Italy Anti Aging Therapeutics Market Analysis

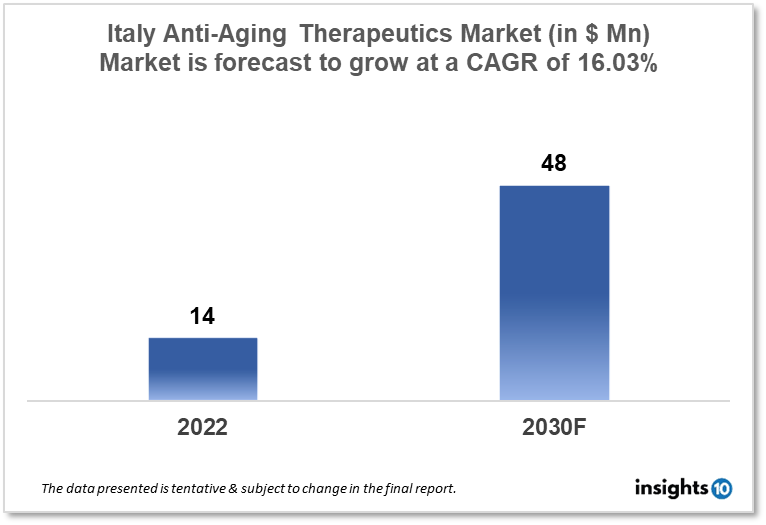

Italy anti-aging therapeutics market is expected to witness growth from $14 Mn in 2022 to $48 Mn in 2030 with a CAGR of 16.03% for the year 2022-2030. The rising awareness about age-related disorders among the Italian population and growing investments in anti-aging treatments in Italy by major biotechnology companies are driving the growth of the market. The Italy anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Recipharm, Italfarmaco, and Cambrian Biopharma are among the leading players in the market.

Buy Now

Italy Anti-Aging Therapeutics Market Executive Summary

The Italy anti-aging therapeutics market size is at around $14 Mn in 2022 and is projected to reach $48 Mn in 2030, exhibiting a CAGR of 16.03% during the forecast period. Italy's health spending is smaller than that of other Western European nations in 2022, coming in at 8.7% of GDP. About 74% of all health spending in 2022 was covered by state funding, with households paying the majority of the remaining costs (23%) out of their own pockets. Expanding vaccination coverage, restructuring hospital care and raising standards, revising the benefits package, and putting in place performance tracking systems for the health system are recent policy initiatives. Addressing historical underinvestment in the health workforce, updating outdated infrastructure and technology, and improving information infrastructure are key challenges for the health system. The Italian government intends to strengthen primary and community care by investing in facilities, enhancing the SSN digital infrastructure, upgrading medical equipment, and funding health worker training with the help of its EU-funded National Recovery and Resilience Plan.

The uncontrolled aging of the population is profoundly altering Italian society because the proportion of the elderly is what primarily determines their requirements and the resources that should be allocated to them. The present uncertainty about the ability to maintain the quality and quantity of the health supply is caused by the forecast of rising costs for health and social care due to longevity. The primary goal of Italian anti-aging research is to increase health span. Innovative gene therapy-based methods appear to be among the most hopeful ones currently available for preventing and treating chronic polygenic pathologies, including those that are age-related. The use of direct (such as gene editing) and indirect (such as viral or non-viral vectors) methods to modify the genome architecture is possible with gene-based treatment. The efficacy of these therapeutic options is frequently subpar and constrained by their side effects due to the extraordinarily complex processes involved in aging and the diseases associated with it. As a result, the clinical implementation of such applications will undoubtedly take a long time and involve numerous translational stages to address problems. However, once these problems are resolved, their application in clinical practice may undoubtedly open up new doors for anti-aging therapy.

Market Dynamics

Market Growth Drivers Analysis

With a high %age of citizens 65 years of age and higher, Italy has one of the oldest populations in the world. People who are older are more likely to develop a number of age-related illnesses and conditions, including arthritis, cardiovascular disease, and cognitive loss, all of which could be treated with anti-aging drugs. People are becoming more and more aware of the significance of maintaining excellent health and preventing age-related illnesses. As a result, there is an increasing need for anti-aging treatments that can keep people young at heart and busy as they age. Both local and foreign players have made sizeable investments in the Italy anti-aging therapeutics market. The market has expanded as a result of this investment's ability to support the development of novel treatments and technologies.

Market Restraints

Anti-aging procedures can be expensive which may prevent many people from accessing them. This may pose a sizable obstacle to the Italy anti-aging therapeutics market's expansion. New anti-aging therapies can take a long time to become available and are subject to stringent regulatory requirements during this process. The development and introduction of novel treatments may be dragged down by these difficulties, which may restrict market expansion. Some anti-aging treatments could come with hazards or side effects when used. This may restrict the use of these treatments and have an impact on Italy anti-aging therapeutics market expansion.

Competitive Landscape

Key Players

- InGeno (ITA)

- Fidia Farmaceutici (ITA)

- Biofarma Group (ITA)

- Recipharm (ITA)

- Italfarmaco (ITA)

- Cambrian Biopharma

- CytoMed Therapeutics

- Gero

- Rejuvenate Bio

- Rejenevie Therapeutics

- UT Health

Healthcare Policies and Regulatory Landscape

The Italian Medicines Agency (AIFA), a division of the Italian Ministry of Health, is the regulatory authority in charge of regulating anti-aging therapeutics in Italy. AIFA is in charge of ensuring the safety, efficacy, and high quality of all medications sold in Italy, including anti-aging therapeutics. For use in Italy, AIFA evaluates and authorizes novel medications and treatments, keeps track of their efficacy and safety, and controls their marketing and distribution. To guarantee the security and effectiveness of medications and treatments marketed across Europe, AIFA also works with other regulatory organizations of the European Union.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.