Italy Hypertrophic Cardiomyopathy Therapeutics Market Analysis

Italy hypertrophic cardiomyopathy therapeutics market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 ? 2030. In addition to heart diseases, the market for therapies for hypertrophic cardiomyopathy is primarily driven by rises in the frequency of obesity and sedentary behaviour. Sanofi S.A., Astra Zeneca Plc, Pfizer Inc, ADVANZ PHARMA Corp (Concordia Healthcare Corp), Gilead Sciences Inc, Merck & Co., Inc, Teva Pharmaceutical Industries Ltd, Novartis AG, Mylan N.V., and Bayer AG are a few of the businesses now dominating the global hypertrophic cardiomyopathy therapeutics market.

Buy Now

Italy Hypertrophic Cardiomyopathy Therapeutics Market Analysis Summary

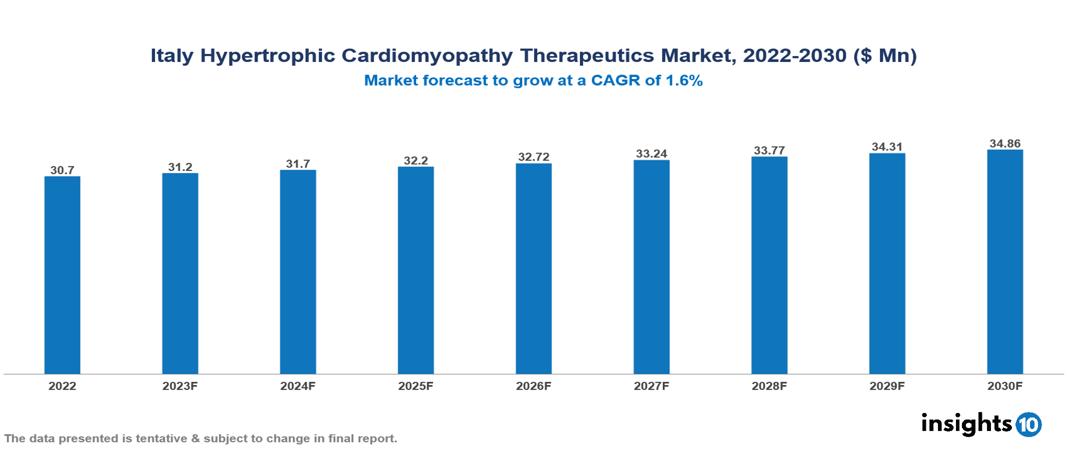

Italy Hypertrophic Cardiomyopathy Therapeutics Market is valued at around $30.7 Mn in 2022 and is projected to reach $34.86 Mn by 2030, exhibiting a CAGR of 1.6% during the forecast period 2023-2030.

A mutation in the sarcomere protein gene, which codes for the heart's contractile system, results in the genetic heart muscle disease hypertrophic cardiomyopathy (HCM), which is characterized by an increase in left ventricular wall thickness that results in left ventricular outflow obstruction, diastolic dysfunction, myocardial ischemia, and mitral regurgitation. There are several symptoms of hypertrophic cardiomyopathy, including fatigue, dyspnea, chest discomfort, palpitations, and syncope.

The global incidence of obesity and the overall sedentary lifestyle of the population are the main drivers of the sector. For instance, the World Health Organization (WHO) reported in June 2021 that over the previous 20 years, the rate of obesity has tripled globally. Additionally, 13 percent of individuals worldwide and 39 percent of adults are overweight or obese, according to the results of the World Population Review survey "Obesity Rates by Country 2022. Each of the major organ systems is significantly impacted by Covid-19. As the number of Covid-19 cases rose in the early stages of the pandemic, all hospitals worldwide canceled appointments, and the target population stayed indoors out of dread of the virus. The risk of SARS-CoV-2-related death is increased, nevertheless, in the presence of underlying cardiac disease, particularly heart failure (HF). As a result, the risk of hypertrophic cardiomyopathy (HCM) increased during the pandemic. Thus, modern pharmaceuticals are increasingly being researched and developed to treat HCM patients who have Covid-19 infection. Sanofi S.A., Astra Zeneca Plc, Pfizer Inc, ADVANZ PHARMA Corp (Concordia Healthcare Corp), Gilead Sciences Inc, Merck & Co., Inc, Teva Pharmaceutical Industries Ltd, Novartis AG, Mylan N.V., and Bayer AG are a few of the businesses now dominating the global hypertrophic cardiomyopathy therapeutics market.

Market Dynamics

Market Drivers

The global incidence of obesity and the overall sedentary lifestyle of the population are the main factors driving the industry. For instance, obesity has tripled over the previous 20 years and has increased globally, according to data published by the World Health Organization (WHO) in June 2021. In addition, the results of the World Population Review's survey "Obesity Rates by Country 2022" show that 39% of adults worldwide are overweight and 13% of individuals worldwide are obese. In patients with hypertrophic cardiomyopathy, being overweight was an independent predictor of major adverse cardiovascular and cerebral events (MACCE), according to the October 2021 paper "Clinical Significance of Overweight in Patients with Hypertrophic Cardiomyopathy." Rehospitalization for heart failure (HF) was more common in overweight patients.

Market Restraints

The high cost of effective therapies, their difficulty in getting them, and an increase in product recalls are all predicted to hinder the growth of the market's revenue. During the foreseeable term, there will undoubtedly be difficulties in the market for treating hypertrophic cardiomyopathy. Furthermore, it is anticipated that a lack of understanding and a decline in diagnosis could obstruct market revenue growth over the course of the anticipated year.

Key players

Novartis Pfizer Sanofi Gilead Sciences GlaxoSmithKline Janssen Pharmaceuticals Merck & Co. AstraZeneca AbbVie Celgene1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Italy Hypertrophic Cardiomyopathy Therapeutics Market Segmentation

By Drugs:

- Anticoagulants

- Antiarrhythmic Agents

- Beta Adrenergic Blocking Agents

- Calcium Channel Blockers

- Others

By Devices:

- Pacemakers

- Defibrillators

- Others

By End User:

- Clinics

- Hospitals

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.