Italy Depression Therapeutics Market Analysis

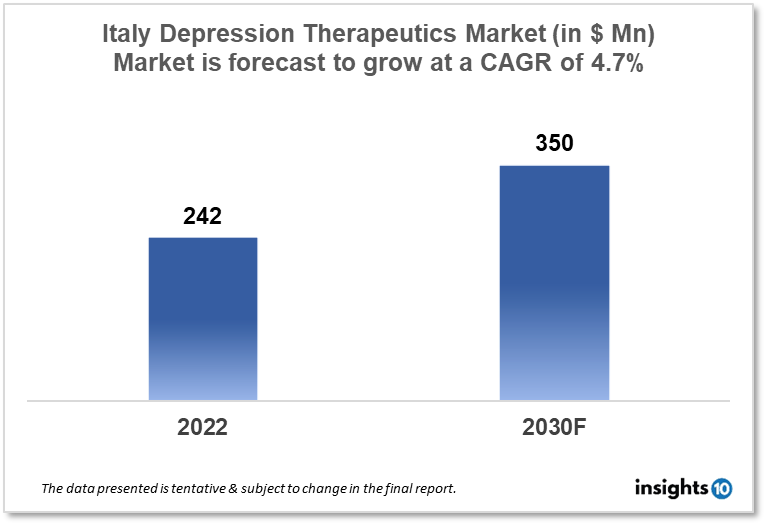

The Italy depression therapeutics market is expected to witness growth from $242 Mn in 2022 to $350 Mn in 2030 with a CAGR of 4.7% for the forecasted year 2022-2030. The rising incidence of depression in Italy and the growing demand for novel therapeutics are responsible for the growth of the market. The Italy depression therapeutics market is segmented by drug type, therapies, indication, and by end users. Procos, Indena, and Cipla are the major players in the Italy depression therapeutics market.

Buy Now

Italy Depression Therapeutics Market Executive Analysis

The Italy depression therapeutics market size is at around $242 Mn in 2022 and is projected to reach $350 Mn in 2030, exhibiting a CAGR of 4.7% during the forecast period. According to the World Health Organization, Italy spent about 9.5% of its GDP on healthcare in 2022, which is a comparatively high amount. Nevertheless, this is less than the typical expenditure in other European nations. The management and provision of healthcare services are handled regionally under the extremely decentralized Italian healthcare system. This may lead to variations in the standard of treatment and accessibility of medical services across the nation.

In Italy, 6.6% of adults experienced depressive symptoms between 2020 and 2021. Among them, 62.8% sought assistance to recover from this mental condition. Sicily and the Aosta Valley were found to have lower rates of depression-related help requests than other areas. The monoamine deficiency hypothesis, which states that a lack of the monoamine neurotransmitter is the primary cause of Major depressive disorder (MDD), stimulated the development of the first antidepressant medications in the 1960s. Due to this, the first wave of monoamine oxidase inhibitors (MAOIs) and later tricyclic antidepressants were created. (TCAs). Soon after, the connection between serotonin and MDD was discovered, which prompted the development of Selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors are currently used as first-line treatments. (SNRIs).

More recently, the FDA approved an esketamine nasal mist after discovering ketamine to be an effective antidepressant. Esketamine gives treatment-resistant depression (TRD) patients with quick symptom relief. However, the substantial dangers attached to esketamine prevent it from being used by a large number of patients. The majority of currently available antidepressants target monoamines, but given how poorly MDD patients respond to these pharmacological treatments, it is clear that additional underlying mechanisms must be taken into account if therapy effectiveness is to be increased. Hence, broadening the presently available treatment options will strive to personalize each patient's pharmacological treatment plan according to the particulars of their diagnosis.

Market Dynamics

Market Growth Drivers

More people are seeking help and getting diagnosed with depression in Italy as a consequence of rising awareness about mental health problems. This is increasing the need for depression treatments. In the upcoming years, the Italy depression therapeutics market expansion is anticipated to be supported by several revolutionary depression therapeutics that are currently in development.

Market Restraints

The pricing and profitability of depression therapeutics may be constrained by the Italian government's cost-containment methods for pharmaceuticals. As a result, it might be less appealing for pharmaceutical companies to spend money on developing novel medications for the Italian market. Alternative therapies for depression include psychotherapy and complementary and alternative medicine, which may reduce the demand for depression therapeutics. In especially for cases of mild to moderate depression, this might affect the Italy depression therapeutics market expansion.

Competitive Landscape

Key Players

- Icrom (ITA)

- Farmaka (ITA)

- Etna Biotech (ITA)

- Procos (ITA)

- Indena (ITA)

- Cipla

- Eli Lily

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Zydus Lifesciences

Healthcare Policies and Regulatory Landscape

In Italy, everyone who is a citizen or a legal resident has access to depression therapy through the national health system. The mainstream of depression treatments, including medication and psychotherapy, are typically protected by insurance. To augment the identification and management of depression, the Italian government has implemented several policies. The government, for instance, started a nationwide campaign to endorse mental health and reduce the disgrace surrounding mental disease in 2019. Initiatives to increase access to mental health resources, including depression treatment, were part of the campaign. The Italian government has implemented cost-containment measures for medicines, including antidepressants, in terms of reimbursement guidelines. Negotiations with pharmaceutical firms to lower drug prices and lower the total charge of the national health service have resulted as an outcome of this. To lower healthcare costs, the government has also endorsed the use of generic drugs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.