Italy Hemophilia A Drugs Market Analysis

Italy Hemophilia A Drugs Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The market for Hemophilia A is rising due to increase in incidence and prevalence of disease, increase in research and development activities, patent advocacy programmes, stratergic collaborations and partnerships. A lack of or failure with regard to clotting factor VIII characterises the rare inherited bleeding condition known as haemophilia A. It is the most prevalent form of haemophilia and primarily affects men, though it can also afflict women who carry the gene mutation. Hemophilia A market development goes beyond traditional markets, with a stronger emphasis on increasing access to care in developing markets. In areas where access to specialised care and therapies may be restricted, efforts are being made to improve diagnosis, treatment infrastructure, and pricing. Some of the notable companies operating in the Hemophilia A Drugs market include BioMarin Pharmaceutical Inc, Bayer AG, Pfizer Inc., Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., Shire (now part of Takeda Pharmaceutical Company Limited), CSL Behring LLC, Sanofi S.A., Grifols S.A. and Octapharma AG.

Buy Now

Italy Hemophilia A Drugs Market Analysis Summary

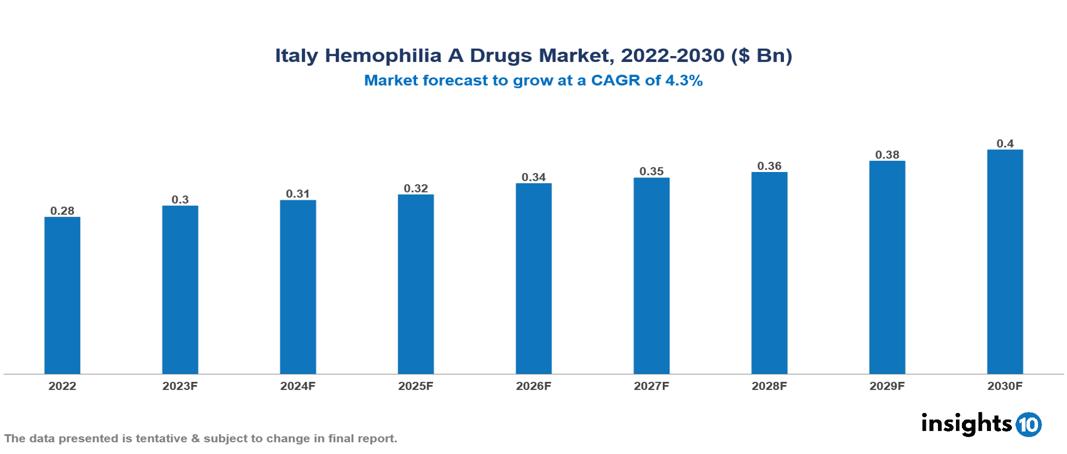

Italy Hemophilia A Drugs Market is valued at around $0.28 Bn in 2022 and is projected to reach $0.4 Bn by 2030, exhibiting a CAGR of 4.3% during the forecast period 2023-2030.

Due to a deficiency in factor VIII, haemophilia A is a rare genetic illness that affects a person's blood's capacity to clot. About one in 5,000 male newborns, each year are affected by haemophilia A, whereas females are less frequently affected. A hereditary mutation in the F8 gene—which codes for the production of clotting factor VIII—leads to haemophilia A. The mutation causes functional factor VIII to be produced insufficiently or not at all, which impairs blood clotting and prolongs bleeding. Bleeding episodes, which can include life-threatening haemorrhages, acute and persistent pain, permanent joint injury with a disability, and adverse effects on quality of life, can occur in people with haemophilia. Immune tolerance induction (ITI) therapy, replacement therapy and gene therapy are the main therapies involved. Gene therapy is projected to grow largest in the forecast period. Recombinant Factor VIII Products like Advate (Antihemophilic Factor [Recombinant]), Kogenate FS (Antihemophilic Factor Recombinant), Xyntha (Antihemophilic Factor Recombinant), Novoeight (Turoctocog Alfa) and Plasma-Derived Factor VIII Concentrates like Humate-P (Antihemophilic Factor/von Willebrand Factor Complex), Extended Half-Life Factor VIII Products Eloctate (Antihemophilic Factor [Recombinant], Fc Fusion Protein)

Sanofi S.A., Grifols S.A., Octapharma AG, BioMarin Pharmaceutical Inc., Bayer AG, Pfizer Inc., Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., Shire (now a subsidiary of Takeda Pharmaceutical Company Limited), CSL Behring LLC, Novo Nordisk A/S, and Shire are a few of the well-known companies in the Hemophilia A Drugs market.

Advate (Antihemophilic Factor [Recombinant]), Kogenate FS (Antihemophilic Factor [Recombinant]), and Eloctate (Antihemophilic Factor [Recombinant], Fc Fusion Protein) hold the highest market share in treatment.

Market Dynamics

Market Drivers

One of the main factors favourably affecting the market is the rising incidence of genetic disorders among people worldwide and the rising number of hemophilic patients. In addition, the increasing prevalence of preventative treatments to treat Hemophilia A and the increasing incidence of disease detection are providing lucrative growth prospects to top market players. In addition, government organizations in many nations are running a number of initiatives to raise awareness of the advantages of early diagnosis and implementing the right policies to support the early screening of newborns, which is encouraging the market. Additionally, because there are few treatment choices available, they are sponsoring R&D initiatives more and more. A positive market outlook is provided by the fact that top industry players are concentrating on introducing technologically cutting-edge diagnostic tools and therapies to improve the efficacy and accuracy of Hemophilia A treatment. The market is also expected to be driven by significant expenditures in the global expansion of specialist Hemophilia A treatment centres (HTCs).

Development in Hemophilia A Drugs Market Analysis

The US Food and Drug Administration (FDA) authorised Sanofi's ALTUVIIIO on February 22, 2023. The FDA has approved ALTUVIIIOTM, a novel class of factor VIII therapy for haemophilia A that provides considerable bleed protection, as a once-weekly regimen.

In individuals with severe haemophilia A, a phase III clinical study is being conducted to assess the safety and efficacy of valoctocogene roxaparvovec combined with preventive corticosteroids.

By 2028, Pfizer expects to have completed the Phase 3, Open-Label, Single-Arm Study to Assess the Efficacy and Safety of Recombinant AAV2/6 Human Factor VIII Gene Therapy in Adult Male Participants with Moderately Severe to Severe Hemophilia A(FVIII:C1 percent).

Key players

Genentech Pfizer Sanofi Roche Novo Nordisk Shire CSL Behring Octapharma Baxter International Kedrion Biopharma1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Italy Hemophilia A Drugs Market

By Treatment

- Prophylaxis

- On-demand

By Therapy

- Recombinant

- Plasma-derived

- Hormonal

- Extended half-life

- Replacement

- Gene therapy

By Drugs

- Desmopressin

- Octocogalfa

- Nonacogalfa

By End User

- Hospital

- Clinic

- Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.