Indonesia Pharmaceutical Packaging Market Analysis

Indonesia Pharmaceutical Packaging Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. The market for Pharmaceutical packaging is growing rapidly as a result of increased demand for drug delivery systems such as prefilled syringes, autoinjectors, transdermal patches and inhalers requiring specialized packaging solutions to ensure proper dosing, administration and product stability, regulatory compliance and safety to ensure product safety, integrity, packaging which must protect against contamination, requirement of counterfeit and tamper resistance packaging and increase in need of blister packaging. Amcor plc, West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Berry Global Inc., AptarGroupInc., Owens-Illinois, Inc., Becton, Dickinson and Company (BD), Constantia Flexibles Group GmbH and WestRock Company are the key global market players in pharmaceutical packaging market.

Buy Now

Indonesia Pharmaceutical Packaging Market Analysis Summary

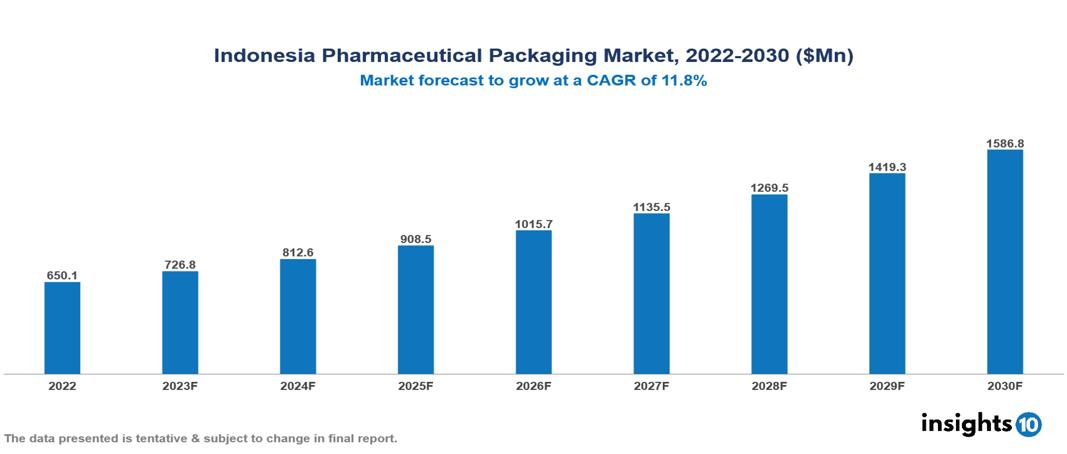

Indonesia Pharmaceutical Packaging Market is valued at around $650.1 Mn in 2022 and is projected to reach $1586.8 Mn by 2030, exhibiting a CAGR of 11.8% during the forecast period 2023-2030.

In order to guarantee the safety, preservation, and transportation of pharmaceutical items to consumers, the pharmaceutical packaging industry is crucial. A vast variety of materials, containers, and technologies are used to package pharmaceutical items. One common type of pharmaceutical packaging is primary packaging which includes an immediate container that directly holds the pharmaceutical product. Secondary packaging is the outer packaging which holds multiple primary containers. Tertiary packaging includes multiple secondary packaging units like shrink wrap, for efficient distribution and logistics. Child-resistant packaging to avoid unintentional child ingestion, frequently using specific closures or mechanisms that call for adult dexterity to open. Tamper-evident packaging is a form of packaging made to give clear signs of tampering, protecting the integrity and safety of the product. Amcor plc, West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Berry Global Inc., AptarGroupInc., Owens-Illinois, Inc., Becton, Dickinson and Company (BD), Constantia Flexibles Group GmbH and WestRock Company are the key global market players in the pharmaceutical packaging market.

Market Dynamics

Market Growth Drivers

- Rising demand from the global pharmaceutical industry

- Increased demand for drug delivery systems such as prefilled syringes, autoinjectors, transdermal patches, and inhalers requiring specialized packaging solutions

- Regulatory Compliance and Safety- To ensure that the product remains within GMP specifications packaging should be of such type which can protect against contamination

- Increasing adoption of generic drugs globally requires more packaging solutions. All these factors act as market growth drivers

Market Restraints

- Rise in counterfeit pharmaceutical drugs, sustainability and environmental concerns, supply chain and logistics challenges, patient convenience and accessibility.

- All these factors act as market growth restraints.

Competitive Landscape

Key Players

- Amcor plc

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Berry Global Inc.

- AptarGroupInc.

- Owens-Illinois, Inc.

- Becton

- Dickinson and Company (BD)

- Constantia Flexibles Group GmbH

- WestRock Company

Notable deals in the Pharmaceutical Packaging Market

In June 2022 - A laminate that is recyclable and has better chemical resistance was introduced by Constantia Flexibles. The first ready-to-recycle mono-material based on polypropylene (PP) with good chemical resistance for pharmaceutical items was introduced by the third-largest flexible packaging company in the world.

In May 2022 - The introduction of EcoPositive, a designation for all of the company's sustainable packaging options, was announced by Bormioli Pharma, a producer of glass and plastic primary packaging for pharmaceutical applications. This includes products made of innovative polymers, recycled glass and plastic, and plastics that are bio-based, compostable, or biodegradable.

In April 2022- Amcor a leader in the design and production of ethical packaging solutions, recently revealed the addition of a new, more environmentally friendly High Shield laminate to its line of pharmaceutical packaging.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Indonesia Pharmaceutical Packaging Market

By Type

- Plastic Bottles

- Blister Packs

- Labels and Accessories

- Caps and Closures

- Medical Specialty Bags

- Pre-Filled Syringes

- Temperature-Controlled Packaging

- Pouches and Strip Packs

- Ampoules

- Vials

- Pre-Filled Inhalers

- Medication Tubes

- Jars and Canisters

- Cartridges

- Others

By Raw Material

- Plastics and Polymers

- Paper & Paperboards

- Glass

- Metals

- Others

By Drug Delivery Mode

- Oral Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Transdermal Drug Delivery Packaging

- Injectable Packaging

- Topical Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Iv Drugs Delivery Packaging

- Other Drugs Delivery Packaging

By Application

- Drug Delivery

- Veterinary

- Vaccines

By Purchase Organization

- Manufacturer

- Packaging Companies

- Government Agencies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.