Italy Diabetes Drugs Market Analysis

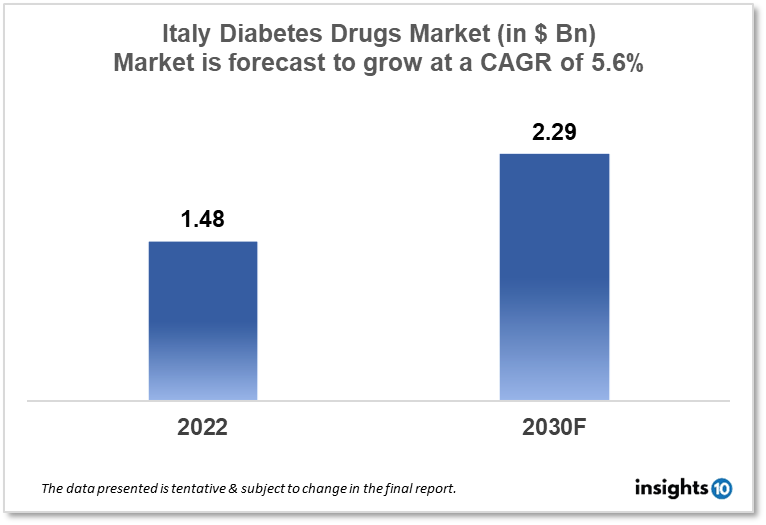

The Italy diabetes drugs market size was valued at $1.48 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030 and will reach $2.29 Bn in 2030. The market is segmented by drug type, application, and distribution channel. The Italy diabetes drug market will grow because, the Italian government has implemented a range of initiatives aimed at improving diabetes management and reducing the burden of the disease on the healthcare system. The key market players are Chiesi Farmaceutici (ITA), Menarini Group (ITA), Boehringer Ingelheim, Sanofi, Boehringer Ingelheim and others.

Buy Now

Italy Diabetes Drugs Market Executive Summary

The Italy diabetes drugs market size was valued at $1.48 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030 and will reach $2.29 Bn in 2030. In Italy, healthcare is largely funded by the government through the National Health Service (Servizio Sanitario Nazionale or SSN). The SSN is funded by taxes, and provides universal healthcare coverage to all citizens and legal residents. Italy has a relatively high level of healthcare expenditure compared to other European countries. According to data from the Organization for Economic Cooperation and Development (OECD), healthcare expenditure in Italy was equivalent to 8.8% of GDP in 2019, which is above the OECD average of 8.4%.

The Italian government has been making efforts to control healthcare spending in recent years, as the cost of providing healthcare services continues to rise. This has included measures such as cost containment programs, which aim to reduce the cost of drugs and medical devices, and efforts to increase efficiency in the healthcare system.

Diabetes is a significant health concern in Italy, with an estimated 3.5 Mn people living with the condition. The prevalence of diabetes in Italy is increasing, driven by factors such as an aging population, sedentary lifestyles, and poor dietary habits. The impact of diabetes epidemic in Italy has had a significant impact on the diabetes drugs market. As more people are diagnosed with diabetes, there is an increasing demand for effective treatments that can help manage the condition and improve patient outcomes. This has created opportunities for pharmaceutical companies to develop and market new diabetes drugs in Italy. At the same time, the Italian government has been taking steps to improve the management of diabetes and reduce the burden of the disease on the healthcare system. This has included initiatives to promote healthy lifestyles, improve diabetes education and awareness, and increase access to diabetes drugs and services.

In recent years, the Italian government has also been implementing cost containment measures to control the rising cost of healthcare, including diabetes drugs. This has created challenges for pharmaceutical companies operating in the Italian market, as they face pressure to reduce drug prices and demonstrate the value of their products. The increasing prevalence of diabetes, coupled with the need for more effective treatments and government initiatives to improve diabetes management, create opportunities for companies to develop and market innovative new therapies for this growing patient population.

