Indonesia Mouth Ulcer Therapeutics Market Analysis

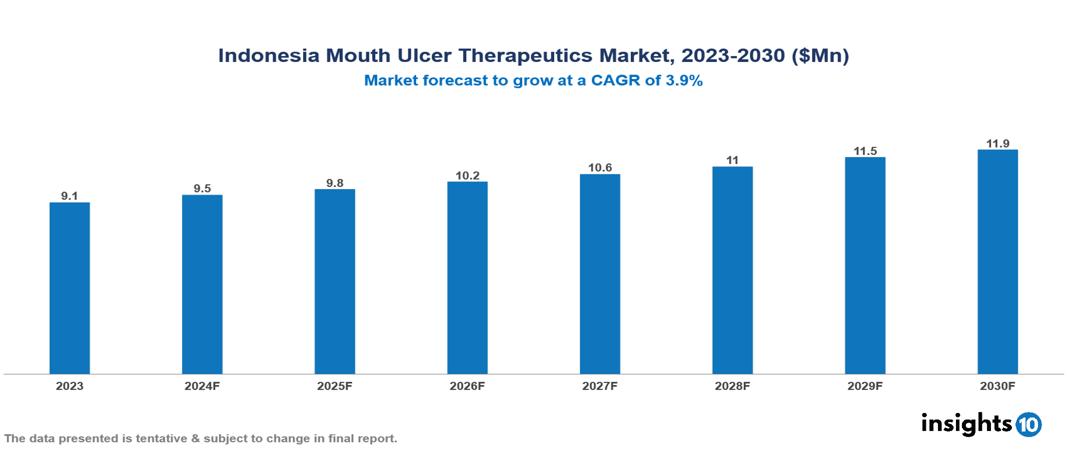

The Indonesia Mouth Ulcer Therapeutics Market was valued at $9.1 Mn in 2023 and is projected to grow at a CAGR of 3.9% from 2023 to 2023, to $11.9 Mn by 2030. The key drivers of this industry are rising awareness about oral hygiene, increasing demand for rapid healing products, growing geriatric population, rise in tobacco consumption, increasing incidence of oral diseases, chemical-based toothpaste and unhealthy lifestyles etc. The industry is primarily dominated by players such as Kalbe Farma, AstraZeneca, Pfizer, Bayer, GSK among others.

Buy Now

Indonesia Mouth Ulcer Therapeutics Market Executive Summary

The Indonesia Mouth Ulcer Therapeutics Market is at around $9.1 Mn in 2023 and is projected to reach $11.9 Mn in 2030, exhibiting a CAGR of 3.9% during the forecast period 2023-2030.

Canker sores, or mouth ulcers, come in three main types: minor (small and oval), major (larger and deeper), and herpetiform (multiple small ulcers that may merge). While the exact cause is unclear, risk factors include stress, hormonal changes, nutrient deficiencies, certain diseases, and oral trauma. These ulcers typically heal on their own within 1-2 weeks but can lead to complications like infections, severe pain affecting eating, and potential scarring. Prevention focuses on stress reduction, avoiding trigger foods, using gentle oral care products, and addressing potential vitamin deficiencies. Treatment aims to relieve symptoms through topical medications, pain relief, and supportive care. Home remedies include maintaining good oral hygiene, salt water rinses, and a balanced diet. Medical attention is advised for persistent, unusual, or severe ulcers, especially if accompanied by fever or difficulty in oral functions.

The previous month prevalence of recurrent aphthous stomatitis (RAS) in the Indonesian population was 12%. The market therefore is driven by significant factors like improving healthcare infrastructure, health consciousness among consumers and surge in the prevalence of mouth ulcers, however, factors such as uneven healthcare access, affordability concerns, and preference for traditional medicines limit market growth.

The industry is primarily dominated by players such as Kalbe Farma, Kimia Farma, Dexa Medica, Pfizer, Bayer, GSK, AstraZeneca among others.

