Ireland Dental Care Market Analysis

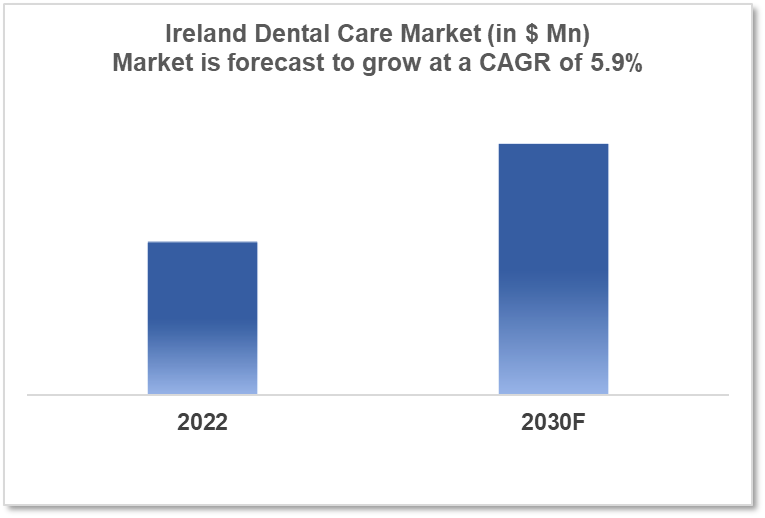

The Ireland Dental Care Market size is at around $xx Bn in 2022 and is projected to reach $xx Bn in 2030, exhibiting a CAGR of 5.9% during the forecast period. With a historic low rate of unemployment and a leader in technological and medical equipment manufacturing, Ireland has been attracting immigrants who are high paying due to excess disposable income. The market is captured by corporations and dental clinic chains. This report is segmented by treatment type, age group, and by clinical setup, and by demography and provides in-depth insights into opportunities for expansion.

Buy Now

Ireland Dental Care Market Executive Summary

Ireland's economy has expanded rapidly in recent years. The unemployment rate is at an all-time low, and the government is running a budget surplus. The services industry, particularly technology and pharmaceuticals, contributed significantly to the country's growth. The country's agriculture and manufacturing sectors are also robust. The Irish economy is regarded as one of the strongest in Europe and has been gradually rising in recent years, but the COVID-19 pandemic has had an impact on the economy, which is still recovering. Due to its highly educated workforce, low corporation tax rate, and favorable economic environment, Ireland has recently attracted foreign investment, notably in the technology industry.

In Ireland, both private and public healthcare services are offered. Individual health experts or healthcare companies provide private healthcare services. Private healthcare services are typically paid in whole by you. You can get private health insurance to assist pay for private healthcare. The government funds public health services. Many public health services are free, however, there may be a price in other situations. The Health Service Executive (HSE) is in charge of providing public health services. The HSE sometimes offers these services directly, and other times it funds other organizations to deliver these services. Visitors from other European Economic Area (EEA) nations or Switzerland, for example, may be eligible for public health care. Oral health in Ireland is usually good, according to the Irish Health Service Executive, but there are variations in oral health results amongst socioeconomic categories. Dental decay and gum disease affect a sizable proportion of the population. Access to oral health care services is also limited in some locations, notably in rural areas. Adult medical card members over the age of 16 have access to dental treatment through the Dental Treatment Services Scheme (DTSS). Each year, medical card holders are eligible for a free dental checkup, extractions, one first-stage endodontic (root canal) treatment, and two fillings. Where necessary, denture repairs, hemorrhage control, and prescription issuance will be paid.

All additional treatments, including the provision of dentures, must be approved in advance by the local HSE Principal Dental Surgeon. Through the public health service, the Health Service Executive (HSE) provides some free dental treatment. Dentists employed by Local Health Offices in your region and private dentists with contracts with the HSE to deliver certain treatments provide services. Children under the age of six, children attending national school, children who have left national school and are under the age of sixteen, children with special needs, and children dependants of medical card holders are all eligible for the HSE's Children's Dental Service.