Market Dynamics

Market Growth Drivers Analysis

The prevalence of diabetes is increasing in Italy, which is driving demand for diabetes drugs. According to the International Diabetes Federation, an estimated 3.5 Mn people in Italy have diabetes. This represents a significant patient population that requires ongoing treatment and management, creating opportunities for pharmaceutical companies to develop and market new diabetes drugs.

Additionally, the Italian government has implemented a range of initiatives aimed at improving diabetes management and reducing the burden of the disease on the healthcare system. These initiatives include programs to promote healthy lifestyles, increase diabetes education and awareness, and improve access to diabetes drugs and services. These efforts are expected to drive demand for diabetes drugs in Italy, as more people are diagnosed with the condition and require effective treatments.

Furthermore, advances in technology are enabling the development of new and innovative diabetes treatments. For example, continuous glucose monitoring (CGM) systems and insulin pumps are becoming increasingly popular in Italy, providing patients with more effective and convenient ways to manage their condition. These advances are creating opportunities for pharmaceutical companies to develop new diabetes drugs that can work in conjunction with these technologies to provide more effective treatment options.

Market Restraints

The Italian government has been implementing cost containment measures to control the rising cost of healthcare, including diabetes drugs. This has created challenges for pharmaceutical companies operating in the Italian market, as they face pressure to reduce drug prices and demonstrate the value of their products. This could limit the profitability of the diabetes drugs market in Italy. Additionally, many diabetes drugs have gone off-patent in recent years, leading to the entry of generic drugs into the market. This has increased competition in the diabetes drugs market in Italy, and has put pressure on prices. Pharmaceutical companies must compete with lower-priced generic drugs, which could limit their profitability and growth potential in the market.

Moreover, the Italian Medicines Agency (AIFA) is responsible for regulating diabetes drugs in Italy, and requires rigorous testing and approval processes before drugs can be approved for use. This can be a time-consuming and costly process for pharmaceutical companies, and may limit the number of new diabetes drugs that are brought to market in Italy. Additionally, AIFA may require post-marketing surveillance and monitoring, which can add additional costs and complexity to the drug development process.

Competitive Landscape

Key Players

- Chiesi Farmaceutici (ITA)

- Menarini Group (ITA)

- Boehringer Ingelheim

- Sanofi

- Boehringer Ingelheim

- Eli Lilly and Company

- AstraZeneca

- Johnson & Johnson

- Bayer Pharmaceuticals

- Novo Nordisk

- Merck

- Novartis

- GlaxoSmithKline

Notable deals

May 2021: Novo Nordisk announced a collaboration with Italian biotech company Energesis Pharmaceuticals to develop a new class of diabetes treatments. The collaboration will focus on developing small molecule drugs that target GPRC6A, a receptor involved in glucose and bone metabolism.

June 2021: Sanofi announced a research collaboration with Italian biotech company Fimbrion Therapeutics to develop new treatments for uropathogenic Escherichia coli (UPEC) infections, which can be a complication of diabetes.

July 2021: Chiesi Farmaceutici entered into a licensing agreement with Zealand Pharma to commercialize glepaglutide, a GLP-2 agonist for the treatment of short bowel syndrome, in Italy and other European countries.

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

The regulation of diabetes drugs in Italy is the responsibility of the Italian Medicines Agency (AIFA), which is a regulatory agency under the authority of the Ministry of Health. The AIFA is responsible for evaluating the safety, efficacy, and quality of drugs before they are approved for use in Italy. Before a diabetes drug can be approved in Italy, it must undergo a rigorous testing and approval process that includes preclinical and clinical trials. The drug manufacturer must provide extensive data on the safety and efficacy of the drug, including its potential side effects and interactions with other medications. Once a diabetes drug is approved for use in Italy, it is subject to ongoing monitoring and surveillance by the AIFA to ensure that it continues to meet safety and efficacy standards.

In Italy, diabetes drugs are typically reimbursed through the country's National Health Service (Servizio Sanitario Nazionale or SSN), which provides coverage to all citizens and legal residents. The reimbursement system is based on a formulary, which is a list of drugs that are approved for reimbursement by the SSN. To be included on the formulary, a diabetes drug must demonstrate a significant benefit over existing treatments, and its cost must be reasonable in relation to its benefit. The Italian Medicines Agency (AIFA) considers a range of factors when making reimbursement decisions, including the drug's clinical effectiveness, its cost, and its impact on patient outcomes.

