Indonesia Head and Neck Cancer Therapeutics Market Analysis

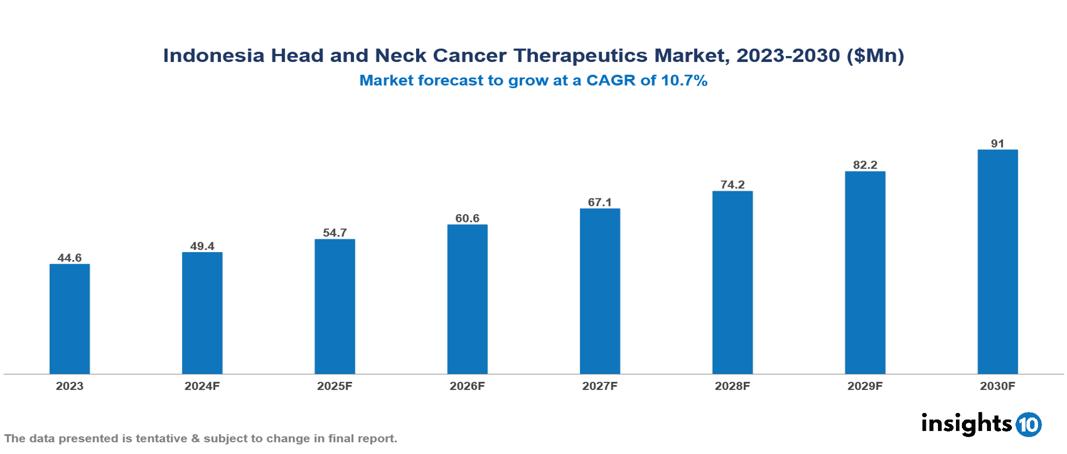

The Indonesia Head and Neck Cancer Therapeutics Market was valued at $44.65 Mn in 2023 and is predicted to grow at a CAGR of 10.70% from 2023 to 2030, to $90.96 Mn by 2030. The key drivers of this industry include the growing aging population, advancement in treatment, and government initiatives. The industry is primarily dominated by players such as Bristol Myers Squibb, Merck, Roche, and Pfizer among others.

Buy Now

Indonesia Head and Neck Cancer Therapeutics Market Executive Summary

The Indonesia Head and Neck Cancer Therapeutics Market was valued at $44.65 Mn in 2023 and is predicted to grow at a CAGR of 10.70% from 2023 to 2030, to $90.96 Mn by 2030.

Head and neck cancers can start in the thin lining cells (squamous cells) of the mouth, throat, and voice box, or even in the salivary glands, sinuses, muscles, or nerves in these areas. Smoking, tobacco use, and HPV infection increase the risk, and symptoms like a painful lump in the neck, a sore that won't heal in the mouth or throat, trouble swallowing, or a hoarse voice could be warning signs.

By 2030, there is a 30% yearly increase expected in the overall incidence of Head and Neck Cancer (HNC). According to estimates, there are more than 20 cases of HNC per 100,000 men, two to four times as many as women. Oral and lip cancer is the second most prevalent cancer in men in developing countries (10 per 100,000). All populations have an increased risk of HNC with age, and most instances are diagnosed in people over 50. The market is driven by significant factors like the growing aging population, advancement in treatment, and government initiatives. However, stringent regulatory processes, high treatment costs, and side effects of treatment restrict the growth and potential of the market.

Prominent players in this field include Bristol Myers Squibb, Merck, Roche, and Pfizer among others.

Market Dynamics

Market Growth Drivers

Growing Aging Population: With an average annual growth rate of 1.52%, the population of Indonesia aged 65 and over increased from 3.4% in 1974 to 7% in 2023. Given that an aging population raises the incidence of head and neck cancer and consequently increases demand for related treatments, this demographic shift is a major market driver for Indonesia's head and neck cancer therapeutics market.

Advancement in Treatment: The introduction of targeted treatments, and immunotherapies, among other recent developments, is greatly expanding the range of available treatment options and improving patient outcomes. Because of these developments, there is a greater need for advanced therapies, which propels the market, providing pharmaceutical companies with a great chance of meeting the increasing need for indicated therapies.

Government Initiatives: The Dharmais National Cancer Center, a key government-owned cancer care facility in West Jakarta, has initiated collaborations with the University of Indonesia, the University of New Mexico, and the Tata Memorial Centre. These partnerships are part of government-led efforts to enhance cancer diagnosis and treatment, driving growth in the head and neck cancer therapeutics market in Indonesia by improving access to advanced care and fostering innovation in treatment methodologies.

Market Restraints

Stringent Regulatory Process: A medicine must receive marketing authorization from Badan Pengawas Obat dan Makanan (Badan POM/BPOM), also known as the Indonesian Food and Drug Administration to enter the Indonesian pharmaceutical market. This regulatory requirement constrains the market for head and neck cancer therapeutics because of the possible intricacies and length of time associated with the licensing procedure.

High Cost of Treatment: Cancer imposes a significant economic burden on patients, their families, and healthcare providers in Indonesia. The high out-of-pocket (OOP) costs for specialized treatment and therapy, which are not fully covered by the National Health Insurance, impact household expenditure, posing a restraint on the head and neck cancer therapeutics market.

Side Effects of Treatment: Side effects from head and neck cancer treatments represent a major market restraint. These negative effects may limit the use of specific therapies and decrease patient compliance, which may affect the overall efficacy of those therapies. Head and neck cancer therapeutics market growth and innovation are hampered by patients' and healthcare providers' reluctance to embrace novel treatments due to the possibility of severe adverse effects.

Regulatory Landscape and Reimbursement Scenario

Under the authority of the Indonesian Ministry of Health (MOH), The Indonesian Food and Drug Administration, or Badan Pengawas Obat dan Makanan (Badan POM/BPOM), is in charge of enforcing local laws pertaining to pharmaceuticals and medical devices. Manufacturers must successfully negotiate a variety of intricate regulatory processes, including registration requirements, market authorizations, and regulatory requirements, to gain entry to the market. Indonesia also has a mandatory health insurance program called Jaminan Kesehatan Nasional (JKN) which is designed to make basic medical care and facilities available to all citizens.

Competitive Landscape

Key Players

Here are some of the major key players in the Indonesia Head and Neck Cancer Therapeutic Market:

- Bristol Myers Squibb

- Merck

- Roche

- Pfizer

- Eli Lilly and Company

- AstraZeneca

- Novartis

- Amgen

- GlaxoSmithKline

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Head and Neck Cancer Therapeutics Market Segmentation

By Treatment

- Targeted Therapy

- Immunotherapy

- Radiation Therapy

- Surgeries

By End Users

- Hospitals

- Specialty Centers

- Ambulatory Surgical Centers

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

By Route of administration

- Injectable

- Oral

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.