Indonesia Hemodialysis Equipment Market Analysis

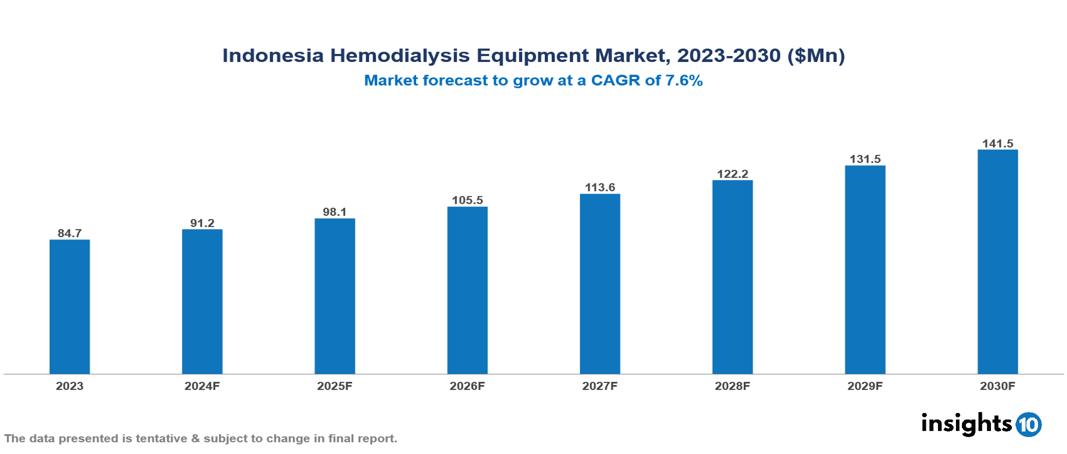

The Indonesia Hemodialysis Equipment Market was valued at $84.7 Mn in 2023 and is projected to grow at a CAGR of 7.6% from 2023 to 2023, to $141.5 Mn by 2030. The key drivers of this industry are increasing incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), availability of advanced dialysis machines and consumables, government initiatives to improve dialysis accessibility, growing adoption of home haemodialysis, expansion of dialysis service providers which has contributed to market growth. The industry is primarily dominated by players such as Angiodynamics, Baxter, B. Braun SE, Fresenius Medical Care AG, Medtronic among others.

Buy Now

Indonesia Hemodialysis Equipment Market Executive Summary

The Indonesia Hemodialysis Equipment Market is at around $84.7 Mn in 2023 and is projected to reach $141.5 Mn in 2030, exhibiting a CAGR of 7.6% during the forecast period 2023-2030.

Hemodialysis is a critical treatment for patients with end-stage renal disease, and it relies on specialized medical devices to function effectively. The main components of a haemodialysis machine include the dialyzer (artificial kidney), blood pump, dialysate pump, air detector, heparin pump, temperature monitor, and conductivity monitor.

The dialyzer is a device that filters blood, eliminating waste and extra fluid. Blood is drawn into the dialyzer by the blood pump, while waste and fluid are removed with the help of the dialysate pump, which also feeds a specific fluid into the dialyzer. In order to avoid air embolism, the air detector looks for air bubbles in the blood line and stops the blood pump if air is found. During dialysis, the heparin pump prevents clotting in the blood by delivering an anticoagulant into the bloodstream. A temperature monitor guarantees that the dialysate stays within a safe temperature range, while a conductivity, monitors measure the electrolyte content in the dialysate.

Side effects can include low blood pressure, muscle cramps, and fatigue. Dietary restrictions and medication management are often necessary alongside dialysis treatment. While hemodialysis is not a cure for kidney failure, it effectively manages the condition, allowing many patients to lead active lives. It's often used as a long-term treatment or as a bridge to kidney transplantation. Ongoing research aims to improve dialysis technology and patient outcomes.

