Indonesia Radiotherapy Market Analysis

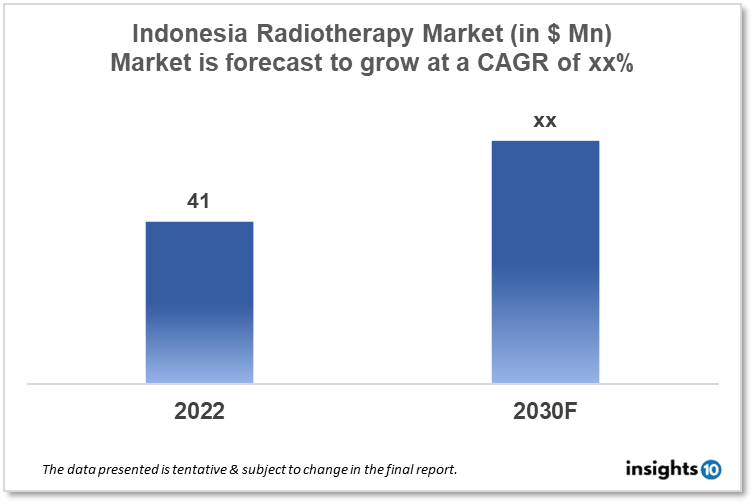

By 2030, it is anticipated that the Indonesia Radiotherapy Market will reach a value of $xx Mn from $41 Mn in 2022, growing at a CAGR of xx% during 2022-30. The Radiotherapy Therapeutics Market in Indonesia is dominated by a few domestic players such as Viet Medical Equipment, Shimadzu Indonesia, and Varian Medical Systems. The radiotherapy market in Indonesia is segmented into different types, technology, procedures, application, and end-user. The major risk factors associated with awareness of radiotherapy shortage of skilled staff, government initiatives and reimbursement policy. The demand for Indonesia Radiotherapy is increasing on account of the rise in cancer cases in the country.

Buy Now

Indonesia Radiotherapy Market Analysis Summary

By 2030, it is anticipated that the Indonesia Radiotherapy Market will reach a value of $xx Mn from $41 Mn in 2022, growing at a CAGR of xx% during 2022-30.

Indonesia is a lower middle-income, developing country located in Southeastern Asia between the Indonesian Ocean and the Pacific Ocean. Overall, the most common malignancies in Indonesia are lung (11.58 %), breast (11.55 %), and colorectum (10.23 %), with the highest death rates being lung (18.43 %), liver and bile duct (9.91 %), and stomach (10.23 %) (8.19 %). Approximately 70% of all diseases, including cancer, are already noncommunicable, and this ratio will rise as Indonesia completes its epidemiological change.

The number of oncological disease incidents in Indonesia is anticipated to reach 396,000 by 2020. The Association of Indonesian Radiation Oncology Society seeks to improve the quality of radiotherapy services in Indonesia in order to improve the quality of life for cancer patients. Indonesia's government spent 3.4% of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

Indonesia has seen the establishment of four new treatment centres, representing a 50% increase in the number of accessible treatment units and a 29% increase in the number of human resources. Except for a few patients who are treated at private institutions or fly overseas, cancer patients in Indonesia are finally directed to both Dharmais National Cancer Center and Cipto Mangunkusumo Hospital, both of which are governmental hospitals. The National Health Insurance (BPJS-JKN) now covers around 82.3 % of Indonesia's 270 million people, including the poor (whose contributions are paid for by the government). These aspects could boost Indonesia's, Radiotherapy Market.

Market restraints

In Indonesia, admission to cancer care is limited, particularly in provincial locations with few or no disease treatment offices. Patients are frequently needed to travel vast distances for treatment, which can be expensive and time-consuming. To meet the demand, Indonesia will need to install at least 200 more machines. The number of patients who received radiation therapies was 14,553 (7.96 %) in 2007 and 24,318 (13.3 %) in 2017, while the WHO recommends 60 %. These factors may deter new entrants into the Indonesia Radiotherapy Market.

Competitive Landscape

Key Players

- Multi Teknologi Nusantara (MTN) - MTN is a leading domestic supplier of medical equipment, including radiotherapy equipment. The company offers a range of products, including linear accelerators, brachytherapy systems, and radiation protection solutions

- Prodia DiaCRO Laboratories - Prodia is an Indonesian company that provides a range of medical equipment, including radiotherapy equipment. The company has a presence in Indonesia and provides equipment to several healthcare facilities

- Elekta - Elekta is a global company that provides advanced radiation therapy equipment and software solutions. In Indonesia, the company has a strong presence and offers a range of products, including linear accelerators, brachytherapy systems, and treatment-planning software

- Varian Medical Systems - Varian is a leading manufacturer of radiotherapy equipment, including linear accelerators, brachytherapy systems, and software solutions. The company has a presence in Indonesia and provides equipment to several healthcare facilities

- Siemens Healthineers - Siemens Healthineers is a global company that provides a wide range of medical equipment and services, including radiotherapy equipment. In Indonesia, the company offers a range of products, including linear accelerators, CT scanners, and MRI machines

Notable Recent Deals

January 2023: As part of government-led efforts to improve cancer diagnosis and treatment, the Dharmais National Cancer Center in West Jakarta, Indonesia's government-owned key cancer care facility and major cancer referral institute, has begun a collaboration with the University of Indonesia (Depok City, West Java, Indonesia), the University of New Mexico (Albuquerque, NM, USA), and the Tata Memorial Centre (Mumbai, India). Project Extension for Community Healthcare Outcomes (ECHO), Cancer Patient Navigation (NAPAK), and an oncology nurse capacity-building project are all part of the collaboration.

Healthcare Policies and Reimbursement Scenarios

In Indonesia, the regulations and reimbursement of radiotherapy are overseen by the Ministry of Health (MOH) and the National Health Insurance (JKN) program. The Indonesian Society of Radiation Oncology (ISRO) is the main professional organization for radiation oncologists in Indonesia and works closely with the MOH to develop guidelines and standards of practice for radiotherapy. The JKN program is responsible for reimbursing the cost of radiotherapy for eligible patients under the national health insurance program.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Radiotherapy Segmentation

By Type (Revenue, USD Billion):

- External Beam Radiation Therapy

- Linear Accelerators

- Compact Advanced Radiotherapy Systems

- Cyberknife

- Gamma Knife

- ?Tomotherapy

- Proton Therapy

- Cyclotron

- ?Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and Afterloaders

- Electronic Brachytherapy

- Systemic Radiation Therapy

- ?Others

?By Technology (Revenue, USD Billion):

- External Beam Radiotherapy

- Intensity-Modulated Radiation Therapy (IMRT)

- Image-Guided Radiation Therapy (IGRT)

- Stereotactic Radiation Therapy (SRT)

- 3D Conformal Radiation Therapy (3D-CRT)

- Particle Therapy

- Internal Beam Radiotherapy

- Brachytherapy

- High-Dose Rate Brachytherapy

- Low-Dose Rate Brachytherapy

- Image-Guided Brachytherapy

- Pulse-Dose Rate Brachytherapy

- Systemic Radiation Therapy

- Intravenous Radiotherapy

- Oral Radiotherapy?

By Application (Revenue, USD Billion):

- Breast Cancer

- Cervical Cancer

- Colon and rectum Cancers

- Stomach Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Liver Cancer

- Other types of cancer

By End User (Revenue, USD Billion):

- Hospitals

- Radiotherapy Centers & Ambulatory Surgery Centers

- ?Cancer Research Institutes

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.