Once a diabetes drug is approved for reimbursement, it is typically covered by the National Health Service. However, patients may still be responsible for a co-pay or deductible, depending on their specific insurance plan. Some diabetes drugs may also be covered by private health insurance plans, depending on the terms of the individual policy.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Drugs Market Segmentation

By Drug Type (Revenue, USD Bn):

The drug types considered, in this report include Injectable Drugs and Oral Drugs. Injectable drugs are further classified into insulin-based and non-insulin-based injectables. Oral drugs are further classified into various classes as per their mechanism of action as mentioned below :

- Injectable Drugs

- Insulin Based Injectables

- Non-insulin Based Injectables

- Exenatide (Byetta)

- Dulaglutide (Trulicity)

- Semaglutide (Ozempic, Wegovy)

- Liraglutide (`Saxenda, Victoza)

- Lixisenatide (Adlyxin)

- Pramlintide (Symlin)

- Tirzepatide (Mounjaro)

- Albiglutide (Tanzeum)

- Oral Drugs

- Biguanides - Metformin (Glucophage and Glucophase XR)

- Sulfonylureas - Glimepiride (Amaryl), Glyburide (DiaBeta), Glipizide (Glucotrol), Gliclazide (Diamicron), Chlorpropamide (Diabinese)

- Meglitinides and D-Phenylalanine Derivatives - Repaglinide (Prandin), Nateglinide (Starlix)

- Thiazolidinediones (TZDs) - Rosiglitazone (Avandia), Pioglitazone (Actos)

- Dipeptidyl peptidase-IV (DPP-4) inhibitors - Sitagliptin (Januvia), Saxagliptin (Onglyza), Linagliptin (Tradjenta), and Alogliptin (Nesina and Vipidia), Teneligliptin (Tenelia), Vildagliptin (Galvus)

- Alpha-glucosidase Inhibitors - Acarbose (Precose), Miglitol (Glyset), Voglibose (Voglib)

- Sodium-glucose co-transporter-2 (SGLT2) inhibitors - Canagliflozin (Invokana), Dapagliflozin (Farxiga), Empagliflozin (Jardiance), Ertugliflozin (Stelgatro)

- Dopamine D2 agonist – Bromocriptine (Parlodel and Cycloset)

- Glucagon like peptide 1 (GLP-1) receptor agonists - Semaglutide (Rybelsus)

- Bile Acid Sequestrants (BASs) - Colesevelam (Welchol)

- Others (Fixed Dose Combination Drugs)

By Application (Revenue, USD Bn):

Based on application, the market is segmented into Type 1 and Type 2. The 2 types of diabetes drugs are segmented and dominate the market. The Type 2 diabetes segment accounts for the largest sales of the worldwide market a few different kinds. The excessive prevalence of type 2 because of sedentary lifestyles and obesity in all age groups is attributed to the current situation. Around 10% of all diabetes cases are type 1, and approximately 90% of all cases of diabetes in UK are type 2. Hence, it is estimated to the diabetes drugs market will grow across the globe during the forecast period.

- Type 1 diabetes (due to β-cell destruction, usually leading to absolute insulin deficiency)

- Type 2 diabetes (due to a progressive insulin secretory defect on the background of insulin resistance)

- Other diabetes types

By Distribution Channel (Revenue, USD Bn):

Based on distribution channels, the market is classified into hospital pharmacies, rental pharmacies, and online pharmacies. The hospital pharmacies captured the highest market share, owing to the availability of trained & qualified personnel and favorable reimbursement structure. Online pharmacies are estimated to register the highest CAGR in the forecast period, it is attributed to the technological adaptation and acceptance of online pharmacies. Retail pharmacies showed a moderate market share improvement in the healthcare facilities in developing countries is anticipated to propel the popularity of retail pharmacies during the forecast period.

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.