Market Dynamics

Market Growth Drivers

Using telemedicine and other technology, there may be chances to expand dental services into remote areas where access to care is limited. Ireland has a booming technological sector, particularly in software development, biotechnology, and medical device manufacturing, which can give career possibilities for qualified immigrants. This has resulted in an inflow of immigrants and, as a result, an increased demand for dental treatment. As Ireland's population grows and ages, there may be an increase in demand for dental care. This could encompass both preventative and restorative care, as well as orthodontic and cosmetic procedures. New dental technologies such as digital dentistry, CAD-CAM, and implantology are also creating new potential for growth in dental services. Because public dental services may be restricted in some locations, the demand for private dental treatment is increasing. This may involve an increase in dental tourism, as Ireland is becoming a popular destination for patients seeking dental care.

Market Restraints

The country has several obstacles, including high housing costs and the need to invest in infrastructure and public services to sustain the rising population. There could be a number of impediments preventing dental firms from expanding in Ireland. Among the possibilities are High operating expenditures, such as rent, equipment, and employee compensation, which can make it difficult for dental firms to produce a profit or expand their business. New entrants must comply with tight regulations and oversight from the Dental Council of Ireland and the Irish Health Service Executive, which can make navigating the regulatory landscape complex and costly. In Ireland, dental firms face intense rivalry, making it difficult to recruit new patients and increase market share. Corporations also have trouble obtaining capital to expand their operations, making growth challenging. It is difficult to recruit and retain dental practitioners, especially in remote locations, which limits service expansion. The cost of dental care in Ireland can be quite high, which may be a barrier to access for some individuals or families, but it is not necessarily a barrier to growth for dental enterprises, as they can still create viable business models.

Competitive Landscape

Key Players

- Irish Dental Care

- MyDental

- Smiles Dental

- Access Dental Care

- Dental Care Ireland

Notable Recent Deals

November 2022 - A long-established dental business in Belfast has new ownership and a $300,000 job-creation investment. Gate Lodge Dental Practice was founded approximately 30 years ago when former owner and current partner dentist John McCambridge purchased the Gate Lodge to Belfast Castle and transformed it into a working dental surgery. Conor O'Hare, who worked in private practise dentistry in New Zealand before returning to Templepatrick six years ago, has purchased it. Ulster Bank has now given the practice a six-figure grant to assist it expand its offerings and patient numbers.

Healthcare Policies and Regulatory Landscape

The Dental Council of Ireland is the regulatory authority for dental services in Ireland (DCI). The DCI is in charge of registering dentists and dental hygienists, establishing and implementing dental education and training requirements, and upholding a code of conduct for dental professionals. They also establish infection control, professional conduct, and ethical behavior requirements for dental professionals. Furthermore, the DCI analyses complaints filed against dental professionals and, if required, takes disciplinary action.

Reimbursement Scenario

The Dental Treatment Benefit Scheme is offered to insured workers and retirees who have made the necessary PRSI contributions. The Department of Social Protection pays the whole cost of an oral examination once a year under this scheme. Private dentists on a Department of Social Protection panel perform the examination. The majority of dentists are on the panel, so you should have no trouble choosing one. In our Identify-A-Dentist section, you can find a dentist in your region who is a member of the Scheme. The application forms will be available from the dentist or the Department. These forms demand information like Personal Public Service Number (PPSN). The HSE administers the dental plan for medical card holders. This scheme is only open to medical cardholders who are at least 16 years old. Private dentists who have an arrangement with the HSE can provide free dental treatment under the scheme. HSE provides a network of authorized dentists that may be found via the Find-a-Dentist inquiry. In April 2010, the HSE made amendments to the Scheme. The new measures prioritize the range of accessible treatments based on their clinical requirement and priority. Services for high-risk patients (including those with special needs) and those requiring extraordinary care are subject to prior permission from an HSE clinician, who will prioritize high-risk patients. Adult Dental Plans like Healthy Smiles Level 1 (age 18-39) start at $15 per month with DeCare Dental, and Kids Dental Plans start at $10.17 per month. These provide coverage for check-ups, cleanings, and emergencies, as well as protection in the event of a dental emergency. Healthy Smiles supports consistent and long-term preventative treatment by covering all examinations, cleanings, and x-rays. Major and orthodontic coverage, as well as claims up to €5,000 with Oral Cancer Benefits, are charged at a higher rate.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.