Market Dynamics

Market Growth Drivers

Rising Awareness and Health Consciousness: With increasing urbanization, exposure to information, and improving education levels, there is a growing awareness and health consciousness among the Indonesian population regarding oral health and the importance of seeking treatment for conditions like mouth ulcers. This awareness drives the demand for effective remedies.

Improving Healthcare Infrastructure: Indonesia has been making efforts to improve its healthcare infrastructure, including dental and oral healthcare facilities. This improved accessibility enables more individuals to seek professional care and access treatments for mouth ulcers, driving market growth.

Increase in Prevalence: The increasing prevalence of mouth ulcers in Indonesia which is approximately around, 12%. Driven by factors such as smoking cessation, tobacco use, and consumption of citric and chemical-laden foods. This rising prevalence is expected to lead to a higher demand for effective treatments, driving market growth.

Market Restraints

Uneven Healthcare Access: Access to healthcare services, including oral healthcare, remains uneven across different regions of Indonesia, particularly in rural and remote areas. This limited accessibility can restrain market growth in those underserved regions.

Affordability Concerns: While disposable incomes are rising, a significant portion of the Indonesian population may still face affordability concerns when it comes to certain healthcare expenses, including treatments for mouth ulcers. This financial barrier can limit the adoption of advanced or specialized treatments.

Traditional Medicine Preferences: In some regions of Indonesia, there is be a strong cultural preference for traditional herbal remedies and alternative therapies over modern pharmaceutical treatments. This preference poses competition to mainstream mouth ulcer treatments and constrain market growth.

Regulatory Landscape and Reimbursement Scenario

Indonesia's pharmaceutical regulatory body is the National Agency of Drug and Food Control (BPOM), responsible for ensuring the safety, efficacy, and quality of pharmaceutical products. BPOM regulates the importation, manufacturing, and distribution of medicines, as well as the registration of new drugs and medical devices. Key responsibilities include drug registration, inspection and monitoring, drug recall, and labelling and packaging. The agency also conducts regular inspections of pharmaceutical manufacturing facilities and distribution centres to ensure compliance with good manufacturing practices (GMP) and good distribution practices (GDP).

Indonesia's reimbursement policy is governed by the National Formulary (NF), which is a list of medicines covered by the social health insurance (JKN) program. The National Health Ministry (MOH) compiles the list, and it is used to determine which medicines are eligible for reimbursement. The e-Catalogue is an electronic platform that lists medicines covered by the JKN program, used by healthcare facilities to procure medicines and by patients to access medicines at a lower cost. The reimbursement ceiling, set by the Case-Based Groups (INA-CBGs), determines the maximum amount that healthcare facilities can claim for a particular medicine, affecting the pricing of medicines and reimbursement rates. The MOH negotiates prices with pharmaceutical companies for medicines included in the NF, considering factors such as the drug's clinical value, production costs, and market conditions. The Health Technology Assessment (HTA) process is used to evaluate the clinical and cost-effectiveness of new medicines, with the HTA committee reviewing evidence and making recommendations for inclusion in the NF and e-Catalogue. Overall, Indonesia's pharmaceutical regulatory body and reimbursement policy aim to ensure the availability of good quality, efficacious, and affordable medicines while controlling healthcare costs.

Competitive Landscape

Key Players

Here are some of the major key players in the Indonesia Mouth Ulcers Therapeutics Market:

- Kalbe Farma

- Kimia Farma

- Dexa Medica

- Sanbe Farma

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc.

- Sanofi

- AstraZeneca

- Reckitt Benckiser

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Mouth Ulcer Treatment Market Segmentation

By Treatment Drug Class

- Corticosteroid

- Antihistamine

- Antimicrobial

- Analgesic

- Anesthetic

- Anti-inflammatory Agents

By Treatment Formulation Type

- Gel

- Mouthwash

- Ointment

- Spray

- Lozenges

Mouth Ulcer Treatment Indications

- Aphthous Stomatitis

- Oral Lichen Planus

- Others

By End Users

- Pharmacy

- Online Stores

- Hospitals and Clinics

- Home care

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.