The prevalence of chronic kidney disease in Indonesia is estimated to be around 12.5% of the population. The hemodialysis market is driven by significant factors like aging population, increase prevalence rate of chronic diseases, increasing incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), availability of advanced dialysis machines and consumables, government initiatives to improve dialysis accessibility, growing adoption of home haemodialysis, expansion of dialysis service providers which has contributed to market growth.

The prominent players operating in this market include Asahi Kasei Corporation, B. Braun, Baxter International Inc., DaVita, Angiodynamics Inc., Diaverum Deutschland Gmbh., Nikkiso Co. Ltd., Nipro Corporation.

Market Dynamics

Market Drivers

Rising Prevalence of Chronic Kidney Disease and ESRD: The prevalence of chronic kidney disease in Indonesia is estimated to be around 12.5% of the population. The number of patients on dialysis in Indonesia has increased from around 4,000 in 2000 to over 50,000 in 2021, reaching around 180 patients per 1 Mn population, which is boosting the market of hemodialysis in Indonesia.

Increased Incidence of Diabetes: Indonesia has a high prevalence of diabetes, with around 6.9% of the adult population affected as of 2021. Diabetes is a major risk factor for kidney disease, and the high prevalence of diabetes is a key driver of the growing dialysis market in Indonesia.

Technological Improvement: The Indonesian dialysis market has seen continuous technological advancements, leading to the development of more efficient and user-friendly dialysis machines and associated products. These advancements have improved treatment outcomes, reduced treatment time, and enhanced patient comfort, driving market growth.

Market Restraints

Limited Insurance Coverage: Many patients in Indonesia lack adequate insurance coverage for dialysis treatment, which can be a significant financial burden. Only around 40% of the population in Indonesia has health insurance coverage, leaving the majority of patients reliant on limited public healthcare resources.

Lack Skilled Healthcare Professionals: There is a shortage of nephrologists and trained dialysis nurses in Indonesia, which can limit the quality of care and access to dialysis services. There are only around 500 nephrologists serving a population of over 270 Mn people in Indonesia, which is limiting the market growth rate in Indonesia.

Regulatory Hurdles: New dialysis technology and treatments may take longer to get approved and introduced in Indonesia due to regulatory obstacles and bureaucratic bottlenecks. This may restrict access to the most recent technological developments.

Regulatory Landscape and Reimbursement Scenario

Indonesia's medical device regulations are managed by the Ministry of Health, employing a risk-based classification system from Class A (lowest risk) to D (highest risk), with hemodialysis equipment typically in higher risk categories. All devices require registration, involving technical documentation, quality certificates, and clinical evidence for high-risk devices, while foreign manufacturers need local representatives.

Hemodialysis reimbursement is primarily through the National Health Insurance (JKN) scheme, implemented by BPJS Kesehatan, covering treatments for eligible patients with minimal copayments, though limitations may apply. Despite improved access via JKN, challenges persist, including limited availability of dialysis centers in rural areas, potential out-of-pocket expenses, long waiting times, and geographical disparities in service distribution.

Private insurance supplements JKN coverage for some patients. Indonesia continues to work on expanding healthcare infrastructure and improving hemodialysis accessibility, while also focusing on preventive measures and early detection of kidney diseases. However, the country faces ongoing challenges in meeting the growing demand for dialysis treatments across its large, geographically dispersed population, balancing the need for advanced medical technologies with equitable healthcare access.

Competitive Landscape

Key Players

Here are some of the major key players in the Indonesia Hemodialysis Equipment Market:

- Angiodynamics Inc

- Nipro Corporation

- Nikkiso Co., Ltd.

- Asahi Kasei Medical

- Fresenius Medical Care

- Baxter International

- B. Braun

- Medtronic

- Diaverum

- DaVita Inc.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Hemodialysis Equipment Market Segmentation

By Hemodialysis Type

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

By Product & Services

- Equipment

- Consumables

- Dialysis Drugs

- Services

By End Use

- Home-based

- Hospital-based

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.