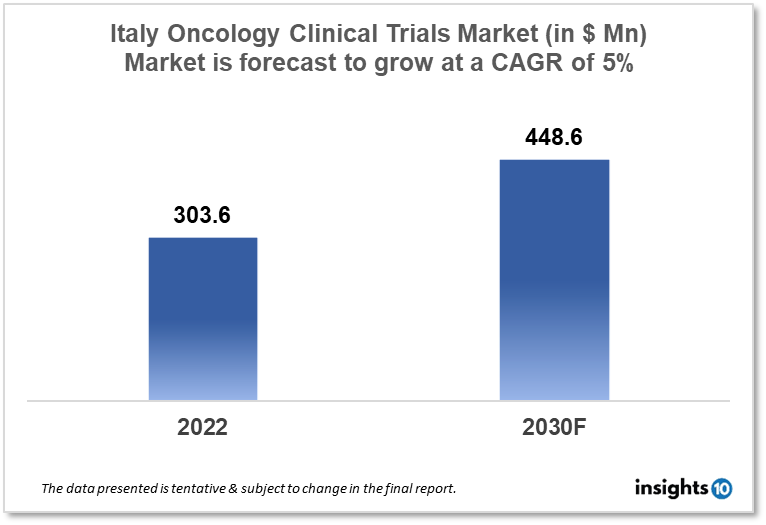

Italy Oncology Clinical Trials Market Analysis

Italy's oncology clinical trials market is projected to grow from $303.6 Mn in 2022 to $448.6 Mn by 2030, registering a CAGR of 5% during the forecast period of 2022-30. The market will be driven by the rising incidence of cancer in Italy & well-established research infrastructure and regulatory environment. The market is segmented by phase, by study design & by indication. Some of the major players include Pfizer Inc., Roche Holding AG & MolMed S.p.A.

Buy Now

Italy Oncology Clinical Trials Market Executive Summary

Italy's oncology clinical trials market is projected to grow from $303.6 Mn in 2022 to $448.6 Mn by 2030, registering a CAGR of 5% during the forecast period of 2022-30. The Italian public health system is regarded as one of the most advanced worldwide, with almost all patient expenditures covered. The system emphasizes both preventive and curative treatment. According to research on the functioning of the Italian healthcare system, Emilia Romagna had the highest grade in healthcare provision in 2022. According to Globocan 2020, the total incidence of all cancer was found to be 415 269. Out of which 13.3% were breast cancer cases, 11.7% were colorectum cases & 10.1% were lung cancer cases. Prostate cancer was the most common kind of cancer in males, with over 36 thousand new cases expected in 2020, followed by lung and colorectal cancer. Breast cancer was the most frequent kind of cancer in women, accounting for about 55 thousand cases in 2020, followed by colorectal and lung cancer.

According to the EU Clinical Trials Registry, about 4,000 current cancer clinical studies are underway in Italy, accounting for around 30% of all ongoing clinical trials in the nation. These studies include chemotherapy, targeted treatments, immunotherapies, and various cancer kinds and treatment techniques. In Italy, both public and private organizations, such as hospitals, university medical centers, research institutes, and commercial firms, undertake oncology clinical trials. The major institutes in this discipline are;

- National Cancer Institute, Milan

- European Institute of Oncology, Milan

- Regina Elena National Cancer Institute, Rome

Market Dynamics

Market Growth Drivers

The Italian Association of Medical Oncology (AIOM) is a member of the European Organisation for Research and Treatment of Cancer (EORTC) and engages in several of its clinical trials. These partnerships have also aided Italy's status as a leader in the worldwide cancer research environment. With several world-renowned institutes and academic centers participating in cancer research, Italy has a well-developed research infrastructure. This provides a solid framework for the government to undertake clinical trials. The Italian government has shown a significant commitment to research and development in the healthcare industry, especially cancer. This includes clinical trial financing, infrastructural development, and tax exemptions for enterprises participating in R&D.

Market Restraints

The regulatory framework for clinical trials in Italy is extensive, which might be a barrier to entry for certain businesses. Clinical trial permission may be a time-consuming and expensive procedure, thus some organizations may choose to conduct studies in nations with more simplified regulatory systems. Despite the Italian government's commitment to promoting R&D in the healthcare industry, financing for clinical trials remains low. This may make it challenging for academics and firms to undertake clinical trials.

Competitive Landscape

Key Players

- Pfizer Inc.

- Roche Holding AG

- Novartis AG

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- AstraZeneca PLC

- Sanofi S.A.

- Moleculin Biotech

- Menarini Group (ITA)

- Chiesi Farmaceutici S.p.A (ITA)

- Angelini Pharma (ITA)

- Dompé farmaceutici S.p.A. (ITA)

- MolMed S.p.A. (ITA)

Notable Deals

- December 2022, Pluvicto®, developed by Novartis, was approved by the European Commission as the first targeted radioligand therapy for the treatment of progressing PSMA-positive metastatic castration-resistant prostate cancer

- December 2022, Moleculin Biotech has received approval from the Agenzia Italiana del Farmaco (AIFA, the Italian Medicines Agency's competent authority) and the Istituto Superiore di Sanità (ISS, the Italian National Institute of Health) to begin its Phase I/II clinical trial of Annamycin plus Cytarabine (Ara-C) to treat acute myeloid leukaemia (AML)

Healthcare Policies and Regulatory Landscape

Several international cooperation for cancer clinical trials includes Italian universities. The Italian Association of Medical Oncology (AIOM), is a member of the European Organisation for Research and Treatment of Cancer (EORTC) and takes part in several of its clinical trials. The regulatory framework for cancer clinical trials in Italy is comparable to that of other European nations. The Italian Medicines Agency (AIFA) is in charge of approving clinical trials and verifying that they adhere to ethical and scientific requirements in Italy. In general, the regulatory procedure for clinical study authorization is swift and simplified.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Oncology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.