticals (JPN)

- Otsuka Pharmaceuticals (JPN)

- Torii Pharmaceuticals (JPN)

- Teva Pharmaceuticals

- Candela

- Almirall

- Galderma

Healthcare Policies and Regulatory Landscape

In order to ensure the efficacy and safety of the products, the Pharmaceutical and Food Safety Bureau in Japan gathers and disseminates information on the rules governing the manufacturing and sale of pharmaceuticals, quasi-drugs, cosmetics, and medical devices as well as information on adverse reactions. It is mandated that pharmaceutical corporations report to the government, the information they have gathered about significant adverse drug responses. The Bureau participates in the WHO International Medication Monitoring Program and strives to communicate with other nations about information pertaining to adverse drug reactions.

Acne treatment is covered by Japan's national health insurance system, which also covers a wide range of other medical procedures and services. However, according to the type of treatment and the person's health insurance plan, the particular coverage guidelines for acne treatment may differ. The majority of insurance policies will often pay for at least a percentage of prescription drugs and topical treatments, and some may also pay for more invasive procedures like laser therapy or surgery.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.