Italy Electronic Health Records Market Analysis

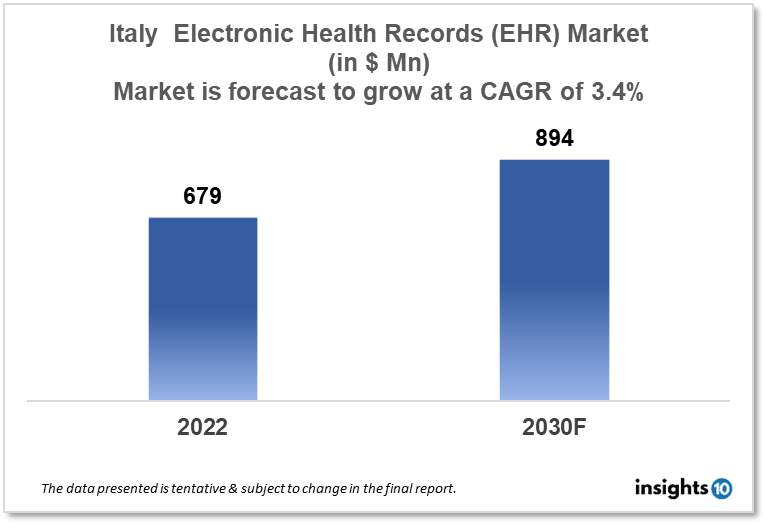

The Italy Electronic Health Record (EHR) market size was valued at $679 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 3.4% from 2022 to 2030 and will reach $894 Mn in 2030. The market is segmented by product, application, and end user. The Italy EHR market will grow due to government initiatives to promote the adoption of EHRs. The key market players are Sistemi, GIMA, SOFTWIN, Siemens Healthineers, and others.

Buy Now

Italy Electronic Health Record (EHR) Market Executive Summary

The Italy Electronic Health Record market size was valued at $679 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 3.4% from 2022 to 2030 and will reach $894 Mn in 2030. According to data from the Organisation for Economic Co-operation and Development (OECD), in 2020 Italy's healthcare expenditure as a percentage of gross domestic product (GDP) was around 8.2%, which is lower than the average for the European Union (EU) of 8.9%. In terms of per capita spending, Italy's healthcare expenditure was around $3,973 in 2020, which is also lower than the EU average of $5,168.

Digital healthcare spending in Italy refers to the money invested in technology-enabled healthcare solutions such as electronic health records (EHRs), telemedicine, mHealth, and other digital health tools. The Italian government has invested in digital healthcare solutions in order to improve the quality of care and reduce the costs of the national health system. The government's plan for the digitalization of healthcare services is expected to drive the market for digital health solutions in Italy in the coming years.

The EHR market is expected to account for the largest share of the digital healthcare market in Italy during the forecast period, due to rising chronic disease rates, aging populations, and government. Healthcare providers can access and share electronic health records (EHRs), which are computerized representations of a patient's medical history and information, to improve the quality of care and treatment.

Market Dynamics

Market Growth Drivers

The Italian government has implemented several initiatives to promote the adoption of EHRs in the healthcare sector. This includes the creation of a national health information system, which aims to improve the efficiency and quality of healthcare delivery through the use of EHRs.

Moreover, the growing prevalence of chronic diseases such as diabetes, heart disease, and cancer is driving the need for more efficient and effective healthcare delivery, which can be achieved through the use of EHRs. Additionally, the ongoing developments in healthcare technology are making it easier and more cost-effective to implement EHRs, which is driving the growth of the market.

Furthermore, as more healthcare providers and patients become aware of the benefits of EHRs, such as improved patient care, more efficient healthcare delivery, and better population health management, the demand for EHRs is increasing. With the increasing amount of patient data being stored electronically, there is a growing need for secure and reliable EHR systems to protect this sensitive information.

Market Restraints

One of the major challenges facing the EHR market in Italy is the lack of standardization and interoperability among different systems, which can make it difficult for healthcare providers to share patient information and coordinate care.

High cost of implementation and maintenance: The cost of implementing and maintaining EHR systems can be high, which can be a barrier for some healthcare providers, particularly smaller clinics and hospitals. Moreover, there may be resistance among healthcare providers to adopt new technology, particularly if they are not familiar with EHRs and the benefits they can provide. As with any technology that stores and processes sensitive patient information, there are concerns about data privacy and security with EHRs.

Furthermore, some rural areas may have limited IT infrastructure, lack of trained personnel to handle and manage EHRs can also be a constraint, this lack of trained personnel can slow down the adoption and implementation process.

Competitive Landscape

Key Players

- Sistemi (ITA)

- GIMA (ITA)

- SOFTWIN (ITA)

- Siemens Healthineers

- MEDITECH

- NextGen Healthcare

- Epic Systems

- Siemens Healthineers

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

In Italy, electronic health records (EHRs) are regulated by the Ministry of Health and the National Institute of Health. The Italian government has implemented several initiatives to promote the adoption of EHRs in the healthcare sector, including the creation of a national health information system and the creation of a national system of digital prescriptions. The government also incentivizes the use of EHRs by allowing the reimbursement of certain medical expenses to those who use them.

In order to ensure the security and privacy of patient data, the Ministry of Health has established strict guidelines for the handling and storage of EHRs. This includes requirements for data encryption, regular security audits of EHR systems, and the need for healthcare providers to obtain patient consent for the use of EHRs. In addition, healthcare providers must comply with the Italian Data Protection Act (Codice in materia di protezione dei dati personali), which regulates the use of EHRs.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Electronic Health Records Market Segmentation

By Product (Revenue, USD Billion):

Web-based and cloud-based software is more affordable since it saves on additional costs like license fees, regular upgrades, and device upkeep. Additionally, it reduces the need for IT workers because SaaS providers help with software installation, configuration, testing, operation, and upgrades. The cost-effectiveness of cloud-based EHR systems in small healthcare organizations will therefore fuel developments as well as the expansion of the category. MHealth services

- Web/Cloud-based EHR software

- On-premise EHR software

By Application Type (Revenue, USD Billion):

Large amounts of patient health data may be stored and processed by EHRs, which aids doctors in automating both financial and operational operations with rapid and simple access. Therefore, integrated EHR and practice management software navigates all tasks, making it easier for front-line healthcare providers to do their jobs, and will therefore drive the segment's revenue during the anticipated time period.

- E-prescription

- Practice management

- Referral management

- Patient management

- Population health management

By End User (Revenue, USD Billion):

By 2027, the category of ambulatory surgical centres is expected to rise at a 7.1% annual rate. The acceptance of EHR in these facilities will be fueled by ambulatory surgical centres' growing preference for digital technologies to efficiently manage workflow. These are outpatient facilities offering planned surgeries and same-day surgical services.

- Hospitals

- Specialty centers

- Clinics

- Ambulatory surgical centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.